ADT 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FISCAL YEAR 2014 NEO COMPENSATION—CONTINUED

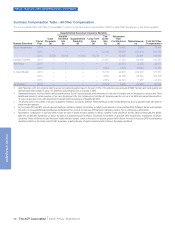

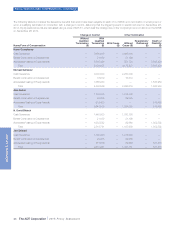

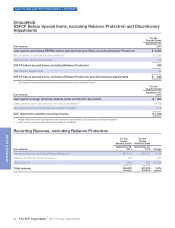

Option Exercises and Stock Vested Table

The following table sets forth information regarding option awards exercised and stock awards vested during fiscal year 2014 for the NEOs.

Values have been rounded to the nearest dollar, where applicable.

Option Awards Stock Awards

Name

Number of Shares

Acquired on

Exercise (#) Value Realized on

Exercise ($) (1)

Number of Shares

Acquired on Vesting (#) Value Realized on

Vesting ($) (2)

Naren Gursahaney 18,000 $787,500 67,282 $2,429,890

Michael Geltzeiler — — — —

Alan Ferber — — 2,835 $ 89,614

N. David Bleisch — — 13,084 $ 476,206

Jerri DeVard — — — —

(1) The amounts in this column reflect the value realized upon the exercise of vested stock options. The value realized is the difference between the sale price of the shares acquired via the

exercise of the options and the exercise price of the options.

(2) The amounts shown in this column reflect the value of stock awards that vested based on the NYSE closing price per share of the Company’s Common Stock on the date of vesting.

Non-Qualified Deferred Compensation Table

The following table presents information related to the non-qualified deferred compensation accounts of each of our NEOs as of September 26,

2014.

Name

Executive

Contributions in Last

Fiscal Year ($) (1)

Registrant

Contributions in Last

Fiscal Year ($) (1)

Aggregate Earnings in

Last Fiscal Year ($) (2)

Aggregate

Withdrawals/

Distributions ($)

Aggregate Balance

at Last Fiscal Year

End ($)

(a) (b) (c) (d) (e) (f)

Naren Gursahaney 36,002 59,025 517,893 — 5,779,880

Michael Geltzeiler — — — — —

Alan Ferber 17,917 8,246 503 — 26,666

N. David Bleisch 3,063 16,895 14,847 (9,891) 166,275

Jerri DeVard — — — — —

(1) The amounts in columns (b) and (c) reflect employee and Company contributions, respectively, under the SSRP, the Company’s non-qualified retirement savings plan. All of the amounts in

column (c) are included in the Summary Compensation Table under the column heading “All Other Compensation.” Under the terms of the SSRP, an eligible executive may elect to defer up

to 50% of his or her base salary and up to 100% of his or her performance bonus.

(2) The amounts in this column include earnings (or losses) on the NEO’s notional account in the SSRP.

Potential Payments Upon Termination or Change in Control

Our NEOs are eligible for certain payments and benefits upon a

termination of employment under either the Severance Plan or the

CIC Severance Plan, depending on the circumstances of their

termination.

Severance Plan. Our NEOs would receive benefits under the

Severance Plan upon an involuntary termination of employment other

than for Cause, permanent disability, or death. Upon such

termination, an NEO would be entitled to the following:

•A payment equal to one and a half times his or her base salary

and one and a half times his or her target annual bonus (two times

base salary and two times target annual bonus for

Mr. Gursahaney).

•Continued participation in the Company’s medical, dental and

health care reimbursement account coverage for 12 months

following termination of employment (or until the NEO commences

employment by another company and becomes eligible for

coverage under the new employer’s plans), subject to the NEO’s

payment of the employee portion of such coverage.

•To the extent the NEO has not become eligible for medical, dental

and health care reimbursement account coverage by a new

employer after the 12-month period following termination of

employment, a cash payment equal to the projected value of the

employer portion of the premiums for such coverage for an

additional period up to 12 months.

•At the Company’s discretion and subject to the Officer Bonus

Plan, a pro-rata bonus for the year of termination based on the

actual performance of the Company and paid when bonuses are

paid to other participants in the plan.

•At the Company’s discretion, outplacement services for a period

not to exceed 12 months.

Each NEO must execute a general release of claims in favor of the

Company in order to receive these benefits. Following termination,

42 The ADT Corporation 2015 Proxy Statement

PROXY STATEMENT