Abercrombie & Fitch 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

56

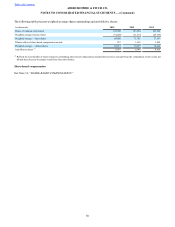

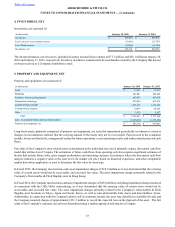

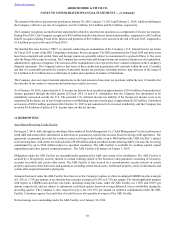

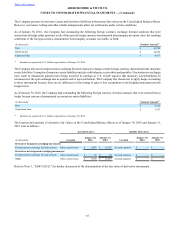

The provision for tax expense consisted of:

(in thousands) Fiscal 2015 Fiscal 2014 Fiscal 2013

Current:

Federal $ (3,124) $ 21,287 $ 52,579

State (434) 1,944 (4,988)

Foreign 12,120 28,614 17,851

8,562 51,845 65,442

Deferred:

Federal 9,224 8,971 (36,732)

State 3,297 1,783 (4,606)

Foreign (5,052) (15,266) (5,455)

7,469 (4,512) (46,793)

Total provision $ 16,031 $ 47,333 $ 18,649

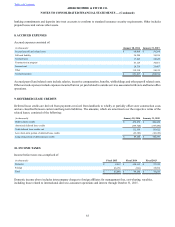

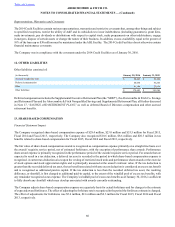

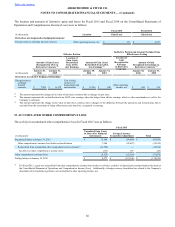

Reconciliation between the statutory federal income tax rate and the effective tax rate is as follows:

Fiscal 2015 Fiscal 2014 Fiscal 2013

U.S. Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of U.S. federal income tax effect 4.6 4.3 (4.1)

Foreign taxation of non-U.S. operations (10.2) 5.4 2.0

U.S. taxation of non-U.S. operations 20.0 — —

Net change in valuation allowances (8.7) 6.6 0.1

Audit and other adjustments to prior years' accruals (8.7) (1.3) (5.6)

Statutory tax rate and law changes 4.2 0.2 —

Permanent items (4.6) (1.1) —

Credit items (2.3) (1.2) (2.8)

Other items, net 0.1 (0.2) 0.9

Total 29.4% 47.7% 25.5%

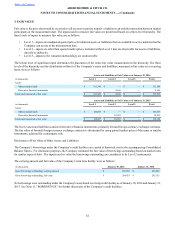

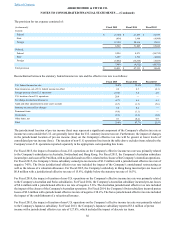

The jurisdictional location of pre-tax income (loss) may represent a significant component of the Company's effective tax rate as

income tax rates outside the U.S. are generally lower than the U.S. statutory income tax rate. Furthermore, the impact of changes

in the jurisdictional location of pre-tax income (loss) on the Company's effective tax rate will be greater at lower levels of

consolidated pre-tax income (loss). The taxation of non-U.S. operations line item in the table above excludes items related to the

Company's non-U.S. operations reported separately in the appropriate corresponding line items.

For Fiscal 2015, the impact of taxation of non-U.S. operations on the Company's effective income tax rate was primarily related

to the Company's subsidiaries in Australia, Switzerland and Hong Kong. For Fiscal 2015, the Company's Australian subsidiary

incurred pre-tax losses of $4.9 million, with no jurisdictional tax effect, related to the closure of the Company’s Australian operations.

For Fiscal 2015, the Company’s Swiss subsidiary earned pre-tax income of $1.9 million with a jurisdictional effective tax rate of

negative 745%. The Swiss jurisdictional effective tax rate included the impact of the Company’s omnichannel restructuring as

well as the release of a valuation allowance. For Fiscal 2015, the Company's subsidiary in Hong Kong incurred pre-tax losses of

$6.8 million with a jurisdictional effective tax rate of 15.8%, slightly below the statutory tax rate of 16.5%.

For Fiscal 2014, the impact of taxation of non-U.S. operations on the Company's effective income tax rate was primarily related

to the Company's Australian and Swiss subsidiaries. For Fiscal 2014, the Company's Australian subsidiary incurred pre-tax losses

of $8.4 million with a jurisdictional effective tax rate of negative 5.6%. The Australian jurisdictional effective tax rate included

the impact of the closure of the Company's Australian operations. For Fiscal 2014, the Company's Swiss subsidiary incurred pretax

losses of $2.6 million with a jurisdictional effective tax rate of negative 218.4%. The Swiss jurisdictional effective tax rate included

the impact of the establishment of a valuation allowance.

For Fiscal 2013, the impact of taxation of non-U.S. operations on the Company's effective income tax rate was primarily related

to the Company's Japanese subsidiary. For Fiscal 2013, the Company's Japanese subsidiary reported $3.4 million of pretax

income with a jurisdictional effective tax rate of 127.8%, which included the impact of discrete tax items.