Abercrombie & Fitch 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

25

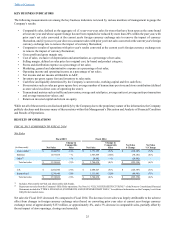

KEY BUSINESS INDICATORS

The following measurements are among the key business indicators reviewed by various members of management to gauge the

Company’s results:

• Comparable sales, defined as the aggregate of: (1) year-over-year sales for stores that have been open as the same brand

at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with

prior year's net sales converted at the current year's foreign currency exchange rate to remove the impact of currency

fluctuation, and (2) year-over-year direct-to-consumer sales with prior year's net sales converted at the current year's foreign

currency exchange rate to remove the impact of currency fluctuation;

• Comparative results of operations with prior year's results converted at the current year's foreign currency exchange rate

to remove the impact of currency fluctuation;

• Gross profit and gross margin rate;

• Cost of sales, exclusive of depreciation and amortization, as a percentage of net sales;

• Selling margin, defined as sales price less original cost, by brand and product category;

• Stores and distribution expense as a percentage of net sales;

• Marketing, general and administrative expense as a percentage of net sales;

• Operating income and operating income as a percentage of net sales;

• Net income and net income attributable to A&F;

• Inventory per gross square foot and inventory to sales ratio;

• Cash flow and liquidity determined by the Company’s current ratio, working capital and free cash flow;

• Store metrics such as sales per gross square foot, average number of transactions per store and store contribution (defined

as store sales less direct costs of operating the store);

• Transactional metrics such as traffic and conversion, average unit retail price, average unit cost, average units per transaction

and average transaction values; and

• Return on invested capital and return on equity.

While not all of these metrics are disclosed publicly by the Company due to the proprietary nature of the information, the Company

publicly discloses and discusses many of these metrics within this Management’s Discussion and Analysis of Financial Condition

and Results of Operations.

RESULTS OF OPERATIONS

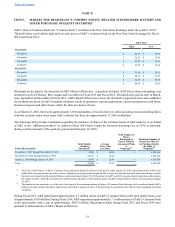

FISCAL 2015 COMPARED TO FISCAL 2014

Net Sales

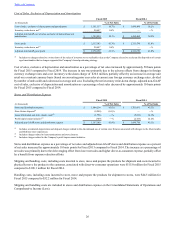

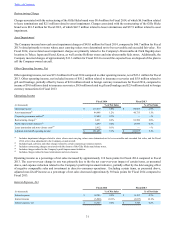

Fiscal 2015 Fiscal 2014

(in thousands) Net Sales

Change in

Comparable

Sales Net Sales

Change in

Comparable

Sales Net Sales

$ Change Net Sales

% Change

Abercrombie(1) $ 1,640,992 (6)% $ 1,771,299 (5)% $ (130,307) (7)%

Hollister 1,877,688 —% 1,947,869 (10)% (70,181) (4)%

Other(2) — —% 24,862 —% (24,862) -

Total net sales $ 3,518,680 (3)% $ 3,744,030 (8)% $ (225,350) (6)%

U.S. $ 2,282,040 (3)% $ 2,408,427 (6)% $ (126,387) (5)%

International 1,236,640 (1)% 1,335,603 (12)% (98,963) (7)%

Total net sales $ 3,518,680 (3)% $ 3,744,030 (8)% $ (225,350) (6)%

(1) Includes Abercrombie & Fitch and abercrombie kids brands.

(2) Represents net sales from the Company's Gilly Hicks operations. See Note 16, "GILLY HICKS RESTRUCTURING," of the Notes to Consolidated Financial

Statements included in "ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA," for additional information on the Company's exit from

Gilly Hicks branded stores.

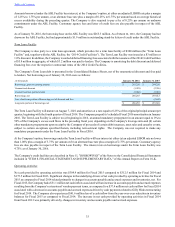

Net sales for Fiscal 2015 decreased 6% compared to Fiscal 2014. The decrease in net sales was largely attributable to the adverse

effect from changes in foreign currency exchange rates (based on converting prior year sales at current year foreign currency

exchange rates) of approximately $153 million, or approximately 4%, and a 3% decrease in comparable sales, partially offset by

the net impact of store openings, closings and remodels.