Abercrombie & Fitch 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

34

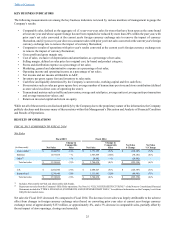

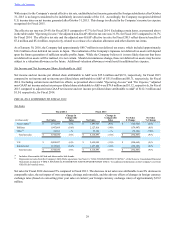

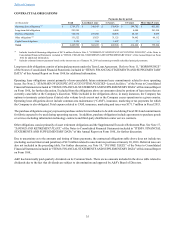

Investing Activities

Cash outflows for investing activities in Fiscal 2015, Fiscal 2014 and Fiscal 2013 were used primarily for new store construction,

store remodels, information technology, and direct-to-consumer and omnichannel capabilities. Fiscal 2015 cash investing activities

also included proceeds from the sale of a Company-owned aircraft.

Financing Activities

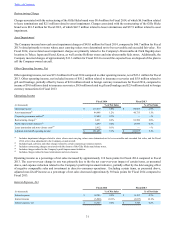

For Fiscal 2015, cash outflows for financing activities consisted primarily of the payment of dividends of $55.1 million and the

repurchase of A&F's Common Stock of $50.0 million. For Fiscal 2014, cash outflows for financing activities consisted primarily

of the repurchase of A&F's Common Stock of $285.0 million, the payment of dividends of $57.4 million and the repayment of

borrowings of $195.8 million. For Fiscal 2013, cash outflows for financing activities consisted primarily of the repurchase of

A&F’s Common Stock of $115.8 million, the repayment of borrowings of $15.0 million and the payment of dividends of $61.9

million. For Fiscal 2014 and Fiscal 2013, cash inflows from financing activities consisted primarily of proceeds from borrowings

of $357.0 million and $150.0 million, respectively.

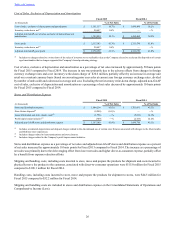

During Fiscal 2015, A&F repurchased approximately 2.5 million shares of A&F’s Common Stock in the open market with a market

value of approximately $50.0 million. During Fiscal 2014, A&F repurchased approximately 7.3 million shares of A&F’s Common

Stock, of which approximately 3.5 million shares with a market value of approximately $135.0 million were purchased in the open

market and approximately 3.8 million shares with an aggregate cost of $150.0 million were purchased pursuant to an accelerated

share repurchase agreement. During Fiscal 2013, A&F repurchased approximately 2.4 million shares of A&F's Common Stock

in the open market with a market value of $115.8 million. Repurchase of A&F's Common Stock were made pursuant to the A&F

Board of Directors' authorizations.

As of January 30, 2016, A&F had approximately 6.5 million remaining shares available for repurchase as part of the A&F Board

of Directors’ previously approved authorizations.

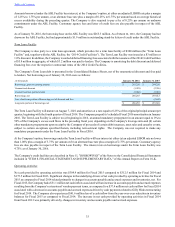

FUTURE CASH REQUIREMENTS AND SOURCES OF CASH

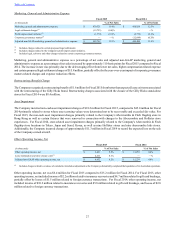

Over the next twelve months, the Company’s primary cash requirements will be to fund operating activities, including the acquisition

of inventory, and obligations related to compensation, leases, taxes and other operating activities, as well as to fund capital

expenditures and quarterly dividends to stockholders subject to approval by A&F's Board of Directors. The Company has

availability under the ABL Facility as a source of additional funding.

The Company may continue to repurchase shares of its Common Stock and would anticipate funding these cash requirements

utilizing free cash flow generated from operations or proceeds from its existing credit facilities.

As of January 30, 2016, $239.4 million of the Company's $588.6 million of cash and equivalents was held by foreign affiliates.

The Company is not dependent on dividends from its foreign affiliates to fund its U.S. operations or make distributions to A&F’s

stockholders. Unremitted earnings from foreign affiliates generally would become subject to U.S. income tax if remitted as

dividends or lent to A&F or a U.S. affiliate. As of January 30, 2016, a provision for U.S. income tax has not been recorded on

$164.5 million of the cash and equivalents held by foreign affiliates.

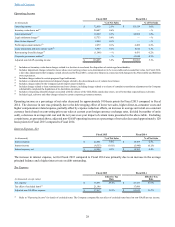

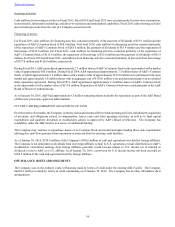

OFF-BALANCE SHEET ARRANGEMENTS

The Company uses in the ordinary course of business stand-by letters of credit under the existing ABL Facility. The Company

had $2.3 million in stand-by letters of credit outstanding as of January 30, 2016. The Company has no other off-balance sheet

arrangements.