ADT 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

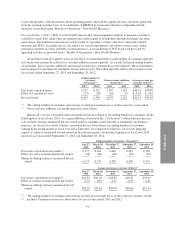

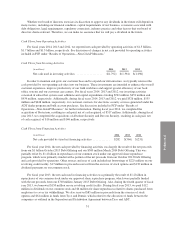

The tables below reconcile EBITDA to net income and FCF to cash flows from operating activities.

EBITDA

(in millions) 2014 2013 2012

Net income ........................................ $ 304 $ 421 $ 394

Interest expense, net ................................. 192 117 92

Income tax expense ................................. 128 221 236

Depreciation and intangible asset amortization ............ 1,040 942 871

Amortization of deferred subscriber acquisition costs ....... 131 123 111

Amortization of deferred subscriber acquisition revenue .... (151) (135) (120)

EBITDA ...................................... $1,644 $1,689 $1,584

For fiscal year 2014, EBITDA decreased $45 million, or 2.7%, as compared with the prior year, despite a

$111 million increase in recurring revenue, due to increased cost to serve expenses, and a $59 million increase in

other expense. The increase in cost to serve expenses includes $44 million of costs associated with our three-year

conversion program to replace 2G radios used in many of our security systems, an $18 million increase in

restructuring and other expenses, $15 million of incremental costs associated with the operations of Protectron

and a $5 million increase in acquisition and integration costs. For further details, refer to the discussion above

under “Results of Operations.” The increase in other expense of $59 million was primarily driven by amounts

recorded pursuant to the 2012 Tax Sharing Agreement.

For fiscal year 2013, EBITDA increased $105 million, or 6.6%, as compared with fiscal year 2012. This

increase was primarily due to the impact of higher recurring customer revenue, partially offset by the impact of

increased cost to serve expenses as discussed above. Additionally other income primarily related to the 2012 Tax

Sharing Agreement increased EBITDA for fiscal year 2013 by $24 million. For further details, refer to the

discussion above under “Results of Operations.”

FCF

(in millions) 2014 2013 2012

Net cash provided by operating activities ................ $1,519 $1,666 $1,493

Dealer generated customer accounts and bulk account

purchases ....................................... (526) (555) (648)

Subscriber system assets ............................. (658) (580) (378)

Capital expenditures ................................. (84) (71) (61)

FCF.......................................... $ 251 $ 460 $ 406

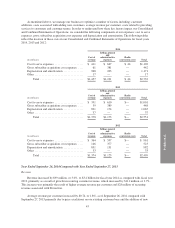

For fiscal year 2014, FCF decreased $209 million compared with fiscal year 2013. This decrease was

primarily due to a $147 million decrease in net cash provided by operating activities, as well as a $78 million

increase in cash outlays for subscriber system assets, partially offset by a $29 million decrease in cash paid for

dealer generated accounts and bulk account purchases. The decrease in net cash provided by operating activities

was driven primarily by a $64 million increase in cash paid for interest, a $63 million increase in taxes paid and

the timing of other operating cash payments. The $78 million increase in cash paid for subscriber system assets

resulted primarily from an increase in the average cost of installed systems, partially driven by an increase in new

ADT Pulse®customers, higher volume of ADT Pulse®upgrades to existing customers and increased promotional

activities. The $29 million decrease in cash paid for dealer generated accounts resulted from the lower levels of

dealer account production and lower levels of bulk account purchases discussed above under “Results of

Operations—Revenue.”

48