ADT 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

For fiscal year 2012, the net cash used in financing activities was primarily the result of changes in parent

company investment of $1.1 billion and changes in balances due to (from) Tyco and affiliates of $63 million,

which were substantially offset by the net proceeds received on our issuance of $2.5 billion in long-term debt and

the removal of $1.5 billion in allocated debt from Tyco.

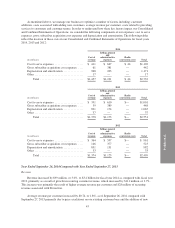

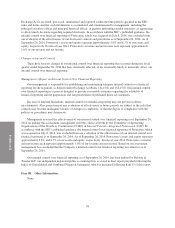

Commitments and Contractual Obligations

The following table provides a summary of our contractual obligations and commitments for debt, minimum

lease payment obligations under non-cancelable leases and other obligations as of September 26, 2014.

(in millions) 2015 2016 2017 2018 2019 Thereafter Total

Long-term debt(1) ............................$1$1$1,126 $— $500 $3,450 $5,078

Interest payments(2) ........................... 205 203 202 184 184 1,216 2,194

Operating leases ............................. 65 52 39 33 21 45 255

Capital leases ............................... 6 6 6 6 6 14 44

Purchase obligations(3) ........................ 48 9 4 — — — 61

Total contractual cash obligations(4) .............. $325 $271 $1,377 $223 $711 $4,725 $7,632

(1) Long-term debt obligations consist primarily of our senior unsecured notes and revolving credit facility and

exclude debt discount and interest.

(2) Interest payments consist primarily of interest on our fixed-rate debt.

(3) Purchase obligations consist of commitments for purchases of goods and services.

(4) Total contractual cash obligations in the table above exclude income taxes as we are unable to make a

reasonably reliable estimate of the timing for the remaining payments in future years. As of September 26,

2014, we recorded gross unrecognized tax benefits of $49 million and gross interest and penalties of $2

million. See Note 6 to the Consolidated and Combined Financial Statements for further information.

As of September 26, 2014, standby letters of credit related to our insurance programs were immaterial.

Off-Balance Sheet Arrangements

As of September 26, 2014, we had no material off-balance sheet arrangements.

Critical Accounting Policies and Estimates

The preparation of the Consolidated and Combined Financial Statements in conformity with U.S. GAAP

requires management to use judgment in making estimates and assumptions that affect the reported amounts of

assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of revenue and

expenses. The following accounting policies are based on, among other things, judgments and assumptions made

by management that include inherent risks and uncertainties. Management’s estimates are based on the relevant

information available at the end of each period.

Revenue Recognition

Substantially all of our revenue is generated by contractual monthly recurring fees received for monitoring

services provided to customers. Revenue from monitoring services is recognized as those services are provided to

customers. Customer billings for services not yet rendered are deferred and recognized as revenue as the services

are rendered. The balance of deferred revenue is included in current liabilities or long-term liabilities, as

appropriate.

For transactions in which we retain ownership of the security system, non-refundable fees (referred to as

deferred subscriber acquisition revenue) received in connection with the initiation of a monitoring contract are

52