ADT 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FISCAL YEAR 2014 NEO COMPENSATION

FISCAL YEAR 2014 NEO COMPENSATION

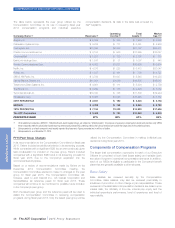

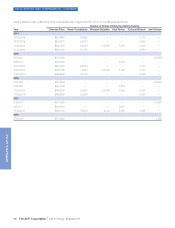

Summary Compensation Table

The information set forth in the following table reflects compensation paid or earned by the NEOs for the fiscal years 2014, 2013 and 2012. The

compensation shown for fiscal year 2012 was earned by each NEO, as applicable, under the compensation programs of Tyco which, prior to

September 28, 2012, was the parent corporation of ADT. The table reflects total compensation earned beginning in the later of fiscal year 2012

or the year an individual first became an NEO.

Name and

Principal Position Year Salary

($) Bonus

($) (3)

Stock/Unit

Awards ($) (4)

Option

Awards

($) (4)

Non-Equity

Incentive Plan

Compensation

($) (5)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($)

All Other

Compensation

($) (6) Total ($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j)

Naren Gursahaney

Chief Executive Officer

2014 900,026 — 2,716,602 1,148,360 630,000 — 70,400 5,465,388

2013 900,000 — 2,708,100 2,602,377 693,000 — 267,286 7,170,763

2012 610,000 290,000 1,747,016 1,698,545 451,300 — 152,957 4,949,818

Michael Geltzeiler

SVP, Chief Financial

Officer (1)

2014 661,953 1,853,414 1,186,135 538,125 — 102,057 4,341,684

Alan Ferber

President, Residential

Business Unit

2014 500,002 75,000 718,401 305,222 235,200 — 22,975 1,856,800

2013 204,545 115,000 498,064 498,456 90,383 — 47,843 1,454,291

N. David Bleisch

SVP, Chief Legal

Officer & Corporate

Secretary

2014 425,012 — 580,489 182,831 211,374 — 337,531 1,737,237

2013 391,667 — 417,690 320,529 191,221 — 126,404 1,447,511

2012 323,820 65,135 350,588 228,789 137,624 — 34,916 1,140,872

Jerri DeVard

SVP, Chief Marketing

Officer (2)

2014 251,924 — 520,078 665,952 126,594 — 90,552 1,655,100

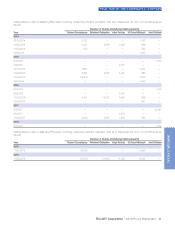

(1) Michael Geltzeiler was appointed by the Company’s Board of Directors on October 14, 2013, with an effective start date of November 14, 2013.

(2) Jerri DeVard was appointed by the Company’s Board of Directors on March 24, 2014, with an effective start date of March 31, 2014.

(3) Bonus: The amount shown in column (d) in fiscal years 2014 and 2013 for Mr. Ferber represent a portion of a sign-on bonus paid when he joined the Company in April 2013, and on the

first anniversary of his hire. The amounts in fiscal year 2012 for Messrs. Gursahaney and Bleisch represent one-time lump sum payments in connection with their promotions into their new

roles with ADT. The amount represents the difference between their fiscal year 2012 salary and target bonus and their post-separation salary and target bonus for the period from April 1,

2012 to September 28, 2012.

(4) Stock/Unit Awards and Option Awards: The amounts in columns (e) and (f) reflect the fair value of equity awards granted in fiscal years 2014, 2013 and 2012, which consisted

of stock options, RSUs and PSUs. These amounts represent the fair value of the entire amount of the award calculated in accordance with Financial Accounting Standards Board ASC Topic

718 (ASC Topic 718), excluding the effect of estimated forfeitures. Amounts for fiscal years 2014 and 2013 were calculated based upon the price of the Company’s common stock (including

the impact on the value of options under the Black-Scholes option pricing model). Values for fiscal year 2012 were calculated based upon the price of Tyco common stock, as awards granted

in fiscal year 2012 were made prior to the Company’s separation from Tyco. For stock options, amounts are computed by multiplying the fair value of the award (as determined under the

Black-Scholes option pricing model) by the total number of options granted. For RSUs, fair value is computed by multiplying the total number of shares subject to the award by the closing

market price of the Company’s common stock on the date of grant. For PSUs, fair value is based on a model that considers the closing market price of the Company’s common stock on the

date of grant, the range of shares subject to such stock award and the estimated probabilities of vesting outcomes. The value of PSUs included in the table assumes target performance. The

following amounts represent the maximum potential performance share value by individual for fiscal year 2014, determined at the time of grant (200% of the target award): Mr. Gursahaney—

$3,558,378; Mr. Geltzeiler—$1,779,190; Mr. Ferber—$943,890; and Mr. Bleisch—$568,004. Ms. DeVard did not receive PSUs in fiscal year 2014.

Amounts in columns (e) and (f) for fiscal year 2014 for Mr. Geltzeiler include, in addition to the value of awards granted with respect to our annual long-term incentive plan, the value of

awards representing grants of RSUs and stock options with respect to a sign-on equity award. The value of these sign-on grants included in columns (e) and (f) are $497,313 and $611,955,

respectively.

Amounts in column (e) for fiscal year 2012 include the incremental fair value associated with the shortening of the performance period for outstanding PSUs. The shortening of the

performance period was associated with ADT’s separation from Tyco. Amounts in column (f) for fiscal year 2012 include the incremental fair value associated with the conversion of

outstanding Tyco stock options into stock options of ADT. On July 12, 2012, in connection with the separation, the Tyco Board of Directors approved the conversion of all outstanding Tyco

PSUs into RSUs based on performance achieved through June 29, 2012. On August 2, 2012, the Tyco Compensation Committee approved the conversion ratio based on its review and

certification of performance results. On October 12, 2011 the Tyco Compensation Committee approved the methodology that would apply to convert outstanding Tyco equity awards upon

completion of the separation into post-separation equity awards of ADT, or split into equity awards of Tyco, ADT and Pentair Ltd., in order to preserve intrinsic value.

(5) Non-Equity Incentive Plan Compensation: The amounts reported in column (g) for each NEO reflect annual cash incentive compensation for the applicable fiscal year. Annual

incentive compensation for fiscal year 2014 is discussed in further detail above under the heading “Annual Incentive Compensation.” Amounts for fiscal year 2012 were earned pursuant to

incentive plans designed and administered by Tyco.

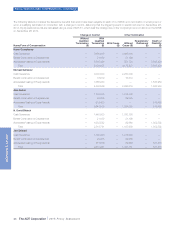

(6) All Other Compensation: The amounts reported in column (i) for fiscal years 2014 and 2013 represent the Company’s contributions to the 401(k) Retirement Savings and Investment

Plan and Supplemental Savings and Retirement Plan, taxable relocation benefits and associated tax gross-ups, and the value of the executive physical, as applicable. The amounts reported

for fiscal year 2012 were paid and/or earned with respect to similar programs administered by Tyco, as well as to cash perquisites and to insurance premiums paid by Tyco for the benefit of

the officer (and, in some cases, the officer’s spouse). Details with respect to the amounts in this column are set forth below, in the All Other Compensation table.

The ADT Corporation 2015 Proxy Statement 35

PROXY STATEMENT