ADT 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

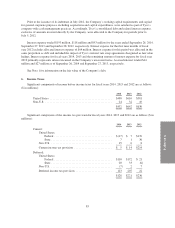

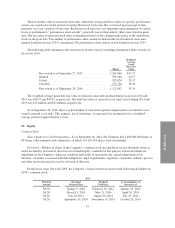

As of September 26, 2014, the Company had approximately $2.6 billion of U.S. Federal NOL

carryforwards, $1.4 billion of state NOL carryforwards and immaterial foreign NOL carryforwards. The U.S.

Federal NOL carryforwards will expire between 2016 and 2033, and the state NOL carryforwards will expire

between 2015 and 2033. Although future utilization will depend on the Company’s actual profitability and the

result of income tax audits, the Company anticipates that its U.S. Federal NOL carryforwards will be fully

utilized prior to expiration. Of the $2.6 billion U.S. Federal NOL carryforwards, $0.8 billion was generated by a

prior consolidated group. As of September 28, 2012, this amount was subject to Separate Return Limitation Year

(“SRLY”) rules which placed limits on the amount of SRLY loss that could offset consolidated taxable income in

the future. However, during fiscal year 2013, the Company determined that the SRLY limitation was no longer

applicable as an “ownership change” is deemed to have occurred upon Separation from Tyco on September 28,

2012 pursuant to Internal Revenue Code (the “Code”) Section 382. Therefore, the tax attributes as of the end of

September 2012 are only subject to the limitations provided by Code Sections 382 and 383. The Company does

not, however, expect that this limitation will impact its ability to utilize the tax attributes carried forward from

pre-Separation periods.

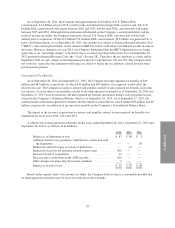

Unrecognized Tax Benefits

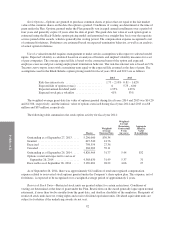

As of September 26, 2014 and September 27, 2013, the Company had unrecognized tax benefits of $49

million and $87 million, respectively, of which $49 million and $69 million, if recognized, would affect the

effective tax rate. The Company recognizes interest and penalties related to unrecognized tax benefits in income

tax expense. Accrued interest and penalties related to the unrecognized tax benefits as of September 26, 2014 and

September 27, 2013 were not material. All unrecognized tax benefits and related interest were presented as non-

current in the Company’s Condensed Balance Sheet as of September 26, 2014. As of September 27, 2013, the

current portion of the unrecognized tax benefits and the related accrued interest, which totaled $28 million and $8

million, respectively, are reflected in income taxes payable on the Company’s Consolidated Balance Sheet.

The impact to the income tax provision for interest and penalties related to unrecognized tax benefits was

immaterial for fiscal years 2014, 2013 and 2012.

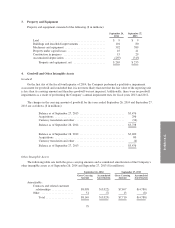

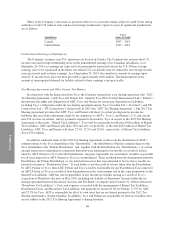

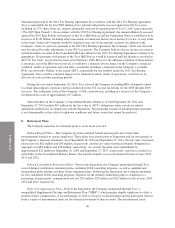

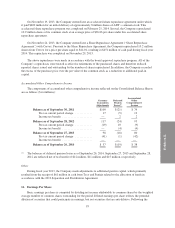

A rollforward of unrecognized tax benefits for the years ended September 26, 2014, September 27, 2013 and

September 28, 2012 is as follows ($ in millions):

2014 2013 2012

Balance as of beginning of year ............................ $ 87 $ 88 $ 3

Additions based on tax positions contributed in conjunction with

the Separation ........................................ — — 85

Reductions related to lapse of statute of limitations ............. — (1) —

Reductions based on tax positions related to prior years ......... (38) — —

Increase related to acquisitions ............................. 15 — —

Decrease due to reductions in the AMT payable ............... (18) — —

Other changes not impacting the income statement ............. 3 — —

Balance as of end of year ................................. $ 49 $ 87 $ 88

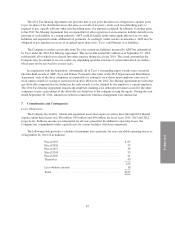

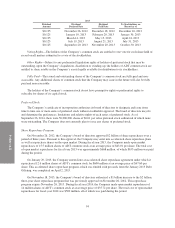

Based on the current status of its income tax audits, the Company believes that it is reasonably possible that

no unrecognized tax benefits may be resolved in the next twelve months.

85