Abercrombie & Fitch 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

35

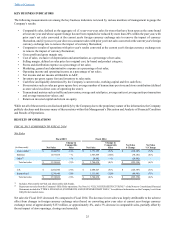

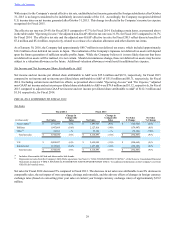

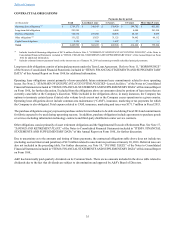

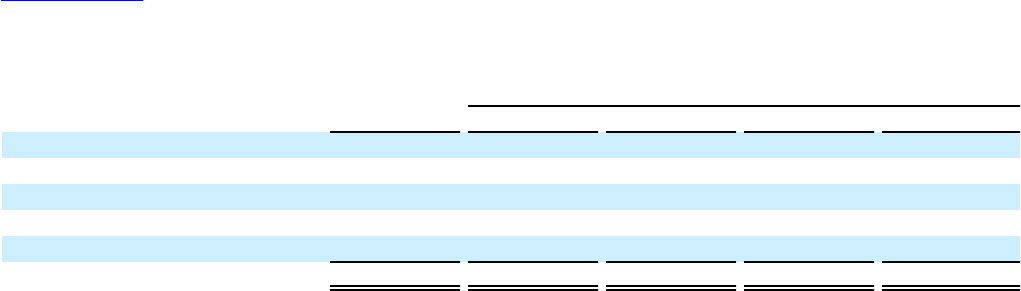

CONTRACTUAL OBLIGATIONS

Payments due by period

(in thousands) Total Less than 1 year 1-3 years 3-5 years More than 5 years

Operating lease obligations (1) $ 1,734,171 $ 390,166 $ 570,920 $ 349,782 $ 423,303

Long-term debt obligations 293,250 — 6,000 6,000 281,250

Purchase obligations 324,538 255,600 40,094 20,145 8,699

Other obligations (2) 131,522 15,823 31,125 38,462 46,112

Capital lease obligations 2,118 634 1,407 77 —

Totals $ 2,485,599 $ 662,223 $ 649,546 $ 414,466 $ 759,364

(1) Includes leasehold financing obligations of $47.4 million. Refer to Note 2, "SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES," of the Notes to

Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on Form

10-K for additional information.

(2) Includes estimated interest payments based on the interest rate as of January 30, 2016 and assuming normally scheduled principal payments.

Long-term debt obligations consist of principal payments under the Term Loan Agreement. Refer to Note 11, "BORROWINGS,"

of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA” of this Annual Report on Form 10-K for additional information.

Operating lease obligations consist primarily of non-cancelable future minimum lease commitments related to store operating

leases. See Note 2, “SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES--Leased facilities,” of the Notes to Consolidated

Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report

on Form 10-K, for further discussion. Excluded from the obligations above are amounts related to portions of lease terms that are

currently cancelable at the Company's discretion. While included in the obligations above, in many instances, the Company has

options to terminate certain leases if stated sales volume levels are not met or the Company ceases operations in a given country.

Operating lease obligations do not include common area maintenance (“CAM”), insurance, marketing or tax payments for which

the Company is also obligated. Total expense related to CAM, insurance, marketing and taxes was $171.7 million in Fiscal 2015.

The purchase obligations category represents purchase orders for merchandise to be delivered during Fiscal 2016 and commitments

for fabric expected to be used during upcoming seasons. In addition, purchase obligations include agreements to purchase goods

or services including information technology contracts and third-party distribution center service contracts.

Other obligations consist primarily of asset retirement obligations and the Supplemental Executive Retirement Plan. See Note 17,

“SAVINGS AND RETIREMENT PLANS,” of the Notes to Consolidated Financial Statements included in “ITEM 8. FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report on Form 10-K, for further discussion.

Due to uncertainty as to the amounts and timing of future payments, the contractual obligations table above does not include tax

(including accrued interest and penalties) of $2.9 million related to uncertain tax positions at January 30, 2016. Deferred taxes are

also not included in the preceding table. For further discussion, see Note 10, “INCOME TAXES,” of the Notes to Consolidated

Financial Statements included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA” of this Annual Report

on Form 10-K.

A&F has historically paid quarterly dividends on its Common Stock. There are no amounts included in the above table related to

dividends due to the fact that dividends are subject to determination and approval by A&F's Board of Directors.