Abercrombie & Fitch 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

59

Term Loan Facility

A&F, through its subsidiary A&F Management as the borrower (with A&F and certain other subsidiaries as guarantors), also

entered into a term loan agreement on August 7, 2014, which, as amended, provides for a term loan facility of $300 million (the

"Term Loan Facility" and, together with the ABL Facility, the "2014 Credit Facilities"). A portion of the proceeds of the Term

Loan Facility was used to repay the outstanding balance of approximately $127.5 million under the Company's 2012 Term Loan

Agreement, to repay outstanding borrowings of approximately $60 million under the Company's 2011 Credit Agreement and to

pay fees and expenses associated with the transaction.

The Term Loan Facility was issued at a 1.0% discount. In addition, the Company recorded deferred financing fees associated with

the issuance of the 2014 Credit Facilities of $5.8 million in aggregate, of which $3.2 million was paid to lenders. The Company

is amortizing the debt discount and deferred financing fees over the respective contractual terms of the 2014 Credit Facilities.

The Company's Term Loan debt is presented in the Consolidated Balance Sheets, net of the unamortized discount and fees paid

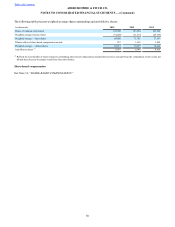

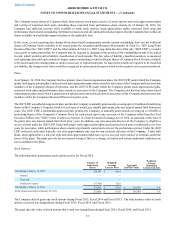

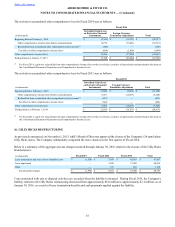

to lenders. Net borrowings as of January 30, 2016 and January 31, 2015 were as follows:

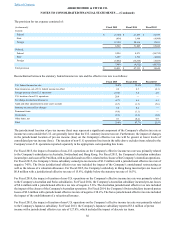

(in thousands) January 30, 2016 January 31, 2015

Borrowings, gross at carrying amount $ 293,250 $ 299,250

Unamortized discount (1,929) (2,786)

Unamortized fees paid to lenders (5,086) (3,052)

Borrowings, net 286,235 293,412

Less: short-term portion of borrowings, net of discount and fees — (2,102)

Long-term portion of borrowings, net $ 286,235 $ 291,310

The Term Loan Facility will mature on August 7, 2021 and amortizes at a rate equal to 0.25% of the original principal amount per

quarter, beginning with the fourth quarter of Fiscal 2014. The Term Loan Facility is subject to (a) beginning in 2016, an annual

mandatory prepayment in an amount equal to 0% to 50% of the Company's excess cash flows in the preceding fiscal year, depending

on the Company's leverage ratio and (b) certain other mandatory prepayments upon receipt by the Company of proceeds of certain

debt issuances, asset sales and casualty events, subject to certain exceptions specified therein, including reinvestment rights. The

Company was not required to make any mandatory prepayments under the Term Loan Facility in Fiscal 2016.

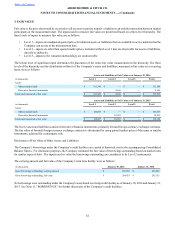

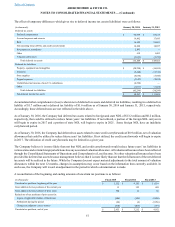

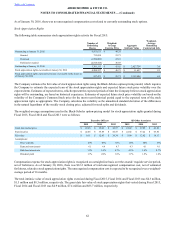

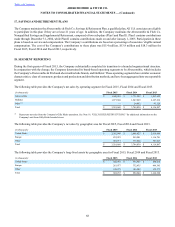

A summary of future minimum payments under the Term Loan facility is as follows:

(in thousands)

Fiscal 2016(1) $ —

Fiscal 2017 $ 3,000

Fiscal 2018 $ 3,000

Fiscal 2019 $ 3,000

Fiscal 2020 $ 3,000

Thereafter $ 281,250

(1) The Company prepaid its regularly scheduled Fiscal 2016 principal payments in January 2016.

All obligations under the Term Loan Facility are unconditionally guaranteed by A&F and certain of its subsidiaries. The Term

Loan Facility is secured by a first-priority security interest in certain property and assets of the borrowers and guarantors, including

certain fixed assets, intellectual property, stock of subsidiaries and certain after-acquired material real property. The Term Loan

Facility is also secured by a second-priority security interest in certain working capital of the borrowers and guarantors consisting

of inventory, accounts receivable and certain other assets, with certain exceptions.

At the Company's option, borrowings under the Term Loan Facility will bear interest at either (a) an adjusted LIBOR rate no lower

than 1.00% plus a margin of 3.75% per annum or (b) an alternate base rate plus a margin of 2.75% per annum. Customary agency

fees are also payable in respect of the Term Loan Facility. The interest rate on borrowings under the Term Loan Facility was 4.75%

as of January 30, 2016.