Abercrombie & Fitch 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

49

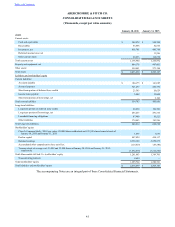

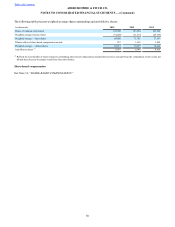

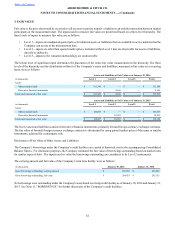

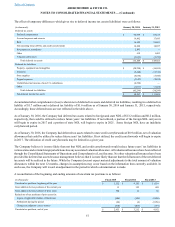

A summary of rent expense follows:

(in thousands) 2015 2014 2013

Store rent:

Fixed minimum(1) $ 404,836 $ 432,794 $ 464,937

Contingent 10,161 8,886 8,624

Deferred lease credits amortization (28,619) (38,437) (45,899)

Total store rent expense 386,378 403,243 427,662

Buildings, equipment and other 3,849 4,619 4,987

Total rent expense $ 390,227 $ 407,862 $ 432,649

(1) Includes lease termination fees of $3.3 million, $12.4 million and $39.2 million for Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively. Fiscal 2015 includes

a benefit of $1.6 million related to better than expected lease exit terms associated with the closure of the Gilly Hicks stand-alone stores. Fiscal 2014 and Fiscal

2013 include lease termination fees of $6.8 million and $39.1 million, respectively, related to the Gilly Hicks restructuring.

At January 30, 2016, the Company was committed to non-cancelable leases with remaining terms of one to 15 years. Excluded

from the obligations below are portions of lease terms that are currently cancelable at the Company's discretion without condition.

While included in the obligations below, in many instances the Company has options to terminate certain leases if stated sales

volume levels are not met or the Company ceases operations in a given country, which may be subject to lease termination policies.

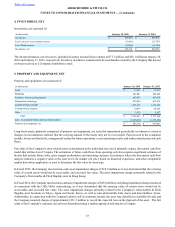

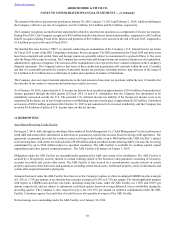

A summary of operating lease commitments, including leasehold financing obligations, under non-cancelable leases follows:

(in thousands)

Fiscal 2016 $ 388,501

Fiscal 2017 $ 327,244

Fiscal 2018 $ 240,877

Fiscal 2019 $ 193,747

Fiscal 2020 $ 155,732

Thereafter $ 423,303

Leasehold financing obligations

In certain lease arrangements, the Company is involved in the construction of a building and is deemed to be the owner of the

construction project. In those instances, the Company records an asset for the amount of the total project costs, including the

portion funded by the landlord, and an amount related to the value attributed to the pre-existing leased building in property and

equipment, net, and a corresponding financing obligation in leasehold financing obligations, on the Consolidated Balance Sheets.

Once construction is complete, if it is determined that the asset does not qualify for sale-leaseback accounting treatment, the

Company continues to amortize the obligation over the lease term and depreciates the asset over its useful life. The Company

allocates a portion of its rent obligation to the assets which are owned for accounting purposes as a reduction of the financing

obligation and interest expense. As of January 30, 2016 and January 31, 2015, the Company had $47.4 million and $50.5 million,

respectively, of long-term liabilities related to leasehold financing obligations. Total interest expense related to landlord financing

obligations was $5.3 million, $6.2 million and $6.6 million for Fiscal 2015, Fiscal 2014 and Fiscal 2013, respectively.

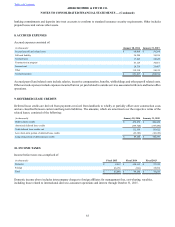

Store pre-opening expenses

Pre-opening expenses related to new store openings are expensed as incurred and are reflected as a component of "stores and

distribution expense."

Design and development costs

Costs to design and develop the Company’s merchandise are expensed as incurred and are reflected as a component of “marketing,

general and administrative expense.”

Net income per share

Net income per basic and diluted share is computed based on the weighted-average number of outstanding shares of common

stock.