Abercrombie & Fitch 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

21

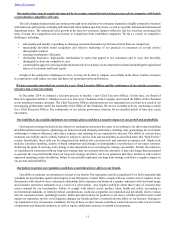

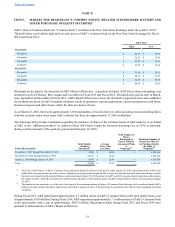

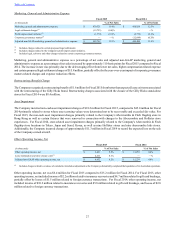

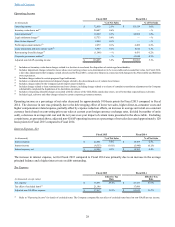

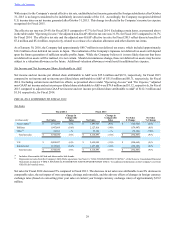

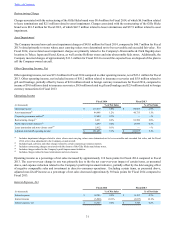

ITEM 6. SELECTED FINANCIAL DATA

The following financial information is derived from our Consolidated Financial Statements. The information presented below

should be read in conjunction with "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATION" and the Company's Consolidated Financial Statements and notes thereto included in "ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA" of this Annual Report on Form 10-K. We have also included

certain non-financial information to enhance the understanding of our business.

(Thousands, except per share and per square foot amounts, ratios and store data)

Fiscal 2015 Fiscal 2014 Fiscal 2013 Fiscal 2012(1) Fiscal 2011

Statements of operations data

Net sales $ 3,518,680 $ 3,744,030 $ 4,116,897 $ 4,510,805 $ 4,158,058

Gross profit $ 2,157,543 $ 2,313,570 $ 2,575,435 $ 2,816,709 $ 2,550,224

Operating income $ 72,838 $ 113,519 $ 80,823 $ 374,233 $ 221,384

Net income attributable to A&F $ 35,576 $ 51,821 $ 54,628 $ 237,011 $ 143,934

Net income per basic share attributable to A&F $ 0.52 $ 0.72 $ 0.71 $ 2.89 $ 1.66

Net income per diluted share attributable to A&F $ 0.51 $ 0.71 $ 0.69 $ 2.85 $ 1.61

Basic weighted-average shares outstanding 68,880 71,785 77,157 81,940 86,848

Diluted weighted-average shares outstanding 69,417 72,937 78,666 83,175 89,537

Cash dividends declared per share $ 0.80 $ 0.80 $ 0.80 $ 0.70 $ 0.70

Balance sheet data

Working capital(2) $ 644,277 $ 679,016 $ 752,344 $ 617,023 $ 858,248

Current ratio(3) 2.20 2.40 2.32 1.89 2.23

Total assets $ 2,433,039 $ 2,505,167 $ 2,850,997 $ 2,987,401 $ 3,117,032

Borrowings, net $ 286,235 $ 293,412 $ 135,000 $ — $ —

Leasehold financing obligations $ 47,440 $ 50,521 $ 60,726 $ 63,942 $ 57,851

Total stockholders’ equity $ 1,295,722 $ 1,389,701 $ 1,729,493 $ 1,818,268 $ 1,931,335

Return on average stockholders’ equity(4) 3 % 3 % 3 % 13 % 7%

Other financial and operating data

Net cash provided by operating activities $ 309,941 $ 312,480 $ 175,493 $ 684,171 $ 365,219

Net cash used for investing activities $ (122,567) $ (175,074) $ (173,861) $ (247,238) $ (340,689)

Net cash used for financing activities $ (106,875) $ (181,453) $ (40,831) $ (380,071) $ (265,329)

Capital expenditures $ 143,199 $ 174,624 $ 163,924 $ 339,862 $ 318,598

Free cash flow(5) $ 166,742 $ 137,856 $ 11,569 $ 344,309 $ 46,621

Comparable sales(6) (3)% (8)% (11)% (1)% 5%

Net store sales per average gross square foot $ 360 $ 381 $ 417 $ 485 $ 463

Total number of stores open 932 969 1,006 1,041 1,045

Total store square footage at end of period 7,292 7,517 7,736 7,958 7,778

(1) Fiscal 2012 was a fifty-three week year.

(2) Working capital is computed by subtracting current liabilities from current assets.

(3) Current ratio is computed by dividing current assets by current liabilities.

(4) Return on average stockholders’ equity is computed by dividing net income attributable to A&F by the average stockholders’ equity balance.

(5) Free cash flow is computed by subtracting capital expenditures from the GAAP financial measure of net cash provided by operating activities, both of

which are disclosed above in the table preceding the measure of free cash flow. The Company believes that the non-GAAP measure of free cash flow is

useful to investors to understand available cash flows generated from operations less cash flows used for capital expenditures. The closest GAAP financial

measure is net cash provided by operating activities. The non-GAAP financial measure of free cash flow should not be used in isolation or as an alternative

to net cash provided by operating activities or an indicator of the ongoing performance of the Company. It is also not intended to supersede or replace the

Company's GAAP financial measure.

(6) Comparable sales is defined as the aggregate of: (1) year-over-year sales for stores that have been open as the same brand at least one year and whose

square footage has not been expanded or reduced by more than 20% within the past year, with prior year's net sales converted at the current year's exchange

rate to remove the impact of currency fluctuation, and (2) year-over-year direct-to-consumer sales with prior year's net sales converted at the current year's

exchange rate to remove the impact of currency fluctuation. Beginning with Fiscal 2012, comparable sales include comparable direct-to-consumer sales.

Figures for Fiscal 2011 have not been restated and only include comparable store sales.