Abercrombie & Fitch 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

29

With respect to the Company’s annual effective tax rate, undistributed net income generated by foreign subsidiaries after October

31, 2015 is no longer considered to be indefinitely invested outside of the U.S. Accordingly, the Company recognized deferred

U.S. income taxes on net income generated after October 31, 2015. This change is reflected in the Company’s income tax expense

recognized for Fiscal 2015.

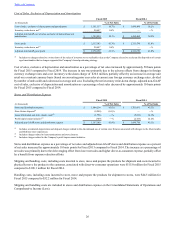

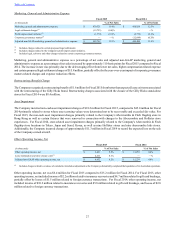

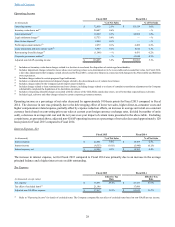

The effective tax rate was 29.4% for Fiscal 2015 compared to 47.7% for Fiscal 2014. Excluding certain items, as presented above

in the table under "Operating Income," the adjusted non-GAAP effective tax rate was 31.5% for Fiscal 2015 compared to 36.7%

for Fiscal 2014. The effective tax rate and the adjusted non-GAAP effective tax rate for Fiscal 2015 reflect discrete benefits of

$7.4 million and $5.4 million, respectively, related to a release of a valuation allowance and other discrete tax items.

As of January 30, 2016, the Company had approximately $89.7 million in net deferred tax assets, which included approximately

$14.2 million of net deferred tax assets in Japan. The realization of the Company's Japanese net deferred tax assets will depend

upon the future generation of sufficient taxable profits Japan. While the Company believes it is more likely than not that these

net deferred tax assets will be realized, it is not certain. Should circumstances change, these net deferred tax assets may become

subject to a valuation allowance in the future. Additional valuation allowances would result in additional tax expense.

Net Income and Net Income per Share Attributable to A&F

Net income and net income per diluted share attributable to A&F were $35.6 million and $0.51, respectively, for Fiscal 2015

compared to net income and net income per diluted share attributable to A&F of $51.8 million and $0.71, respectively, for Fiscal

2014. Excluding certain items and their tax effects, as presented above under "Operating Income" and "Tax Expense," adjusted

non-GAAP net income and net income per diluted share attributable to A&F were $78.0 million and $1.12, respectively, for Fiscal

2015 compared to adjusted non-GAAP net income and net income per diluted share attributable to A&F of $112.3 million and

$1.54, respectively, for Fiscal 2014.

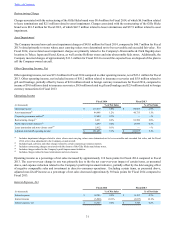

FISCAL 2014 COMPARED TO FISCAL 2013

Net Sales

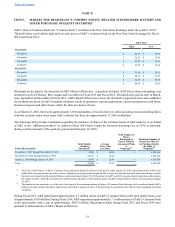

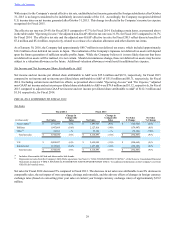

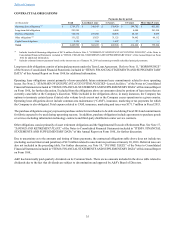

Fiscal 2014 Fiscal 2013

(in thousands) Net Sales

Change in

Comparable

Sales Net Sales

Change in

Comparable

Sales Net Sales

$ Change Net Sales

% Change

Abercrombie(1) $ 1,771,299 (5)% $ 1,893,955 (9)% $ (122,656) (6)%

Hollister 1,947,869 (10)% 2,127,816 (14)% (179,947) (8)%

Other(2) 24,862 —% 95,126 —% (70,264) (74)%

Total net sales $ 3,744,030 (8)% $ 4,116,897 (11)% $ (372,867) (9)%

U.S. $ 2,408,427 (6)% $ 2,659,089 (11)% $ (250,662) (9)%

International 1,335,603 (12)% 1,457,808 (11)% (122,205) (8)%

Total net sales $ 3,744,030 (8)% $ 4,116,897 (11)% $ (372,867) (9)%

(1) Includes Abercrombie & Fitch and abercrombie kids brands.

(2) Represents net sales from the Company's Gilly Hicks operations. See Note 16, "GILLY HICKS RESTRUCTURING," of the Notes to Consolidated Financial

Statements included in "ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA," for additional information on the Company's exit from

Gilly Hicks branded stores.

Net sales for Fiscal 2014 decreased 9% compared to Fiscal 2013. The decrease in net sales was attributable to an 8% decrease in

comparable sales, the net impact of store openings, closings and remodels, and the adverse effects of changes in foreign currency

exchange rates (based on converting prior year sales at current year foreign currency exchange rates) of approximately $19.2

million.