Abercrombie & Fitch 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

64

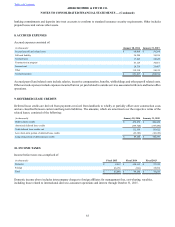

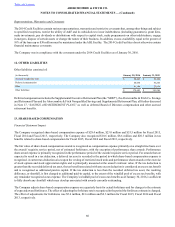

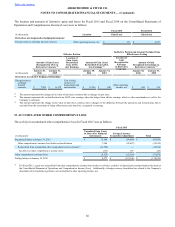

The weighted-average assumptions used for market-based restricted stock units in the Monte Carlo simulation during Fiscal 2015

and Fiscal 2014 were as follows:

Fiscal 2015 Fiscal 2014

Grant date market price $ 22.46 $ 36.20

Fair value $ 19.04 $ 40.42

Assumptions:

Price volatility 45% 49%

Expected term (years) 2.8 2.7

Risk-free interest rate 0.9% 0.8%

Dividend yield 3.5% 2.2%

Average volatility of peer companies 34.0% 36.0%

Average correlation coefficient of peer companies 0.3288 0.3704

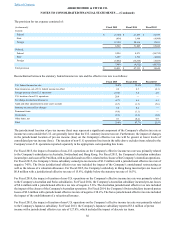

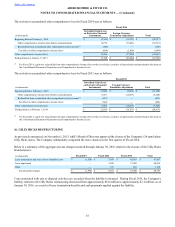

14. DERIVATIVE INSTRUMENTS

The Company is exposed to risks associated with changes in foreign currency exchange rates and uses derivative instruments,

primarily forward contracts, to manage the financial impacts of these exposures. The Company does not use forward contracts

to engage in currency speculation and does not enter into derivative financial instruments for trading purposes.

In order to qualify for hedge accounting treatment, a derivative instrument must be considered highly effective at offsetting changes

in either the hedged item’s cash flows or fair value. Additionally, the hedge relationship must be documented to include the risk

management objective and strategy, the hedging instrument, the hedged item, the risk exposure, and how hedge effectiveness will

be assessed prospectively and retrospectively. The extent to which a hedging instrument has been, and is expected to continue to

be, effective at offsetting changes in fair value or cash flows is assessed and documented at least quarterly. Any hedge ineffectiveness

is reported in current period earnings and hedge accounting is discontinued if it is determined that the derivative instrument is not

highly effective.

For derivative instruments that either do not qualify for hedge accounting or are not designated as hedges, all changes in the fair

value of the derivative instrument are recognized in earnings. For qualifying cash flow hedges, the effective portion of the change

in the fair value of the derivative instrument is recorded as a component of other comprehensive income (loss) (“OCI”) and

recognized in earnings when the hedged cash flows affect earnings. The ineffective portion of the derivative instrument gain or

loss is recognized in current period earnings. The effectiveness of the hedge is assessed based on changes in the fair value

attributable to changes in spot prices. The changes in the fair value of the derivative instrument related to the changes in the

difference between the spot price and the forward price are excluded from the assessment of hedge effectiveness and are also

recognized in current period earnings. If the cash flow hedge relationship is terminated, the derivative instrument gains or losses

that are deferred in OCI will be recognized in earnings when the hedged cash flows occur. However, for cash flow hedges that

are terminated because the forecasted transaction is not expected to occur in the original specified time period, or a two-month

period thereafter, the derivative instrument gains or losses are immediately recognized in earnings.

The Company uses derivative instruments, primarily forward contracts designated as cash flow hedges, to hedge the foreign

currency exposure associated with forecasted foreign-currency-denominated inter-company inventory sales to foreign subsidiaries

and the related settlement of the foreign-currency-denominated inter-company receivables. Fluctuations in exchange rates will

either increase or decrease the Company’s inter-company equivalent cash flows and affect the Company’s U.S. Dollar earnings.

Gains or losses on the foreign currency exchange forward contracts that are used to hedge these exposures are expected to partially

offset this variability. Foreign currency exchange forward contracts represent agreements to exchange the currency of one country

for the currency of another country at an agreed-upon settlement date. These forward contracts typically have a maximum term

of twelve months. The sale of the inventory to the Company’s customers will result in the reclassification of related derivative

gains and losses that are reported in accumulated other comprehensive loss ("AOCL"). Substantially all of the unrealized gains

or losses related to designated cash flow hedges as of January 30, 2016 will be recognized in cost of sales, exclusive of depreciation

and amortization over the next twelve months.