Abercrombie & Fitch 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

57

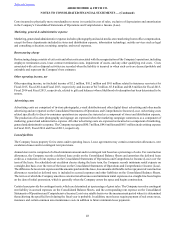

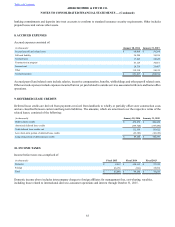

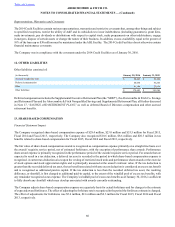

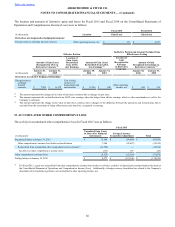

The effect of temporary differences which gives rise to deferred income tax assets (liabilities) were as follows:

(in thousands) January 30, 2016 January 31, 2015

Deferred tax assets:

Deferred compensation $ 62,679 $ 83,157

Accrued expenses and reserves 19,862 17,695

Rent 36,929 38,881

Net operating losses (NOL) and credit carryforwards 14,248 14,897

Investments in subsidiaries 2,895 —

Other 619 1,403

Valuation allowances (1,643) (6,730)

Total deferred tax assets $ 135,589 $ 149,303

Deferred tax liabilities:

Property, equipment and intangibles $ (20,708) $ (16,059)

Inventory (9,480) (11,332)

Store supplies (6,054) (7,046)

Prepaid expenses (3,653) (2,438)

Undistributed net income of non-U.S. subsidiaries (4,390) —

Other (1,011) (1,424)

Total deferred tax liabilities (45,296) (38,299)

Net deferred income tax assets $ 90,293 $ 111,004

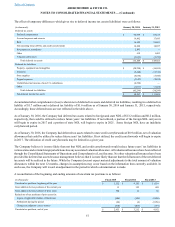

Accumulated other comprehensive (loss) is shown net of deferred tax assets and deferred tax liabilities, resulting in a deferred tax

liability of $1.7 million and a deferred tax liability of $1.6 million as of January 30, 2016 and January 31, 2015, respectively.

Accordingly, these deferred taxes are not reflected in the table above.

As of January 30, 2016, the Company had deferred tax assets related to foreign and state NOL of $13.2 million and $0.2 million,

respectively, that could be utilized to reduce future years’ tax liabilities. If not utilized, a portion of the foreign NOL carryovers

will begin to expire in 2017 and a portion of state NOL will begin to expire in 2021. Some foreign NOL have an indefinite

carryforward period.

As of January 30, 2016, the Company had deferred tax assets related to state credit carryforwards of $0.9 million, net of valuation

allowances that could be utilized to reduce future years’ tax liabilities. If not utilized, the credit carryforwards will begin to expire

in 2017. The utilization of credit carryforwards may be limited in a given year.

The Company believes it is more likely than not that NOL and credit carryforwards would reduce future years’ tax liabilities in

various states and certain foreign jurisdictions less any associated valuation allowance. All valuation allowances have been reflected

through the Consolidated Statements of Operations and Comprehensive (Loss) Income. No other valuation allowances have been

provided for deferred tax assets because management believes that it is more likely than not that the full amount of the net deferred

tax assets will be realized in the future. While the Company does not expect material adjustments to the total amount of valuation

allowances within the next 12 months, changes in assumptions may occur based on the information then currently available. In

such case, the Company will record an adjustment in the period in which a determination is made.

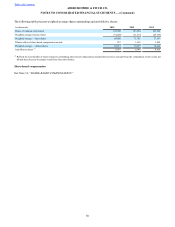

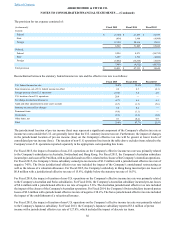

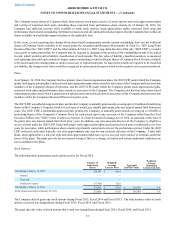

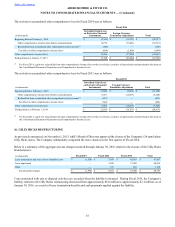

A reconciliation of the beginning and ending amounts of uncertain tax positions is as follows:

(in thousands) Fiscal 2015 Fiscal 2014 Fiscal 2013

Uncertain tax positions, beginning of the year $ 3,212 $ 4,182 $ 11,116

Gross addition for tax positions of the current year 13 152 449

Gross addition for tax positions of prior years 598 33 30

Reductions of tax positions of prior years for:

Lapses of applicable statutes of limitations (986) (348) (2,880)

Settlements during the period (64) (4) (3,936)

Changes in judgment/ excess reserve (318) (803) (597)

Uncertain tax positions, end of year $ 2,455 $ 3,212 $ 4,182