Abercrombie & Fitch 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

51

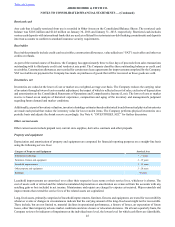

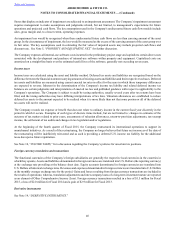

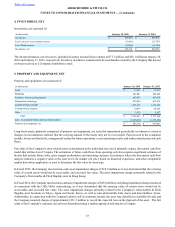

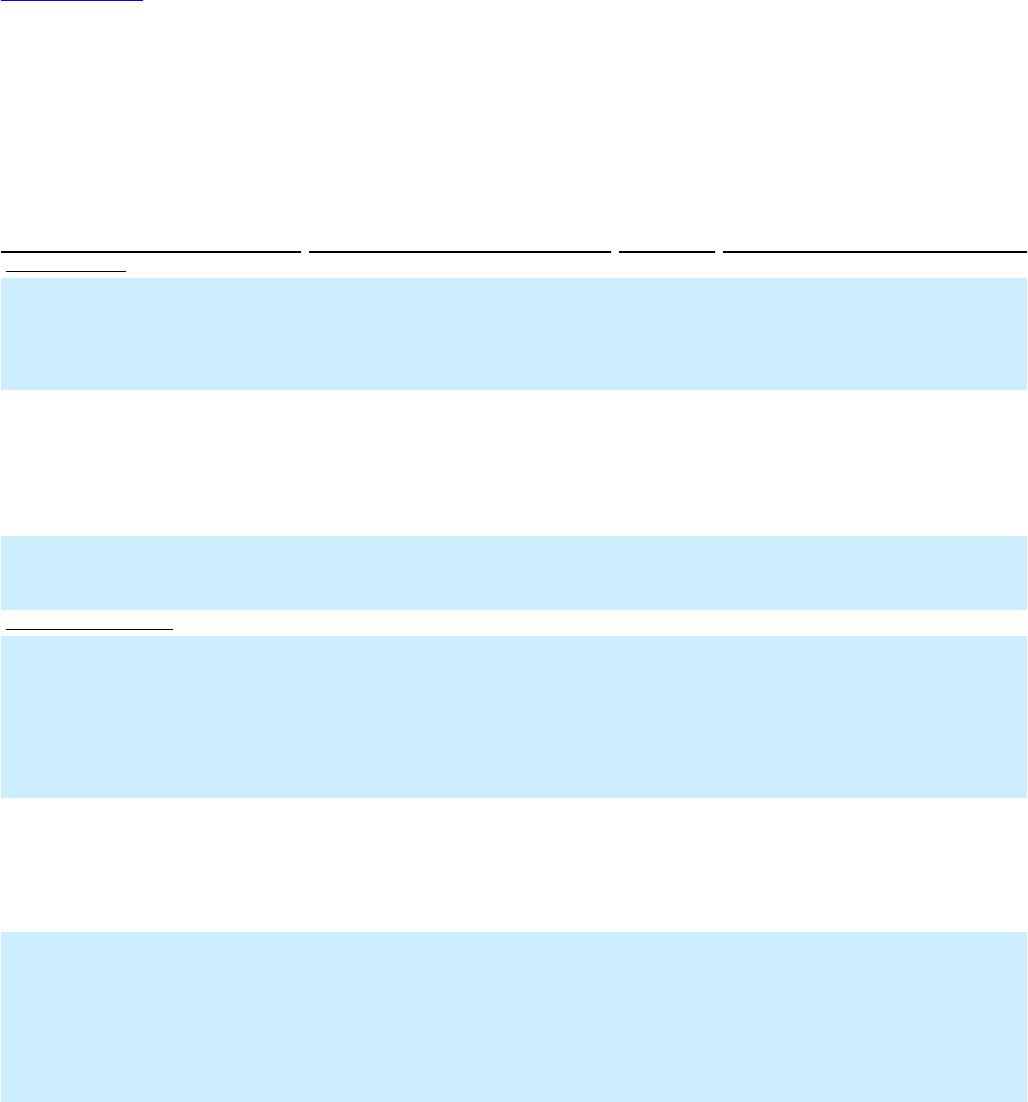

Recent accounting pronouncements

The following table provides a brief description of recent accounting pronouncements that could affect the Company's financial

statements:

Standard Description Effective

Date Effect on the Financial Statements or

Other Significant Matters

Standards adopted

ASU 2015-03, Simplifying the Presentation

of Debt Issuance Costs This standard amends ASC 835, Interest—

Imputation of Interest. The amendment

provides guidance on the financial statement

presentation of debt issuance costs as a direct

reduction of a liability when associated with a

liability.

February 1,

2015 The adoption of this guidance impacted the

Company's consolidated financial statements

by approximately $0.6 million.

ASU 2015-15, Simplifying the Presentation

of Debt Issuance Costs This standard amends ASC 835, Interest—

Imputation of Interest. The amendment

provides guidance on the financial statement

presentation of debt issuance costs associated

with line-of-credit arrangements as an asset

regardless of whether there are any

outstanding borrowings on the line-of-credit

arrangement.

August 2,

2015 The adoption of this guidance did not have any

impact on the Company's consolidated

financial statements.

ASU 2015-17, Income Taxes: Balance Sheet

Classification of Deferred Taxes This standard requires that deferred tax assets

and liabilities be classified as noncurrent in a

classified statement of financial position.

November 1,

2015 The adoption of this standard resulted in the

prospective reclassification of all current

deferred tax assets and liabilities to noncurrent

in the Company's consolidated balance sheet.

Standards not yet adopted

ASU 2014-09, Revenue from Contracts with

Customers This standard supersedes the revenue

recognition requirements in "Revenue

Recognition (Topic 605)." The new ASC

guidance requires entities to recognize

revenue in a way that depicts the transfer of

promised goods or services to customers in an

amount that reflects the consideration which

the entity expects to be entitled to in exchange

for those goods or services.

February 4,

2018 The Company is currently evaluating the

potential impact of this standard.

ASU 2014-15, Presentation of Financial

Statements—Going Concern This standard requires, for each annual and

interim reporting period, an entity’s

management to evaluate whether there are

conditions or events, considered in the

aggregate, that raise substantial doubt about

the entity’s ability to continue as a going

concern.

January 30,

2016* The adoption of this amendment is not

expected to have a material impact on the

Company's consolidated financial statements.

ASU 2015-11, Simplifying the Measurement

of Inventory This standard amends ASC 330, Inventory.

This amendment applies to inventory

measured using first-in, first-out (FIFO) or

average cost. Under this amendment,

inventory should be measured at the lower of

cost and net realizable value, which is the

estimated selling price in the ordinary course

of business, less reasonably predictable costs

of completion, disposal and transportation.

January 29,

2017* The adoption of this amendment is not

expected to have a material impact on the

Company's consolidated financial statements.

ASU 2016-02, Leases This standard supersedes the leasing

requirements in "Leases (Topic 840)." The

new ASC guidance requires an entity to

recognize lease assets and lease liabilities,

classified as operating leases, on the balance

sheet and disclose key leasing information that

depicts the lease rights and obligations of an

entity.

Febuary 4,

2019* The Company is currently evaluating the

potential impact of this standard.

* Early adoption is permitted.