ADT 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

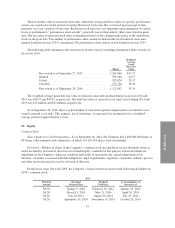

On November 19, 2013, the Company entered into an accelerated share repurchase agreement under which

it paid $400 million for an initial delivery of approximately 8 million shares of ADT’s common stock. This

accelerated share repurchase program was completed on February 25, 2014. In total, the Company repurchased

10.9 million shares of its common stock at an average price of $36.86 per share under this accelerated share

repurchase agreement.

On November 24, 2013, the Company entered into a Share Repurchase Agreement (“Share Repurchase

Agreement”) with Corvex. Pursuant to the Share Repurchase Agreement, the Company repurchased 10.2 million

shares from Corvex for a price per share equal to $44.01, resulting in $451 million of cash paid during fiscal year

2014. This repurchase was completed on November 29, 2013.

The above repurchases were made in accordance with the board approved repurchase program. All of the

Company’s repurchases were treated as effective retirements of the purchased shares and therefore reduced

reported shares issued and outstanding by the number of shares repurchased. In addition, the Company recorded

the excess of the purchase price over the par value of the common stock as a reduction to additional paid-in

capital.

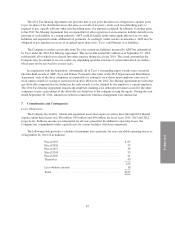

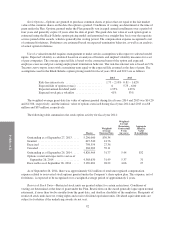

Accumulated Other Comprehensive Income

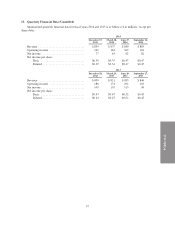

The components of accumulated other comprehensive income reflected on the Consolidated Balance Sheets

are as follows ($ in millions):

Currency

Translation

Adjustments

Deferred

Pension

Losses(1)

Accumulated

Other

Comprehensive

Income

Balance as of September 30, 2011 $100 $ (21) $ 79

Pre-tax current period change ............ 17 (5) 12

Income tax benefit ..................... — 2 2

Balance as of September 28, 2012 117 (24) 93

Pre-tax current period change ............ (19) 10 (9)

Income tax benefit ..................... — (4) (4)

Balance as of September 27, 2013 98 (18) 80

Pre-tax current period change ............ (41) (1) (42)

Income tax benefit ..................... — — —

Balance as of September 26, 2014 $ 57 $ (19) $ 38

(1) The balances of deferred pension losses as of September 26, 2014, September 27, 2013 and September 28,

2012 are reflected net of tax benefit of $12 million, $11 million and $15 million, respectively.

Other

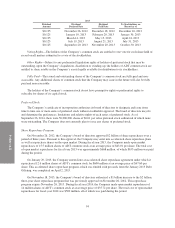

During fiscal year 2013, the Company made adjustments to additional paid-in capital, which primarily

resulted from the receipt of $61 million in cash from Tyco and Pentair related to the allocation of funds in

accordance with the 2012 Separation and Distribution Agreement.

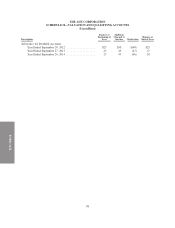

11. Earnings Per Share

Basic earnings per share is computed by dividing net income attributable to common shares by the weighted

average number of common shares outstanding for the period. Diluted earnings per share reflects the potential

dilution of securities that could participate in earnings, but not securities that are anti-dilutive. Following the

95