ADT 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

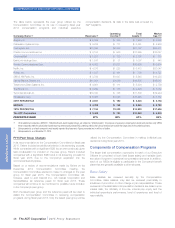

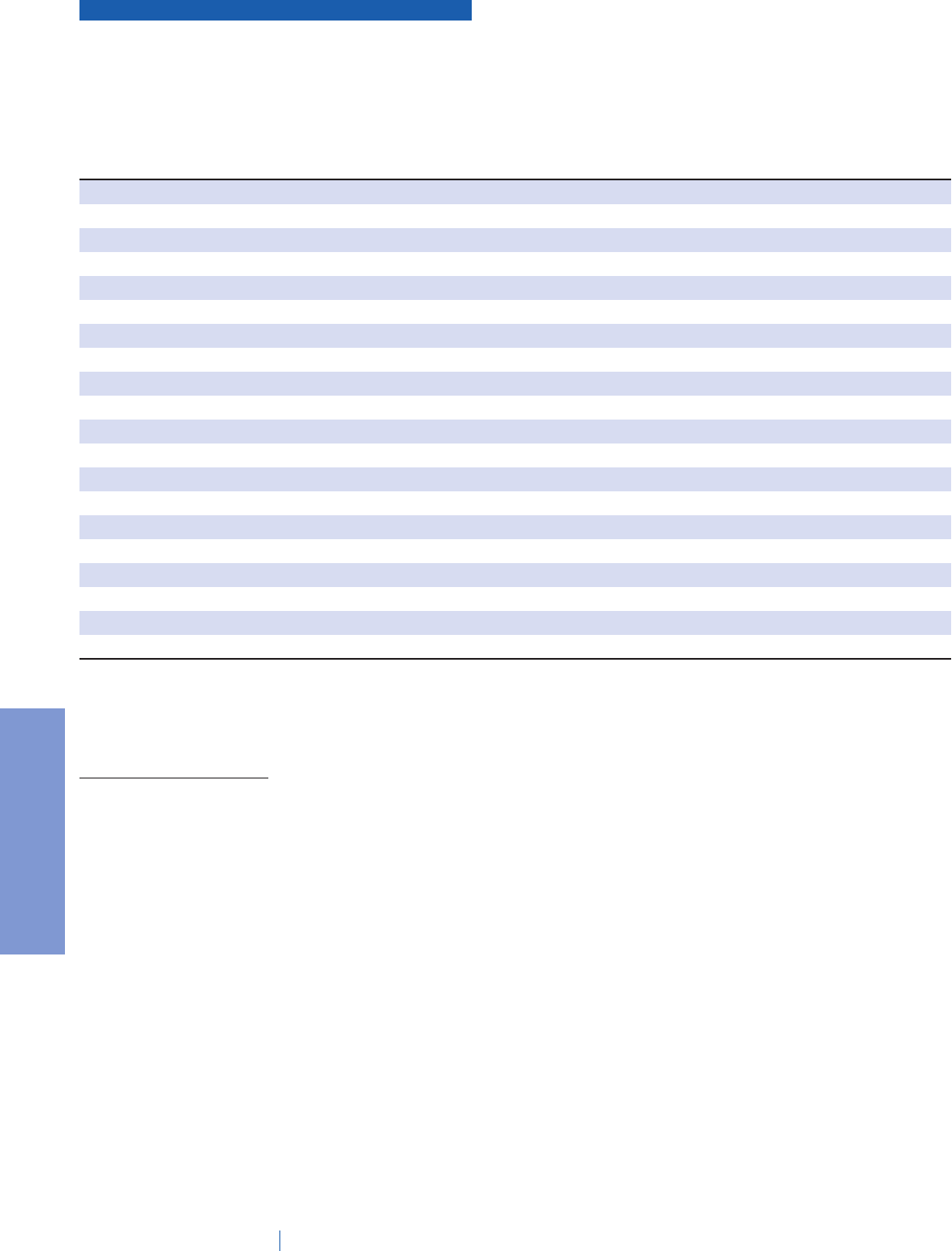

The table below represents the peer group utilized by the

Compensation Committee for its use in reviewing fiscal year

2014 compensation programs and individual executive

compensation decisions. All data in the table was provided by

S&P Capital IQ.

Company Name (1) Revenues (2)

Operating

Income (2)

Total

Assets (2)

Market

Cap (2)(3)

Allegion plc $ 2,094 $ 385 $ 1,980 $ 5,028

Cablevision Systems Corp. $ 6,232 $ 771 $ 6,591 $ 4,950

CenturyLink, Inc. $18,095 $2,833 $51,787 $22,811

Charter Communications, Inc. $ 8,155 $ 956 $17,295 $16,027

Cincinnati Bell $ 1,257 $ 189 $ 2,107 $ 718

EarthLink Holdings Corp. $ 1,241 $ 31 $ 1,007 $ 448

Frontier Communications Corp. $ 4,762 $1,031 $16,635 $ 6,514

Netflix, Inc. $ 4,375 $ 228 $ 5,413 $23,047

Rollins, Inc. $ 1,337 $ 191 $ 739 $ 4,727

SIRIUS XM Radio, Inc. $ 3,799 $1,047 $ 8,845 $19,258

Stanley Black & Decker, Inc. $11,001 $1,089 $16,535 $15,012

Telephone & Data Systems, Inc. $ 4,901 -$ 111 $ 8,904 $ 2,789

The Brink’s Co. $ 3,942 $ 183 $ 2,498 $ 1,039

Tyco International Ltd. $10,340 $ 745 $11,809 $19,244

Windstream Corp. $ 5,988 $1,048 $13,445 $ 5,732

25TH PERCENTILE $ 2,947 $ 190 $ 2,303 $ 3,758

MEDIAN $ 4,762 $ 745 $ 8,845 $ 5,732

75TH PERCENTILE $ 7,194 $1,039 $14,990 $17,636

The ADT Corporation $ 3,408 $ 720 $10,549 $ 6,203

PERCENTILE RANK 27% 50% 61% 54%

(1) Three additional companies, DIRECTV, T-Mobile US and Ascent Capital Group, are utilized as “reference peers” for purposes of assessing compensation design and practices only. While

these companies meet the subscription-based recurring revenue and primary B2C screening criteria, their annual revenues are outside the range used in the screening process.

(2) Data presented is as of each company’s most recently reported fiscal year end. Figures presented are in millions of dollars.

(3) Data presented is as of November 11, 2014.

FY15 Peer Group Changes

In its recommendation to the Compensation Committee for fiscal year

2015, Farient included an additional criterion in its screening process.

While companies with a significant B2B focus were previously given

less consideration for inclusion in the peer group, Farient included

companies with a significant B2B focus in its screening process for

fiscal year 2015 due to the Company’s expansion into the

commercial security space.

Based on a review of recommendations made by Farient at the

December 2014 Compensation Committee meeting, the

Compensation Committee elected to make no changes to the peer

group for fiscal year 2015. The Compensation Committee did,

however, elect to add Diebold Inc., US Cellular Corporation and

ServiceMaster as reference peers for fiscal year 2015. These

companies will continue to be monitored for possible future inclusion

in the Company’s peer group.

Both the select peer group and the reference peers will be used to

assist the Compensation Committee in reviewing compensation

programs during fiscal year 2015. Only the select peer group will be

utilized by the Compensation Committee in making individual pay

decisions during fiscal year 2015.

Components of Compensation Programs

The target total compensation opportunity for each of our Executive

Officers is comprised of both fixed (base salary) and variable (both

annual and long-term incentives) compensation elements. In addition,

each of our NEOs is eligible to participate in the Company’s benefit

plans that are generally available to all employees.

Base Salary

Base salaries are reviewed annually by the Compensation

Committee. Base salaries may also be reviewed periodically in

situations of promotion or other change in job responsibilities. These

reviews and the associated compensation decisions are based upon

market data, the criticality of the role, internal pay equity and the

individual executive’s performance, level of experience and level of

responsibility.

28 The ADT Corporation 2015 Proxy Statement

PROXY STATEMENT