ADT 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

2013 respectively. These investments are classified as Level 1 for purposes of fair value measurement, which is

performed each reporting period. Any unrealized holding gains or losses are excluded from earnings and reported

in other comprehensive income until realized.

Long-Term Debt Instruments—The fair value of the Company’s unsecured notes as of September 27, 2013

was determined using prices for ADT’s securities obtained from external pricing services, which is considered a

Level 2 input. Subsequently, the Company completed exchange offers for the $2.5 billion notes issued in July

2012, the $700 million notes issued in January 2013 and the $1.0 billion notes issued in October 2013. See Note

5 for further information on the Company’s exchange offers. The completion of these exchange offers enables

the Company to use broker-quoted market prices to determine the fair value of its debt. Therefore the fair value

of the Company’s unsecured notes as of September 26, 2014 was determined using these quoted market prices,

which is considered a Level 2 input. The carrying amount of debt outstanding under the Company’s revolving

credit facility approximates fair value as interest rates on these borrowings approximate current market rates,

which are considered Level 2.

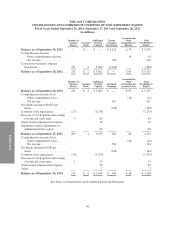

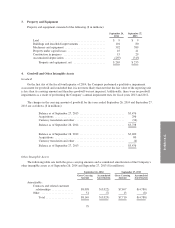

The carrying value and fair value of the Company’s debt that is subject to fair value disclosures as of

September 26, 2014 and September 27, 2013 is as follows ($ in millions):

September 26, 2014 September 27, 2013

Carrying Value Fair Value Carrying Value Fair Value

Long-term debt instruments, excluding

capital lease obligations ............. $5,065 $4,759 $3,340 $2,892

Derivative Instruments—All derivative financial instruments are reported on the Consolidated Balance

Sheets at fair value. For derivative financial instruments designated as fair value hedges, the changes in fair value

of both the derivatives and the hedged items are recognized currently in the Consolidated and Combined

Statements of Operations. The fair values of the Company’s derivative financial instruments are not material.

During the year ended September 26, 2014, the Company entered into interest rate swap transactions to

hedge $500 million of its $1 billion, 6.250% fixed-rate notes due October 2021, and all $500 million of its

4.125% fixed-rate notes due April 2019. These transactions are designated as fair value hedges with the objective

of managing the exposure to interest rate risk by converting the interest rates on the fixed-rate notes to floating

rates. These transactions did not have a material impact on the Company’s Consolidated and Combined Financial

Statements as of and for the year ended September 26, 2014.

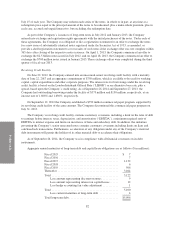

Restructuring and Other Charges—During the year ended September 26, 2014, the Company recognized $8

million in severance charges related to the separation of employees in conjunction with actions taken to reduce

general and administrative expenses, $5 million of which was paid as of September 26, 2014. In addition, during

the year ended September 26, 2014, the Company recognized $6 million in charges, primarily related to a loss on

the sublease of a portion of its office space and $3 million of other costs associated with consulting services

focused on identifying actions to reduce its cost structure and streamline operations.

The Company also recognized other charges of $8 million related to accelerated depreciation on certain

assets abandoned in connection with the rationalization of its business processes and system landscape.

Restructuring and other charges during fiscal years 2013 and 2012 were immaterial.

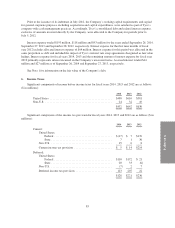

Guarantees—In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the Company’s

financial position, results of operations or cash flows. As of September 26, 2014 and September 27, 2013, the

Company did not have material guarantees.

Recent Accounting Pronouncements—In June 2011, the Financial Accounting Standards Board (“FASB”)

issued authoritative guidance for the presentation of comprehensive income. The guidance amended the reporting

76