ADT 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

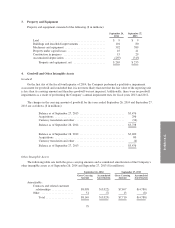

FORM 10-K

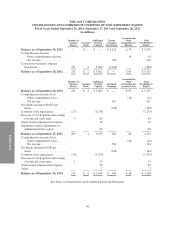

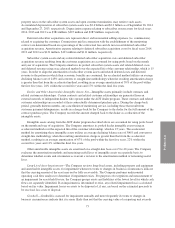

THE ADT CORPORATION

CONSOLIDATED AND COMBINED STATEMENTS OF CASH FLOWS

Fiscal Years Ended September 26, 2014, September 27, 2013 and September 28, 2012

(in millions)

2014 2013 2012

Cash Flows from Operating Activities:

Net income .................................................................. $ 304 $ 421 $ 394

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and intangible asset amortization .................................. 1,040 942 871

Amortization of deferred subscriber acquisition costs ............................. 131 123 111

Amortization of deferred subscriber acquisition revenue ........................... (151) (135) (120)

Stock-based compensation expense ........................................... 20 19 7

Deferred income taxes ...................................................... 123 207 22

Provision for losses on accounts receivable and inventory .......................... 41 51 53

Other non-cash items ....................................................... 3 7 12

Changes in operating assets and liabilities, net of the effects of acquisitions:

Accounts receivable, net ................................................ (52) (55) (33)

Inventories ........................................................... (5) (25) (30)

Accounts payable ..................................................... (18) 58 (9)

Accrued and other liabilities ............................................. (7) 35 19

Income taxes, net ...................................................... (30) 16 184

Deferred subscriber acquisition costs ...................................... (184) (181) (147)

Deferred subscriber acquisition revenue .................................... 226 232 161

Other ............................................................... 78 (49) (2)

Net cash provided by operating activities ........................... 1,519 1,666 1,493

Cash Flows from Investing Activities:

Dealer generated customer accounts and bulk account purchases ........................ (526) (555) (648)

Subscriber system assets ........................................................ (658) (580) (378)

Capital expenditures ........................................................... (84) (71) (61)

Acquisition of businesses, net of cash acquired ...................................... (517) (162) —

Other investing ............................................................... (7) (26) (9)

Net cash used in investing activities ............................... (1,792) (1,394) (1,096)

Cash Flows from Financing Activities:

Proceeds from exercise of stock options ............................................ 17 85 —

Repurchases of common stock under approved program ............................... (1,384) (1,235) —

Dividends paid ................................................................ (132) (112) —

Proceeds received for allocation of funds related to the Separation ....................... — 61 —

Proceeds from long-term borrowings .............................................. 2,100 850 2,489

Repayment of long-term debt .................................................... (378) (3) (1)

Allocated debt activity ......................................................... — — (1,482)

Change in parent company investment ............................................. — — (1,148)

Change in due to from Tyco and affiliates .......................................... — — (63)

Other financing ............................................................... (21) (12) (26)

Net cash provided by (used in) financing activities ....................... 202 (366) (231)

Effect of currency translation on cash .............................................. (1) (2) 3

Net (decrease) increase in cash and cash equivalents ............................... (72) (96) 169

Cash and cash equivalents at beginning of year .................................... 138 234 65

Cash and cash equivalents at end of year ......................................... $ 66 $ 138 $ 234

Supplementary Cash Flow Information:

Interest paid .............................................................. $ 171 $ 107 $ 83

Income taxes paid, net of refunds ............................................. 61 (2) 30

See Notes to Consolidated and Combined Financial Statements

69