ADT 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

If the Separation is determined to be taxable for Swiss withholding tax purposes, we or Tyco could incur

significant Swiss withholding tax liabilities.

Generally, Swiss withholding tax of 35% is due on dividends and similar distributions to our and Tyco’s

shareholders, regardless of the place of residency of the shareholder. As of January 1, 2011, distributions to

shareholders out of qualifying contributed surplus (Kapitaleinlage) accumulated on or after January 1, 1997 are

exempt from Swiss withholding tax, if certain conditions are met (Kapitaleinlageprinzip). Tyco obtained a tax

ruling from the Swiss Federal Tax Administration confirming that the Separation qualifies as payment out of

such qualifying contributed surplus and, therefore, no amount was withheld by Tyco when making the

Separation.

This tax ruling relies on certain facts and assumptions and certain representations and undertakings from

Tyco regarding the past conduct of its businesses and other matters. Notwithstanding this tax ruling, the Swiss

Federal Tax Administration could determine on audit that the Separation should be treated as a taxable

transaction for withholding tax purposes if it determines that any of these facts, assumptions, representations or

undertakings is not correct or has been violated. If the Separation ultimately is determined to be taxable for

withholding tax purposes, we and Tyco could incur material Swiss withholding tax liabilities that could

significantly detract from or eliminate the benefits of the Separation. In addition, we could become liable to

indemnify Tyco for part of any Swiss withholding tax liabilities to the extent provided under the 2012 Tax

Sharing Agreement.

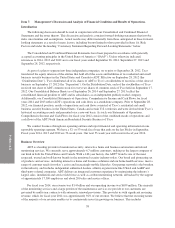

Our combined financial information for periods prior to September 28, 2012, is not necessarily

representative of the results we could achieve as an independent, publicly-traded company and may not

be a reliable indicator of our future results.

The combined financial information included in this report for periods prior to September 28, 2012 does not

necessarily reflect the results of operations, financial condition and cash flows that we could achieve as an

independent, publicly-traded company or those that we will achieve in the future. This is primarily because:

• Prior to the Separation, our business was operated by Tyco as part of its broader corporate

organization, rather than as an independent, publicly-traded company. In addition, prior to the

Separation, Tyco, or one of its affiliates, performed significant corporate functions for us, including tax

and treasury administration and certain governance functions, including internal audit and external

reporting. Our combined financial statements for periods prior to September 28, 2012 reflect

allocations of corporate expenses from Tyco for these and similar functions.

• For periods prior to September 28, 2012, our working capital requirements and capital for our general

corporate purposes, including acquisitions and capital expenditures, were satisfied as part of Tyco’s

company-wide cash management practices. As an independent, publicly-traded company, we no longer

obtain funds from Tyco to finance our working capital or other cash requirements. Rather, we obtain

financing from banks, through public offerings or private placements of debt or equity securities or

other arrangements.

• Other significant changes may occur in our cost structure, management, financing and business

operations as a result of our operating as a company separate from Tyco.

For additional information about our past financial performance and the basis of presentation of our

financial statements, see “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and our Consolidated and Combined Financial Statements.

The ownership by some of our executive officers and directors of common shares, options or other equity

awards of Tyco or Pentair may create, or may create the appearance of, conflicts of interest.

Because of their former positions with Tyco, some of our executive officers, including our chief executive

officer and some of our non-employee directors, own common shares of Tyco and Pentair, options to purchase

31