Abercrombie & Fitch 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

65

The Company presents its derivative assets and derivative liabilities at their gross fair values on the Consolidated Balance Sheets.

However, our master netting and other similar arrangements allow net settlements under certain conditions.

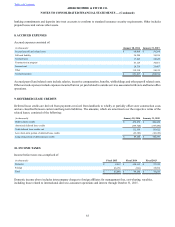

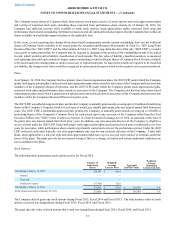

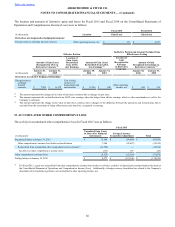

As of January 30, 2016, the Company had outstanding the following foreign currency exchange forward contracts that were

entered into to hedge either a portion, or all, of forecasted foreign-currency-denominated intercompany inventory sales, the resulting

settlement of the foreign-currency-denominated intercompany accounts receivable, or both:

(in thousands) Notional Amount(1)

Euro $ 94,700

British pound $ 22,029

Canadian dollar $ 8,617

(1) Amounts are reported in U.S. Dollars equivalent as of January 30, 2016.

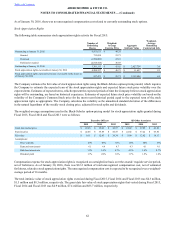

The Company also uses foreign currency exchange forward contracts to hedge certain foreign-currency-denominated net monetary

assets/liabilities. Examples of monetary assets/liabilities include cash balances, receivables and payables. Fluctuations in exchange

rates result in transaction gains/(losses) being recorded in earnings as U.S. GAAP requires that monetary assets/liabilities be

remeasured at the spot exchange rate at quarter-end or upon settlement. The Company has chosen not to apply hedge accounting

to these instruments because there are no differences in the timing of gain or loss recognition on the hedging instrument and the

hedged item.

As of January 30, 2016, the Company had outstanding the following foreign currency forward contracts that were entered into to

hedge foreign currency denominated net monetary assets/liabilities:

(in thousands) Notional Amount(1)

Euro $ 8,714

Switzerland franc $ 3,933

(1) Amounts are reported in U.S. Dollars equivalent as of January 30, 2016.

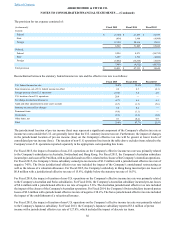

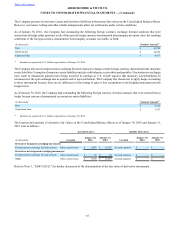

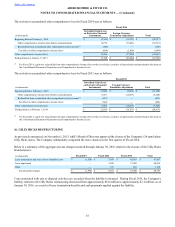

The location and amounts of derivative fair values on the Consolidated Balance Sheets as of January 30, 2016 and January 31,

2015 were as follows:

Asset Derivatives Liability Derivatives

(in thousands) Location January 30,

2016 January 31,

2015 Location January 30,

2016 January 31,

2015

Derivatives designated as hedging instruments:

Foreign currency exchange forward contracts Other current assets $ 4,097 $ 10,283 Accrued expenses $ — $ —

Derivatives not designated as hedging instruments:

Foreign currency exchange forward contracts Other current assets $ 69 $ 10 Accrued expenses $ — $ —

Total Other current assets $ 4,166 $ 10,293 Accrued expenses $ — $ —

Refer to Note 3, “FAIR VALUE,” for further discussion of the determination of the fair value of derivative instruments.