Abercrombie & Fitch 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

52

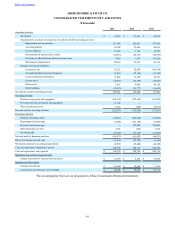

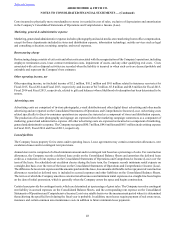

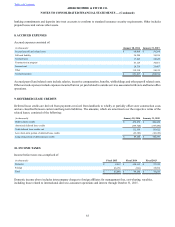

3. FAIR VALUE

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market

participants at the measurement date. The inputs used to measure fair value are prioritized based on a three-level hierarchy. The

three levels of inputs to measure fair value are as follows:

• Level 1—inputs are unadjusted quoted prices for identical assets or liabilities that are available in active markets that the

Company can access at the measurement date.

• Level 2—inputs are other than quoted market prices included within Level 1 that are observable for assets or liabilities,

directly or indirectly.

• Level 3—inputs to the valuation methodology are unobservable.

The lowest level of significant input determines the placement of the entire fair value measurement in the hierarchy. The three

levels of the hierarchy and the distribution within it of the Company’s assets and liabilities, measured at fair value on a recurring

basis, were as follows:

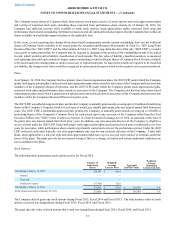

Assets and Liabilities at Fair Value as of January 30, 2016

(in thousands) Level 1 Level 2 Level 3 Total

Assets:

Money market funds $ 311,349 $ — $ — $ 311,349

Derivative financial instruments — 4,166 — 4,166

Total assets measured at fair value $ 311,349 $ 4,166 $ — $ 315,515

Assets and Liabilities at Fair Value as of January 31, 2015

(in thousands) Level 1 Level 2 Level 3 Total

Assets:

Money market funds $ 122,047 $ — $ — $ 122,047

Derivative financial instruments — 10,293 — 10,293

Total assets measured at fair value $ 122,047 $ 10,293 $ — $ 132,340

The level 2 assets and liabilities consist of derivative financial instruments, primarily forward foreign currency exchange contracts.

The fair value of forward foreign currency exchange contracts is determined by using quoted market prices of the same or similar

instruments, adjusted for counterparty risk.

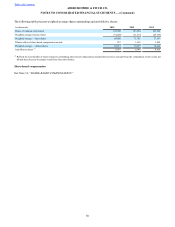

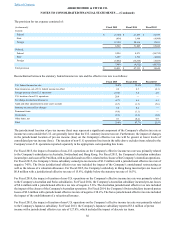

Disclosures of Fair Value of Other Assets and Liabilities:

The Company’s borrowings under the Company's credit facilities are carried at historical cost in the accompanying Consolidated

Balance Sheets. For disclosure purposes, the Company estimated the fair value of borrowings outstanding based on market rates

for similar types of debt. The inputs used to value the borrowings outstanding are considered to be Level 2 instruments.

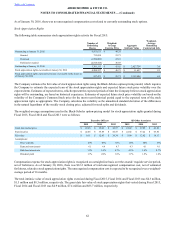

The carrying amount and fair value of the Company's term loan facility were as follows:

(in thousands) January 30, 2016 January 31, 2015

Gross borrowings outstanding, carrying amount $ 293,250 $ 299,250

Gross borrowings outstanding, fair value $ 284,453 $ 295,135

No borrowings were outstanding under the Company's asset-based revolving credit facility as of January 30, 2016 and January 31,

2015. See Note 11, "BORROWINGS," for further discussion of the Company's credit facilities.