Abercrombie & Fitch 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

55

banking commitments and deposits into trust accounts to conform to standard insurance security requirements. Other includes

prepaid leases and various other assets.

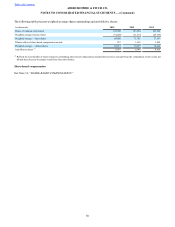

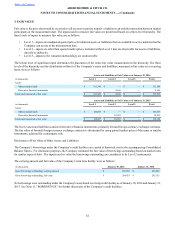

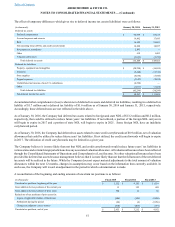

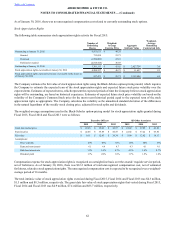

8. ACCRUED EXPENSES

Accrued expenses consisted of:

(in thousands) January 30, 2016 January 31, 2015

Accrued payroll and related costs $ 60,464 $ 56,384

Gift card liability 36,384 36,936

Accrued taxes 37,203 34,629

Construction in progress 43,129 30,661

Accrued rent 24,739 25,607

Other 119,318 98,519

Accrued expenses $ 321,237 $ 282,736

Accrued payroll and related costs include salaries, incentive compensation, benefits, withholdings and other payroll related costs.

Other accrued expenses include expenses incurred but not yet paid related to outside services associated with store and home office

operations.

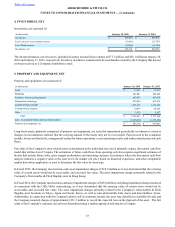

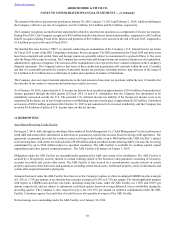

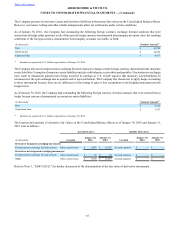

9. DEFERRED LEASE CREDITS

Deferred lease credits are derived from payments received from landlords to wholly or partially offset store construction costs

and are classified between current and long-term liabilities. The amounts, which are amortized over the respective terms of the

related leases, consisted of the following:

(in thousands) January 30, 2016 January 31, 2015

Deferred lease credits $ 472,279 $ 490,452

Amortized deferred lease credits (359,720) (357,430)

Total deferred lease credits, net 112,559 133,022

Less: short-term portion of deferred lease credits (23,303) (26,629)

Long-term portion of deferred lease credits $ 89,256 $ 106,393

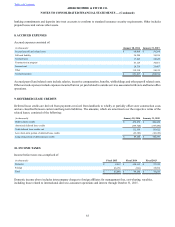

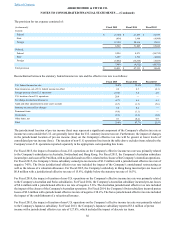

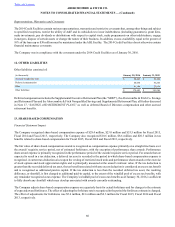

10. INCOME TAXES

Income before taxes was comprised of:

(in thousands) Fiscal 2015 Fiscal 2014 Fiscal 2013

Domestic $ 8,412 $ 100,115 $ 37,325

Foreign 46,178 (961) 35,952

Total $ 54,590 $ 99,154 $ 73,277

Domestic income above includes intercompany charges to foreign affiliates for management fees, cost-sharing, royalties,

including those related to international direct-to-consumer operations and interest through October 31, 2015.