ADT 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

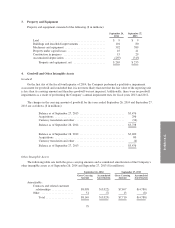

property taxes on the subscriber system assets and upon customer termination, may retrieve such assets.

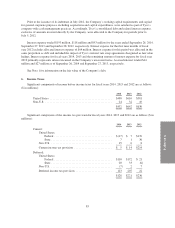

Accumulated depreciation of subscriber system assets was $2.4 billion and $2.2 billion as of September 26, 2014

and September 27, 2013, respectively. Depreciation expense relating to subscriber system assets for fiscal years

2014, 2013 and 2012 was $381 million, $325 million and $287 million, respectively.

Deferred subscriber acquisition costs represent direct and incremental selling expenses (i.e. commissions)

related to acquiring the customer. Commissions paid in connection with the establishment of the monitoring

contract are determined based on a percentage of the contractual fees and do not exceed deferred subscriber

acquisition revenue. Amortization expense relating to deferred subscriber acquisition costs for fiscal years 2014,

2013 and 2012 was $131 million, $123 million and $111 million, respectively.

Subscriber system assets and any related deferred subscriber acquisition costs and deferred subscriber

acquisition revenue resulting from the customer acquisition are accounted for using pools based on the month

and year of acquisition. The Company amortizes its pooled subscriber system assets and related deferred costs

and deferred revenue using an accelerated method over the expected life of the customer relationship, which is 15

years. In order to align the amortization of subscriber system assets and related deferred costs and deferred

revenue to the pattern in which their economic benefits are consumed, the accelerated method utilizes an average

declining balance rate of 245% and converts to straight-line methodology when the resulting amortization charge

is greater than that from the accelerated method, resulting in an average amortization of 59% of the pool within

the first five years, 24% within the second five years and 17% within the final five years.

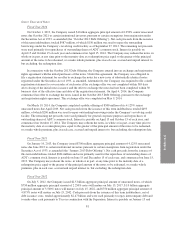

Dealer and Other Amortizable Intangible Assets, Net—Intangible assets primarily include contracts and

related customer relationships. Certain contracts and related customer relationships are generated from an

external network of independent dealers who operate under the ADT dealer program. These contracts and related

customer relationships are recorded at their contractually determined purchase price. During the charge-back

period, generally thirteen months, any cancellation of monitoring service, including those that result from

customer payment delinquencies, results in a charge-back by the Company to the dealer for the full amount of the

contract purchase price. The Company records the amount charged back to the dealer as a reduction of the

intangible assets.

Intangible assets arising from the ADT dealer program described above are accounted for using pools based

on the month and year of acquisition. The Company amortizes its pooled dealer intangible assets using an

accelerated method over the expected life of the customer relationship, which is 15 years. The accelerated

method for amortizing these intangible assets utilizes an average declining balance rate of 300% and converts to

straight-line methodology when the resulting amortization charge is greater than that from the accelerated

method, resulting in an average amortization of 67% of the pool within the first five years, 22% within the

second five years and 11% within the final five years.

Other amortizable intangible assets are amortized on a straight-line basis over 5 to 40 years. The Company

evaluates the amortization methods and remaining useful lives of intangible assets on a periodic basis to

determine whether events and circumstances warrant a revision to the amortization method or remaining useful

lives.

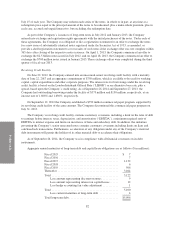

Long-Lived Asset Impairments—The Company reviews long-lived assets, including property and equipment

and amortizable intangible assets, for impairment whenever events or changes in business circumstances indicate

that the carrying amount of the asset may not be fully recoverable. The Company performs undiscounted

operating cash flow analyses to determine if impairment exists. For purposes of recognition and measurement of

an impairment for assets held for use, the Company groups assets and liabilities at the lowest level for which cash

flows are separately identified. If an impairment is determined to exist, any related impairment loss is calculated

based on fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to

be received, less costs of disposal.

Goodwill—Goodwill is assessed for impairment annually and more frequently if events or changes in

business circumstances indicate that it is more likely than not that the carrying value of a reporting unit exceeds

73