ADT 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

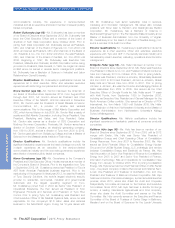

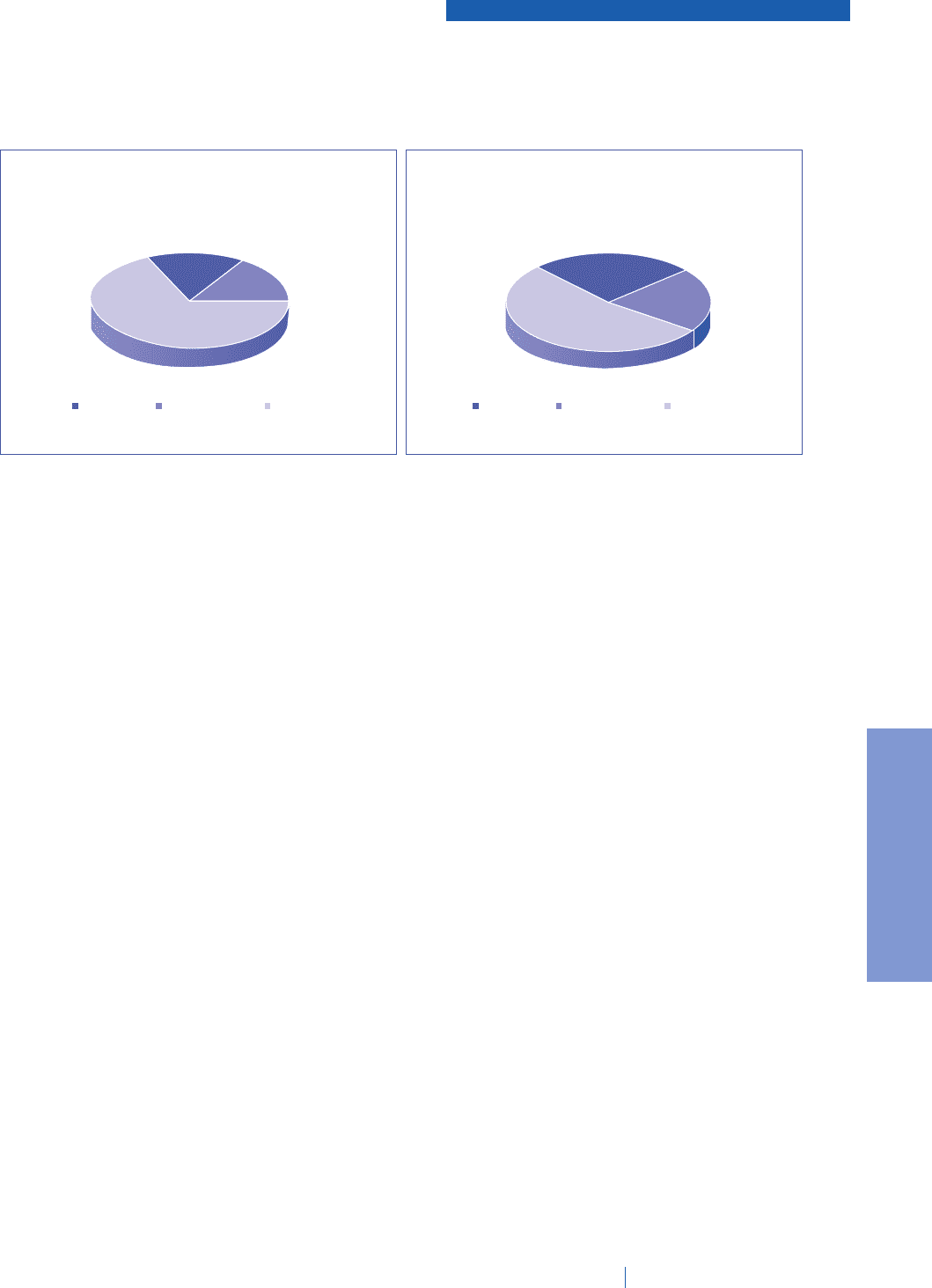

The chart below shows the distribution of targeted total direct pay for

our CEO and the other NEOs (on average) for fiscal year 2014. This

chart illustrates that 84% of CEO target annual compensation and, on

average, 74% of target annual compensation for our other NEOs, is at

risk based on Company and individual performance:

CEO Other NEOs

Base Salary Annual Incentive Long-Term Incentives Base Salary Annual Incentive Long-Term Incentives

53%

21%

26%

68%

16%

16%

Note that the percentages shown in the chart above reflect target

compensation, and are not reflective of actual compensation values

presented in the Summary Compensation Table on page 35 of this

Proxy Statement.

NEO compensation is reviewed annually by the Compensation

Committee (and, in the case of the CEO, by the independent

members of the Board of Directors) to ensure alignment with the

Company’s compensation objectives and market practice.

Fiscal Year 2014 Compensation Decisions

In fiscal year 2014, we made some changes to our incentive

compensation programs which were designed to further align our

incentive plans with the interests of our stockholders, including:

•Replaced the Adjusted Free Cash Flow metrics in our Officer

Short-Term Bonus Plan (“Officer Bonus Plan”), Annual Incentive

Plan (“AIP”) and Long-Term Incentive Plan (“LTIP”) with Steady

State Free Cash Flow (“SSFCF”) metrics. We believed that SSFCF

more accurately captures the impact of the key value drivers of

our business, and moves closer to an ongoing earnings measure.

•Modified the metrics utilized in the Performance Share Unit (“PSU”)

component of our LTIP. The PSUs granted in fiscal year 2014 will

vest based upon our performance against Relative Total

Shareholder Return (“TSR”) and SSFCF metrics, which were

weighted equally at 50%. We believed that replacing the Recurring

Revenue metric previously in use in the LTIP with the TSR metric

more appropriately captures the overall performance of the

Company in comparison to the broader market, as reflected in

stock price movement and adjusted for dividends. For purposes

of the TSR metric, our stock performance is compared to the

median performance of companies in the Standard & Poor’s

(“S&P”) 500 Index.

•Adjusted the weighting of the equity mix for our Executive Officers

to increase the weighting of PSUs and reduce the weighting of

Stock Options. The equity mix for Executive Officers for awards

granted in conjunction with the annual grant process was as

follows: 50% PSUs, 25% Stock Options and 25% Restricted

Stock Units (“RSUs”). The decision to increase the weighting of

PSUs was made to further align the interests of our Executive

Officers with those of our stockholders.

Pay for Performance

We strongly believe that a significant portion of our executives’

compensation opportunity should be correlated with our

performance. Annual incentive compensation and 50% of long-term

equity incentive compensation (in the form of PSUs) is earned only

when the NEOs attain specified goals (including, for our NEOs other

than the CEO, certain individual objectives included as part of our

annual incentive program), thereby placing a substantial portion of

executive compensation at risk. The remaining 50% of our executives’

long-term equity incentive compensation is awarded in Stock Options

and time-vested RSUs, the value of each of which is dependent on

our performance over an extended vesting period as exhibited in the

performance of our stock price. We believe the design of our

incentive compensation plans creates additional incentive for our

executives to focus on sustainable, long-term growth.

Short-Term Incentives. The Compensation Committee set aggressive

targets in our annual incentive plans for fiscal year 2014 to focus our

executives on taking appropriate actions to ensure the Company is

well-positioned for long-term success. In fiscal year 2014, the

Company did not fully meet the aggressive targets set in our AIP (see

the performance targets and actual performance in “Fiscal Year 2014

Annual Incentive Compensation Design Summary”, as well as the

discussion regarding our fiscal year 2014 performance, below). As a

result, our CEO was awarded an annual incentive equal to 70% of his

targeted annual payout. Our other NEOs received an average payout

of 70.5% of their targeted awards, including the impact of their

performance against individual objectives. The Compensation

Committee believes these results reflect the proper alignment of pay

and performance. The Compensation Committee continued to set

aggressive targets for fiscal year 2015 to ensure the relationship with

performance continues.

Long-Term Incentives. The fiscal year 2014 long-term incentive

program was designed to reward management for performance

directly related to increasing stockholder value. Our CEO and the

other Executive Officers received 50% of their long-term incentive

The ADT Corporation 2015 Proxy Statement 25

PROXY STATEMENT