Abercrombie & Fitch 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

37

The Company believes the following policies are the most critical to the portrayal of the Company’s financial condition and results

of operations.

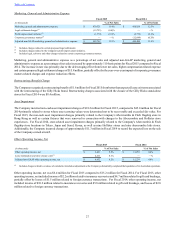

Policy Effect if Actual Results Differ from Assumptions

Revenue Recognition

The Company reserves for sales returns through estimates based

on historical returns experience, recent sales activity and

various other assumptions that management believes to be

reasonable.

The Company has not made any material changes in the

accounting methodology used to determine the sales return

reserve over the past three fiscal years.

The Company does not expect material changes to the

underlying assumptions used to measure the sales return reserve

as of January 30, 2016. However, actual results could vary from

estimates and could result in material gains or losses.

Inventory Valuation

The Company reviews inventories on a quarterly basis. The

Company reduces the inventory valuation when the carrying

cost of specific inventory items on hand exceeds the amount

expected to be realized from the ultimate sale or disposal of the

goods, through a lower of cost or market ("LCM") adjustment.

The valuation reserve is established to reduce inventory to its

net realizable value based on the Company's consideration of

multiple factors and assumptions including demand forecasts,

current sales volumes, expected sell-off activity, composition

and aging of inventory, historical recoverability experience and

risk of obsolescence from changes in economic conditions or

customer preferences.

The Company does not expect material changes to the

underlying assumptions used to measure the shrink reserve or

the LCM reserve as of January 30, 2016. However, actual results

could vary from estimates and could significantly impact the

ending inventory valuation at cost, as well as gross margin.

An increase or decrease in the LCM reserve of 10% would have

affected pre-tax income by approximately $2.0 million for

Fiscal 2015.

Additionally, as part of inventory valuation, an inventory shrink

estimate is made each quarter that reduces the value of inventory

for lost or stolen items, based on sales volumes, average unit

costs, historical losses and actual shrink results from previous

physical inventories.

An increase or decrease in the inventory shrink accrual of 10%

would have affected pre-tax income by approximately $1.1

million for Fiscal 2015.

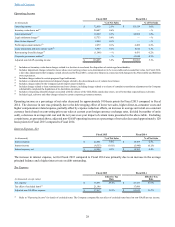

Long-lived Assets

Long-lived assets, primarily comprised of leasehold

improvements, furniture, fixtures and equipment, are tested for

recoverability whenever events or changes in circumstances

indicate that the carrying amount of the long-lived asset might

not be recoverable. These include, but are not limited to,

material declines in operational performance, a history of

losses, an expectation of future losses, other than temporary

adverse market conditions and store closure or relocation

decisions. On at least a quarterly basis, the Company reviews

for indicators of impairment at the individual store level, the

lowest level for which cash flows are identifiable.

Impairment loss calculations involve uncertainty due to the

nature of the assumptions that management is required to make,

including estimating projected cash flows and selecting the

discount rate that best reflects the risk inherent in future cash

flows. If actual results are not consistent with the estimates and

assumptions used, there may be a material impact on the

Company's financial condition or results of operation.

As of January 30, 2016, stores that were tested for impairment

and not impaired had a net book value of $7.6 million and had

undiscounted cash flows which were in the range of 100% to

150% of their respective net asset values.

Stores that display an indicator of impairment are subjected to

an impairment assessment. The Company’s impairment

assessment requires management to make assumptions and

judgments related, but not limited, to management's

expectations for future operations and projected cash flows. The

key assumptions used in the Company's undiscounted future

cash flow models include sales, gross margin and, to a lesser

extent, operating expenses.

An impairment loss would be recognized when these

undiscounted future cash flows are less than carrying amount

of the asset group. In the circumstance of impairment, the loss

would be measured as the excess of the carrying amount of the

asset group over its fair value. The key assumptions used in

estimating the fair value of impaired assets may include

projected cash flows and discount rate.

For stores assessed by management as having indicators of

impairment, a 10% decrease in the sales assumption used to

project future cash flows in the impairment testing performed

as of January 30, 2016 would have increased the Fiscal 2015

impairment charge by an insignificant amount.