Abercrombie & Fitch 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

66

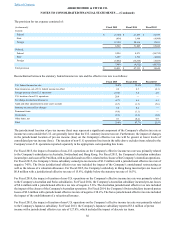

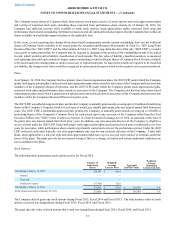

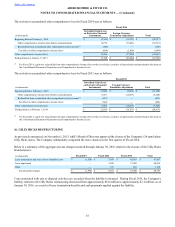

The location and amounts of derivative gains and losses for Fiscal 2015 and Fiscal 2014 on the Consolidated Statements of

Operations and Comprehensive Income (Loss) were as follows:

Fiscal 2015 Fiscal 2014

(in thousands) Location Gain/(Loss) Gain/(Loss)

Derivatives not designated as hedging instruments:

Foreign currency exchange forward contracts Other operating income, net $ 751 $ 2,537

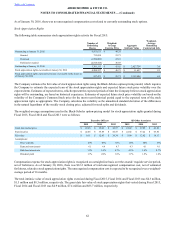

Effective Portion Ineffective Portion and Amount Excluded from

Effectiveness Testing

Amount of Gain (Loss)

Recognized in OCI on

Derivative Contracts (1)

Location of

Gain (Loss)

Reclassified

from AOCL

into Earnings

Amount of Gain (Loss)

Reclassified from AOCL

into Earnings (2)

Location of

Gain

Recognized in

Earnings

on Derivative

Contracts

Amount of Gain

Recognized in Earnings on

Derivative Contracts (3)

(in thousands) January 30,

2016 January 31,

2015 January 30,

2016 January 31,

2015 January 30,

2016 January 31,

2015

Derivatives in cash flow hedging relationships:

Foreign currency

exchange

forward

contracts $ 7,204 $ 16,572

Cost of sales,

exclusive of

depreciation and

amortization $ 15,596 $ 440 Other operating

income, net $ 242 $ 215

(1) The amount represents the change in fair value of derivative contracts due to changes in spot rates.

(2) The amount represents the reclassification from AOCL into earnings when the hedged item affects earnings, which is when merchandise is sold to the

Company’s customers.

(3) The amount represents the change in fair value of derivative contracts due to changes in the difference between the spot price and forward price that is

excluded from the assessment of hedge effectiveness and, therefore, recognized in earnings.

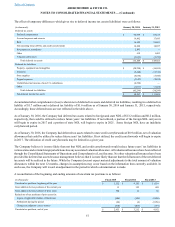

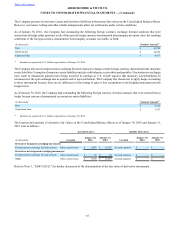

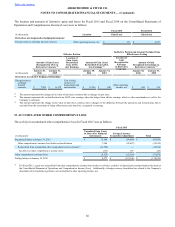

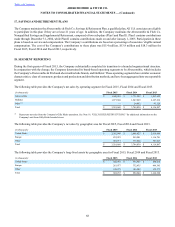

15. ACCUMULATED OTHER COMPREHENSIVE LOSS

The activity in accumulated other comprehensive loss for Fiscal 2015 was as follows:

Fiscal 2015

(in thousands)

Unrealized Gain (Loss)

on Derivative Financial

Instruments Foreign Currency

Translation Adjustment Total

Beginning balance at January 31, 2015 $ 13,100 $ (96,680) $ (83,580)

Other comprehensive income (loss) before reclassifications 7,204 (22,623) (15,419)

Reclassified from accumulated other comprehensive (loss) income(1) (15,596) — (15,596)

Tax effect on other comprehensive income (loss) (131) 107 (24)

Other comprehensive income (loss) (8,523) (22,516) (31,039)

Ending balance at January 30, 2016 $ 4,577 $ (119,196) $ (114,619)

(1) For Fiscal 2015, a gain was reclassified from other comprehensive income (loss) to the cost of sales, exclusive of depreciation and amortization line item on

the Consolidated Statement of Operations and Comprehensive Income (Loss). Additionally, a foreign currency translation loss related to the Company's

dissolution of its Australian operations was reclassified to other operating income, net.