Abercrombie & Fitch 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

61

The Company issues shares of Common Stock from treasury stock upon exercise of stock options and stock appreciation rights

and vesting of restricted stock units, including those converted from performance share awards. As of January 30, 2016, the

Company had sufficient treasury stock available to settle stock options, stock appreciation rights, restricted stock units and

performance share awards outstanding. Settlement of stock awards in Common Stock also requires that the Company have sufficient

shares available in stockholder-approved plans at the applicable time.

In the event, at each reporting date during which share-based compensation awards remain outstanding, there are not sufficient

shares of Common Stock available to be issued under the Amended and Restated Abercrombie & Fitch Co. 2007 Long-Term

Incentive Plan (the “2007 LTIP”) and the Abercrombie & Fitch Co. 2005 Long-Term Incentive Plan (the “2005 LTIP”), or under

a successor or replacement plan, the Company may be required to designate some portion of the outstanding awards to be settled

in cash, which would result in liability classification of such awards. The fair value of liability-classified awards is re-measured

each reporting date until such awards no longer remain outstanding or until sufficient shares of Common Stock become available

to be issued under the existing plans or under a successor or replacement plan. As long as the awards are required to be classified

as a liability, the change in fair value would be recognized in current period expense based on the requisite service period rendered.

Plans

As of January 30, 2016, the Company had two primary share-based compensation plans: the 2005 LTIP, under which the Company

grants stock appreciation rights, restricted stock units and performance share awards to associates of the Company and non-associate

members of the Company's Board of Directors, and the 2007 LTIP, under which the Company grants stock appreciation rights,

restricted stock units and performance share awards to associates of the Company. The Company also has four other share-based

compensation plans under which it granted stock options and restricted stock units to associates of the Company and non-associate

members of the the Company's Board of Directors in prior years.

The 2007 LTIP, a stockholder-approved plan, permits the Company to annually grant awards covering up to 2.0 million of underlying

shares of the Company's Common Stock for each type of award, per eligible participant, plus any unused annual limit from prior

years. The 2005 LTIP, a stockholder-approved plan, permits the Company to annually grant awards covering up to 250,000 of

underlying shares of the Company's Common Stock for each award type to any associate of the Company (other than the Chief

Executive Officer (the "CEO")) who is subject to Section 16 of the Securities Exchange Act of 1934, as amended, at the time of

the grant, plus any unused annual limit from prior years. In addition, any non-associate director of the Company is eligible to

receive awards under the 2005 LTIP. Under both plans, stock appreciation rights and restricted stock units vest primarily over four

years for associates, while performance share awards are primarily earned and vest over the performance period. Under the 2005

LTIP, restricted stock units typically vest after approximately one year for non-associate directors of the Company. Under both

plans, stock options have a ten-year term and stock appreciation rights have up to a ten-year term, subject to forfeiture under the

terms of the plans. The plans provide for accelerated vesting if there is a change of control and certain additional conditions are

met as defined in the plans.

Stock Options

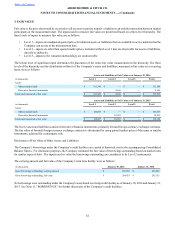

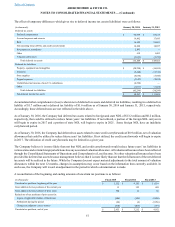

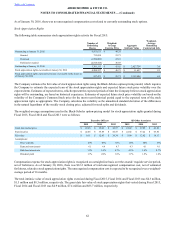

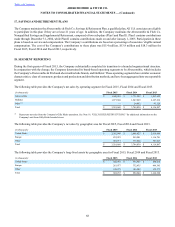

The following table summarizes stock option activity for Fiscal 2015:

Number of

Underlying

Shares

Weighted-

Average

Exercise Price Aggregate

Intrinsic Value

Weighted-

Average

Remaining

Contractual Life

Outstanding at January 31, 2015 328,100 $ 64.64

Granted — —

Exercised — —

Forfeited or expired (57,100) 72.16

Outstanding at January 30, 2016 271,000 $ 63.05 $ 354,740 1.8

Stock options exercisable at January 30, 2016 271,000 $ 63.05 $ 354,740 1.8

The Company did not grant any stock options during Fiscal 2015, Fiscal 2014 and Fiscal 2013. The total intrinsic value of stock

options exercised was insignificant during Fiscal 2015, Fiscal 2014, and Fiscal 2013.

The grant date fair value of stock options that vested was insignificant during Fiscal 2015, Fiscal 2014, and Fiscal 2013.