Abercrombie & Fitch 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

46

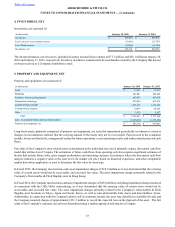

Stores that display an indicator of impairment are subjected to an impairment assessment. The Company’s impairment assessment

requires management to make assumptions and judgments related, but not limited, to management's expectations for future

operations and projected cash flows. The key assumptions used in the Company's undiscounted future cash flow models include

sales, gross margin and, to a lesser extent, operating expenses.

An impairment loss would be recognized when these undiscounted future cash flows are less than carrying amount of the asset

group. In the circumstance of impairment, the loss would be measured as the excess of the carrying amount of the asset group over

its fair value. The key assumptions used in estimating the fair value of impaired assets may include projected cash flows and

discount rate. See Note 5, “PROPERTY AND EQUIPMENT, NET,” for further discussion.

The Company expenses all internal-use software costs incurred in the preliminary project stage and capitalizes certain direct costs

associated with the development and purchase of internal-use software within property and equipment. Capitalized costs are

amortized on a straight-line basis over the estimated useful lives of the software, generally not exceeding seven years.

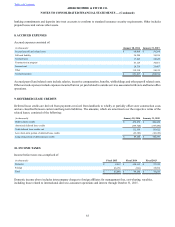

Income taxes

Income taxes are calculated using the asset and liability method. Deferred tax assets and liabilities are recognized based on the

difference between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred

tax assets and liabilities are measured using current enacted tax rates in effect for the years in which those temporary differences

are expected to reverse. Inherent in the determination of the Company's income tax liability and related deferred income tax

balances are certain judgments and interpretations of enacted tax law and published guidance with respect to applicability to the

Company's operations. The Company is subject to audit by taxing authorities, usually several years after tax returns have been

filed, and the taxing authorities may have differing interpretations of tax laws. Valuation allowances are established to reduce

deferred tax assets to the amount expected to be realized when it is more likely than not that some portion or all of the deferred

tax assets will not be realized.

The Company records tax expense or benefit that does not relate to ordinary income in the current fiscal year discretely in the

period in which it occurs. Examples of such types of discrete items include, but are not limited to: changes in estimates of the

outcome of tax matters related to prior years, assessments of valuation allowances, return-to-provision adjustments, tax-exempt

income, the settlement of tax audits and changes in tax legislation and/or regulations.

At the beginning of the fourth quarter of Fiscal 2015, the Company restructured its international operations to support its

omnichannel initiatives. As a result of the restructuring, the Company no longer believes that future net income as of the date of

the restructuring will be indefinitely reinvested and as such is providing a deferred U.S. income tax liability for the additional

taxes due upon a future repatriation.

See Note 10, “INCOME TAXES,” for a discussion regarding the Company’s policies for uncertain tax positions.

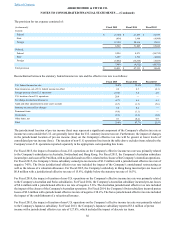

Foreign currency translation and transactions

The functional currencies of the Company’s foreign subsidiaries are generally the respective local currencies in the countries in

which they operate. Assets and liabilities denominated in foreign currencies are translated into U.S. Dollars (the reporting currency)

at the exchange rate prevailing at the balance sheet date. Equity accounts denominated in foreign currencies are translated into

U.S. Dollars at historical exchange rates. Revenues and expenses denominated in foreign currencies are translated into U.S. Dollars

at the monthly average exchange rate for the period. Gains and losses resulting from foreign currency transactions are included in

the results of operations; whereas, translation adjustments and inter-company loans of a long-term investment nature are reported

as an element of Other Comprehensive Income (Loss). Foreign currency transactions resulted in a loss of $1.5 million for Fiscal

2015, a loss of $2.0 million for Fiscal 2014 and a gain of $2.9 million for Fiscal 2013.

Derivative instruments

See Note 14, “DERIVATIVE INSTRUMENTS.”