ADT 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

Annual Incentive Compensation

Executive Officers of the Company are eligible to earn annual incentives under the Officer Bonus Plan. Under the Officer Bonus Plan, which is

intended to comply with Section 162(m) of the Code, annual incentives are based upon achievement against an Operating Income target, which

is determined annually by the Compensation Committee. For fiscal year 2014, each of the Company’s Executive Officers was eligible for a

maximum bonus under the Officer Bonus Plan equal to 0.5% of the Company’s Operating Income.

After determining the Company’s performance against the Operating Income criterion, the Compensation Committee applies negative discretion

to the calculated maximum incentive amount. The Compensation Committee generally utilizes a guideline formula in applying its negative

discretion. This guideline formula is based upon the Company’s AIP, which is the plan upon which a majority of incentive-eligible employees’

annual incentives are based.

The guideline formula for purposes of the Officer Bonus Plan in effect for fiscal year 2014 reflects the Company’s focus as a subscriber-based

business with significant recurring monthly revenues, and the metrics utilized in the AIP were selected to drive results in those categories which

have the most significant impact on the success of our business. Officer Bonus Plan payouts are based upon the Company’s performance

against a variety of predetermined financial goals, as well as specific individual objectives (other than for the CEO).

The following table provides a basis for the rationale behind the selection of the AIP metrics:

Measure Rationale for Inclusion in AIP

Recurring Revenue Growth Supports our strategy of increasing recurring revenue through customer additions,

retention of existing customers and increased Average Revenue Per User (“ARPU”)

Steady State Free Cash Flow Key measure in assessing the economic potential of the Company’s existing

subscriber base; also aligns to metrics reported by key industry competitors

Net Attrition Focuses efforts on reducing customer attrition, which is a key value driver and

significantly impacts our operations

Individual Objectives (excluding CEO) Provide individual line-of-sight to employees in supporting the strategic goals of the

Company

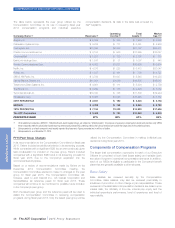

Fiscal 2014 Annual Incentive Compensation Design Summary

The financial performance measures and targets utilized in the fiscal year 2014 AIP and in the Officer Bonus Plan guideline formula, as well as the

actual performance against the targets, are summarized in the table below. Actual Performance figures below exclude the impact of the

acquisition of Reliance Protectron, Inc.

Performance Measure Weighting Performance

Target Actual

Performance

%of

Target

Attained

Mr. Gursahaney

Recurring Revenue Growth* 37.5% 5.1% 2.7% 52.9%

Steady State Free Cash Flow (1)*37.5% $ 1,050M $ 948M 90.3%

Net Attrition 25% 13.9% 13.5% 102.9%

Messrs. Geltzeiler, Ferber and Bleisch and Ms. DeVard

Recurring Revenue Growth* 30% see above see above see above

Steady State Free Cash Flow (1)*30% see above see above see above

Net Attrition 20% see above see above see above

Individual Objectives (2) 20% various various various

(1) For compensation purposes, SSFCF is adjusted to exclude the effects of events that the Compensation Committee deems would not reflect the performance of the NEOs. The categories of

special items were identified at the time the performance measure was approved at the beginning of the fiscal year, although the Compensation Committee may in its discretion make

adjustments during the fiscal year. For fiscal year 2014, the approved categories of adjustments included adjustments related to (i) business acquisitions and divestitures; (ii) debt

refinancing; (iii) legacy legal and tax matters; (iv) goodwill and intangible asset impairments for business acquired prior to 2002; (v) certain unbudgeted capital expenditures and pension

contributions; (vi) significant unbudgeted restructuring or other one-time charges; (vii) charges related to the separation into a stand-alone public company; and (viii) realignments of

segment and corporate costs.

(2) Individual objectives typically vary by NEO, but in general are related to performance against key strategic goals and value drivers for the Company, including, but not limited to, growing the

core business, improving customer attrition through the implementation of customer non-pay initiatives and improved credit screening, and strengthening of business platforms to support

efficiencies and process improvements.

* For further definition of non-GAAP financial measures and a reconciliation to GAAP measures, see “Reconciliation of Non-GAAP Measures to GAAP Measures and Selected Definitions” on

page 49 of this Proxy Statement.

The ADT Corporation 2015 Proxy Statement 29

PROXY STATEMENT