Abercrombie & Fitch 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

67

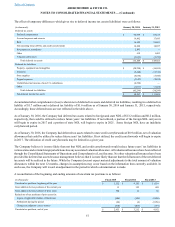

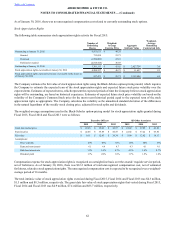

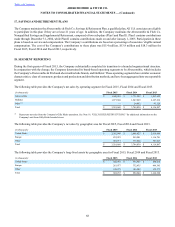

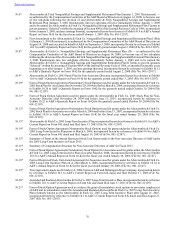

The activity in accumulated other comprehensive loss for Fiscal 2014 was as follows:

Fiscal 2014

(in thousands)

Unrealized Gain (Loss)

on Derivative Financial

Instruments Foreign Currency

Translation Adjustment Total

Beginning balance February 1, 2014 $ (2,166) $ (18,751) $ (20,917)

Other comprehensive income (loss) before reclassifications 16,572 (76,891) (60,319)

Reclassified from accumulated other comprehensive (loss) income(1) (440) — (440)

Tax effect on other comprehensive income (loss) (866) (1,038) (1,904)

Other comprehensive income (loss) 15,266 (77,929) (62,663)

Ending balance at January 31, 2015 $ 13,100 $ (96,680) $ (83,580)

(1) For Fiscal 2014, a gain was reclassified from other comprehensive income (loss) to the cost of sales, exclusive of depreciation and amortization line item on

the Consolidated Statement of Operations and Comprehensive Income (Loss).

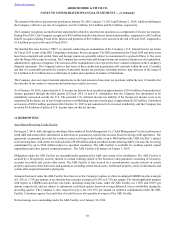

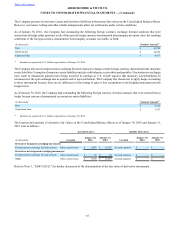

The activity in accumulated other comprehensive loss for Fiscal 2013 was as follows:

Fiscal 2013

(in thousands)

Unrealized Gain (Loss)

on Derivative Financial

Instruments Foreign Currency

Translation Adjustment Total

Beginning balance February 2, 2013 $ (7,220) $ (6,068) $ (13,288)

Other comprehensive income (loss) before reclassifications 6,435 (12,683) (6,248)

Reclassified from accumulated other comprehensive (loss) income(1) (857) — (857)

Tax effect on other comprehensive income (loss) (524) — (524)

Other comprehensive income (loss) 5,054 (12,683) (7,629)

Ending balance at February 1, 2014 $ (2,166) $ (18,751) $ (20,917)

(1) For Fiscal 2013, a gain was reclassified from other comprehensive income (loss) to the cost of sales, exclusive of depreciation and amortization line item on

the Consolidated Statement of Operations and Comprehensive Income (Loss).

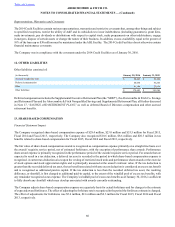

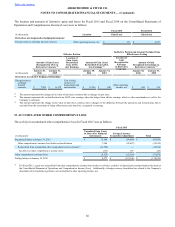

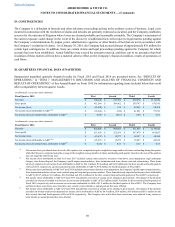

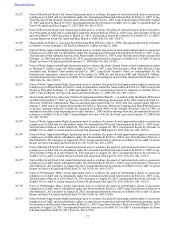

16. GILLY HICKS RESTRUCTURING

As previously announced, on November 1, 2013, A&F’s Board of Directors approved the closure of the Company’s 24 stand-alone

Gilly Hicks stores. The Company substantially completed the store closures in the first quarter of Fiscal 2014.

Below is a summary of the aggregate pre-tax charges incurred through January 30, 2016 related to the closure of the Gilly Hicks

branded stores:

(in thousands) Fiscal 2015 Fiscal 2014 Fiscal 2013 Total

Lease terminations and store closure (benefits) costs $ (1,598) $ 5,998 $ 42,667 $ 47,067

Asset impairment — 2,096 37,940 40,036

Other — 337 893 1,230

Total (benefits) charges $ (1,598) $ 8,431 $ 81,500 $ 88,333

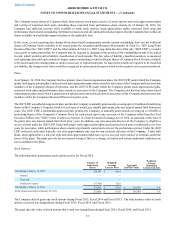

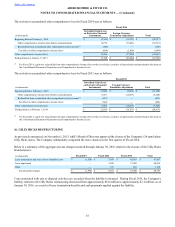

Costs associated with exit or disposal activities are recorded when the liability is incurred. During Fiscal 2015, the Company's

liability related to the Gilly Hicks restructuring decreased from approximately $6.0 million to approximately $2.1 million, as of

January 30, 2016, as a result of lease termination benefits and cash payments applied against the liability.