Abercrombie & Fitch 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

32

The increase in interest expense for Fiscal 2014 compared to Fiscal 2013 was primarily due to an increase in the average principal

balance and interest rate on debt outstanding.

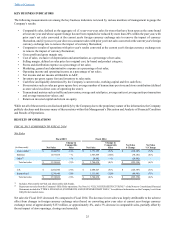

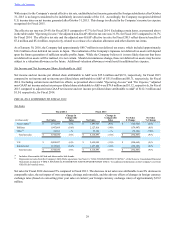

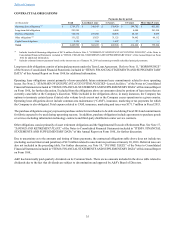

Tax Expense

Fiscal 2014 Fiscal 2013

(in thousands, except ratios) Effective Tax

Rate Effective Tax

Rate

Tax expense $ 47,333 47.7% $ 18,649 25.5%

Tax effect of excluded items(1) 17,686 46,063

Adjusted non-GAAP tax expense $ 65,019 36.7% $ 64,712 30.1%

(1) Refer to "OPERATING INCOME" for details of excluded items. The Company computed the tax effect of excluded items based on non-GAAP pre-tax

income.

The effective tax rate was 47.7% for Fiscal 2014 compared to 25.5% for Fiscal 2013. Excluding certain items, as presented above,

the adjusted non-GAAP effective tax rate was 36.7% for Fiscal 2014 compared to 30.1% for Fiscal 2013.

The change in the effective tax rate for Fiscal 2014 as compared to Fiscal 2013 was primarily due to an unfavorable change in the

mix of earnings on a jurisdictional basis, a $6.1 million valuation allowance established in 2014 for net operating loss carryforwards

for which the Company determined based on evidence it was more likely than not that the associated deferred tax asset would not

be realized, as well as a benefit of $6.7 million in Fiscal 2013 resulting from the settlement of certain state tax audits and other

discrete matters.

As of January 31, 2015, the Company had approximately $111.0 million in net deferred tax assets, which included approximately

$15.9 million of net deferred tax assets related to Japan. The realization of the Company's Japanese net deferred tax assets is

dependent upon the future generation of sufficient taxable profits in Japan. While the Company believes it is more likely than not

that these net deferred tax assets will be realized, it is not certain. Should circumstances change, these net deferred tax assets may

become subject to a valuation allowance in the future. Additional valuation allowances would results in additional tax expense.

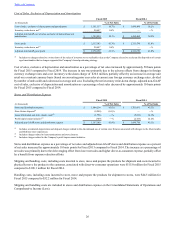

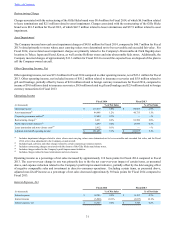

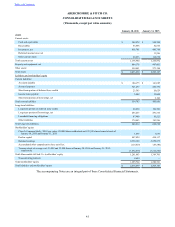

Net Income and Net Income per Share Attributable to A&F

Net income and net income per diluted share attributable to A&F was $51.8 million and $0.71, respectively, for Fiscal 2014

compared to net income and net income per diluted share attributable to A&F of $54.6 million and $0.69, respectively, for Fiscal

2013. Excluding certain items and their tax effects, as presented above under "OPERATING INCOME" and "TAX EXPENSE,"

adjusted non-GAAP net income and net income per diluted share attributable to A&F was $112.3 million and $1.54, respectively,

for Fiscal 2014 compared to adjusted non-GAAP net income and net income per diluted share attributable to A&F of $150.6

million and $1.91, respectively, for Fiscal 2013.

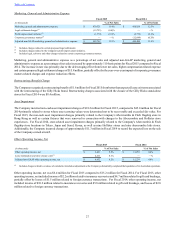

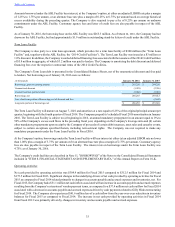

LIQUIDITY AND CAPITAL RESOURCES

HISTORICAL SOURCES AND USES OF CASH

Seasonality of Cash Flows

The Company’s business has two principal selling seasons: the Spring season which includes the first and second fiscal quarters

(“Spring”) and the Fall season which includes the third and fourth fiscal quarters ("Fall"). As is typical in the apparel industry, the

Company experiences its greatest sales activity during the Fall season due to Back-to-School and Holiday sales periods, particularly

in the U.S. The Company relies on excess operating cash flows, which are largely generated in the Fall season, to fund operating

expenses throughout the year and to reinvest in the business to support future growth. The Company also has a revolving credit

facility available as a source of additional funding.

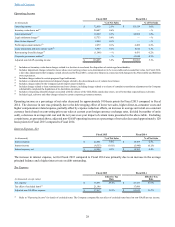

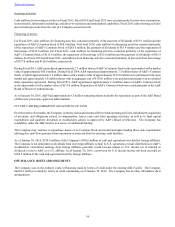

Asset-Based Revolving Credit Facility

The Company has a senior secured revolving credit facility with availability of up to $400 million (the “ABL Facility”), subject

to a borrowing base. The ABL Facility is available for working capital, capital expenditures and other general corporate purposes.

The ABL Facility will mature on August 7, 2019. No borrowings were outstanding under the ABL Facility as of January 30, 2016.