Abercrombie & Fitch 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

22

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

OVERVIEW

BUSINESS SUMMARY

The Company is a specialty retailer that operates stores in North America, Europe, Asia and the Middle East and direct-to-consumer

operations in North America, Europe and Asia that serve its customers throughout the world. The Company sells casual sportswear

apparel, including knit tops and woven shirts, graphic t-shirts, fleece, jeans and woven pants, shorts, sweaters, and outerwear;

personal care products; and accessories for men, women and kids under the Abercrombie & Fitch, abercrombie kids and Hollister

brands.

The Company’s fiscal year ends on the Saturday closest to January 31, typically resulting in a fifty-two week year, but occasionally

giving rise to an additional week, resulting in a fifty-three week year. For purposes of this “ITEM 7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” the fifty-two week period

ended January 30, 2016 is compared to the fifty-two week period ended January 31, 2015 and the fifty-two week period ended

January 31, 2015 is compared to the fifty-two week period ended February 1, 2014.

During the first quarter of Fiscal 2015, the Company substantially completed its transition to a branded organizational structure.

In conjunction with the change, the Company determined its brand-based operating segments to be Abercrombie, which includes

the Company's Abercrombie & Fitch and abercrombie kids brands, and Hollister. These operating segments have similar economic

characteristics, classes of consumers, products and production and distribution methods, and have been aggregated

into one reportable segment.

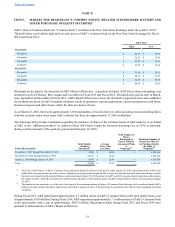

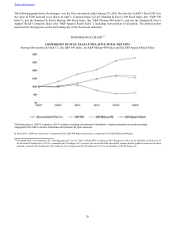

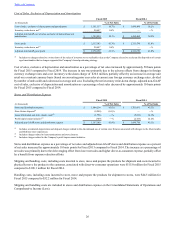

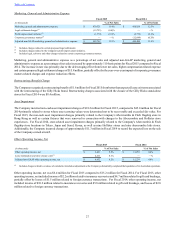

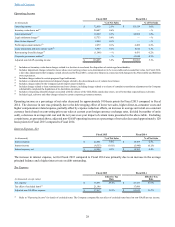

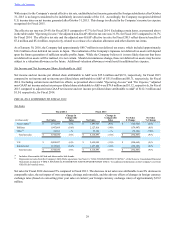

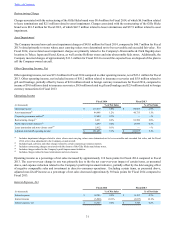

For Fiscal 2015, net sales decreased 6% to $3.519 billion from $3.744 billion for Fiscal 2014. The gross profit rate was 61.3% for

Fiscal 2015, compared to 61.8% for Fiscal 2014. Operating income was $72.8 million for Fiscal 2015, compared to operating

income of $113.5 million for Fiscal 2014. Net income and net income per diluted share attributable to A&F was $35.6 million

and $0.51, respectively, for Fiscal 2015, compared to net income and net income per diluted share attributable to A&F of $51.8

million and $0.71, respectively, for Fiscal 2014.

Excluding certain items, the adjusted non-GAAP gross profit rate was 61.9%, operating income was $136.5 million and net income

and net income per diluted share attributable to Abercrombie & Fitch Co. was $78.0 million and $1.12, respectively, for Fiscal

2015, compared to an adjusted non-GAAP gross profit rate of 61.8%, operating income of $191.7 million and net income and net

income per diluted share attributable to Abercrombie & Fitch Co. of $112.3 million and $1.54, respectively, for Fiscal 2014.

As of January 30, 2016, the Company had $588.6 million in cash and equivalents, and $293.3 million in gross borrowings

outstanding under its term loan facility. Net cash provided by operating activities was $309.9 million for Fiscal 2015. The

Company also used cash of $143.2 million for capital expenditures, $50.0 million to repurchase approximately 2.5 million shares

of A&F's Common Stock and $55.1 million to pay dividends during Fiscal 2015.

REPORTING AND USE OF GAAP AND NON-GAAP MEASURES

The Company believes that the non-GAAP financial measures presented in this "ITEM 7. MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS" are useful to investors as they provide

the ability to measure the Company’s operating performance as compared to historical periods, excluding the effect of certain

items which the Company believes do not reflect its future operating outlook. Management used these non-GAAP financial

measures during the periods presented to assess the Company's performance and to develop expectations for future operating

performance. In addition, the Company provides certain financial information on a constant currency basis to enhance investors'

understanding of underlying business trends and operating performance. These non-GAAP financial measures should be used in

conjunction with, not as an alternative to, the Company's GAAP financial results. Such financial measures are presented on both

a GAAP and non-GAAP basis under "RESULTS OF OPERATIONS," with excluded items specifically identified.