Abercrombie & Fitch 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

60

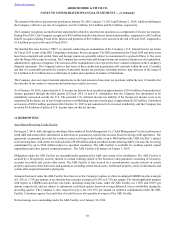

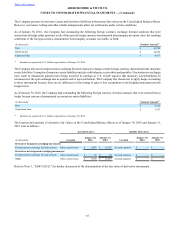

Representations, Warranties and Covenants

The 2014 Credit Facilities contain various representations, warranties and restrictive covenants that, among other things and subject

to specified exceptions, restrict the ability of A&F and its subsidiaries to incur indebtedness (including guarantees), grant liens,

make investments, pay dividends or distributions with respect to capital stock, make prepayments on other indebtedness, engage

in mergers, dispose of certain assets or change the nature of their business. In addition, excess availability equal to the greater of

10% of the loan cap or $30 million must be maintained under the ABL Facility. The 2014 Credit Facilities do not otherwise contain

financial maintenance covenants.

The Company was in compliance with the covenants under the 2014 Credit Facilities as of January 30, 2016.

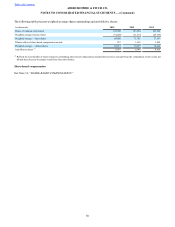

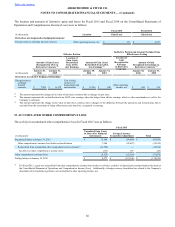

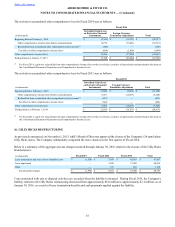

12. OTHER LIABILITIES

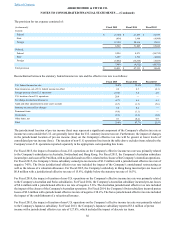

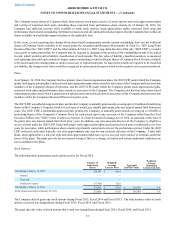

Other liabilities consisted of:

(in thousands) January 30, 2016 January 31, 2015

Accrued straight-line rent $ 90,445 $ 99,108

Deferred compensation 48,058 56,244

Other 41,180 25,934

Other liabilities $ 179,683 $ 181,286

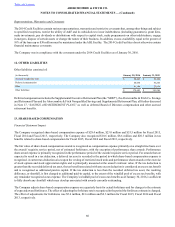

Deferred compensation includes the Supplemental Executive Retirement Plan (the “SERP”), the Abercrombie & Fitch Co. Savings

and Retirement Plan and the Abercrombie & Fitch Nonqualified Savings and Supplemental Retirement Plan, all further discussed

in Note 17, “SAVINGS AND RETIREMENT PLANS,” as well as deferred Board of Directors compensation and other accrued

retirement benefits.

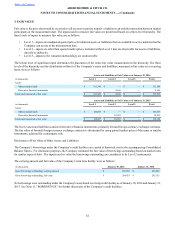

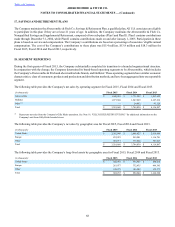

13. SHARE-BASED COMPENSATION

Financial Statement Impact

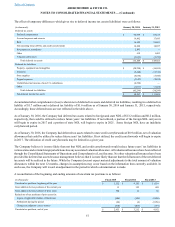

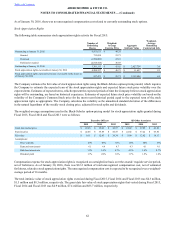

The Company recognized share-based compensation expense of $28.4 million, $23.0 million and $53.5 million for Fiscal 2015,

Fiscal 2014 and Fiscal 2013, respectively. The Company also recognized $10.6 million, $8.6 million and $20.3 million in tax

benefits related to share-based compensation for Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively.

The fair value of share-based compensation awards is recognized as compensation expense primarily on a straight-line basis over

the awards’ requisite service period, net of estimated forfeitures, with the exception of performance share awards. Performance

share award expense is primarily recognized in the performance period of the awards' requisite service period. For awards that are

expected to result in a tax deduction, a deferred tax asset is recorded in the period in which share-based compensation expense is

recognized. A current tax deduction arises upon the vesting of restricted stock units and performance share awards or the exercise

of stock options and stock appreciation rights and is principally measured at the award’s intrinsic value. If the tax deduction is

greater than the recorded deferred tax asset, the tax benefit associated with any excess deduction is considered an excess tax benefit

and is recognized as additional paid-in capital. If the tax deduction is less than the recorded deferred tax asset, the resulting

difference, or shortfall, is first charged to additional paid-in capital, to the extent of the windfall pool of excess tax benefits, with

any remainder recognized as tax expense. The Company’s windfall pool of excess tax benefits as of January 30, 2016, is sufficient

to fully absorb any shortfall which may develop associated with awards currently outstanding.

The Company adjusts share-based compensation expense on a quarterly basis for actual forfeitures and for changes to the estimate

of expected award forfeitures. The effect of adjusting the forfeiture rate is recognized in the period the forfeiture estimate is changed.

The effect of adjustments for forfeitures was $5.6 million, $2.6 million and $2.3 million for Fiscal 2015, Fiscal 2014 and Fiscal

2013, respectively.