Abercrombie & Fitch 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

58

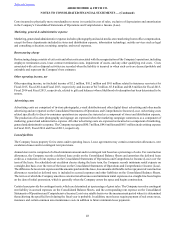

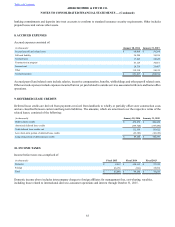

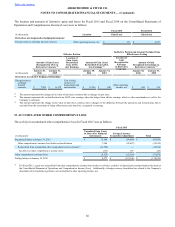

The amount of the above uncertain tax positions at January 30, 2016, January 31, 2015 and February 1, 2014, which would impact

the Company’s effective tax rate if recognized, was $2.5 million, $3.2 million and $4.2 million, respectively.

The Company recognizes accrued interest and penalties related to uncertain tax positions as a component of income tax expense.

During Fiscal 2015, the Company recognized a $0.9 million benefit related to net interest and penalties, compared to a $0.2 million

benefit recognized during Fiscal 2014. Interest and penalties of $0.5 million were accrued at the end of Fiscal 2015, compared to

$1.4 million accrued at the end of Fiscal 2014.

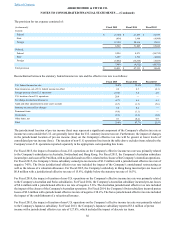

The Internal Revenue Service (“IRS”) is currently conducting an examination of the Company’s U.S. federal income tax return

for Fiscal 2015 as part of the IRS’ Compliance Assurance Process program. The IRS examinations for Fiscal 2014 and prior years

have been completed and settled. State and foreign returns are generally subject to examination for a period of three to five years

after the filing of the respective return. The Company has various state and foreign income tax returns in the process of examination,

administrative appeals or litigation. The outcome of the examinations is not expected to have a material impact on the Company's

financial statements. The Company believes that some of these audits and negotiations will conclude within the next 12 months

and that it is reasonably possible the amount of uncertain income tax positions, including interest, may decrease in the range of

$1.3 million to $1.8 million due to settlements of audits and expiration of statutes of limitations.

The Company does not expect material adjustments to the total amount of uncertain tax positions within the next 12 months, but

the outcome of tax matters is uncertain and unforeseen results can occur.

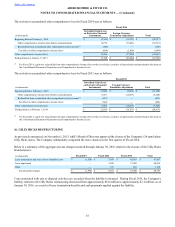

As of January 30, 2016, a provision for U.S. income tax has not been recorded on approximately $126.6 million of unremitted net

income generated through the third quarter of Fiscal 2015 of non-U.S. subsidiaries that the Company has determined to be

indefinitely reinvested outside the U.S. The potential U.S. deferred income tax liability if the foreign net income were to be

repatriated in the future, net of any foreign income or withholding taxes previously paid, is approximately $25 million. Unremitted

net income of $20.8 million generated after October 31, 2015 is not considered to be invested indefinitely, and the Company has

recorded $4.4 million of deferred U.S. income taxes on this net income.

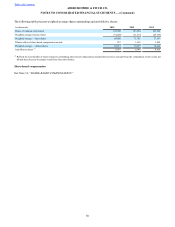

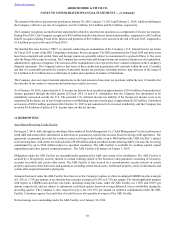

11. BORROWINGS

Asset-Based Revolving Credit Facility

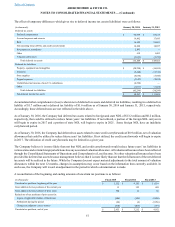

On August 7, 2014, A&F, through its subsidiary Abercrombie & Fitch Management Co. ("A&F Management") as the lead borrower

(with A&F and certain other subsidiaries as borrowers or guarantors), entered into an asset-based revolving credit agreement. The

agreement, as amended, provides for a senior secured revolving credit facility of up to $400 million (the "ABL Facility"), subject

to a borrowing base, with a letter of credit sub-limit of $100 million and an accordion feature allowing A&F to increase the revolving

commitment by up to $100 million subject to specified conditions. The ABL Facility is available for working capital, capital

expenditures and other general corporate purposes. The ABL Facility will mature on August 7, 2019.

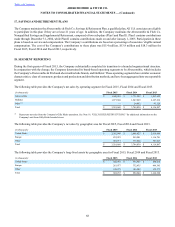

Obligations under the ABL Facility are unconditionally guaranteed by A&F and certain of its subsidiaries. The ABL Facility is

secured by a first-priority security interest in certain working capital of the borrowers and guarantors consisting of inventory,

accounts receivable and certain other assets. The ABL Facility is also secured by a second-priority security interest in certain

property and assets of the borrowers and guarantors, including certain fixed assets, intellectual property, stock of subsidiaries and

certain after-acquired material real property.

Amounts borrowed under the ABL Facility bear interest, at the Company's option, at either an adjusted LIBOR rate plus a margin

of 1.25% to 1.75% per annum, or an alternate base rate plus a margin of 0.25% to 0.75% per annum. The initial applicable margins

with respect to LIBOR loans and base rate loans, including swing line loans, under the ABL Facility are 1.50% and 0.50% per

annum, respectively, and are subject to adjustment each fiscal quarter based on average historical excess availability during the

preceding quarter. The Company is also required to pay a fee of 0.25% per annum on undrawn commitments under the ABL

Facility. Customary agency fees and letter of credit fees are also payable in respect of the ABL Facility.

No borrowings were outstanding under the ABL Facility as of January 30, 2016.