ADT 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Whether our board of directors exercises its discretion to approve any dividends in the future will depend on

many factors, including our financial condition, capital requirements of our business, covenants associated with

debt obligations, legal requirements, regulatory constraints, industry practice and other factors that our board of

directors deems relevant. Therefore, we can make no assurance that we will pay a dividend in the future.

Cash Flows from Operating Activities

For fiscal years 2014, 2013 and 2012, we reported net cash provided by operating activities of $1.5 billion,

$1.7 billion and $1.5 billion, respectively. See discussion of changes in net cash provided by operating activities

included in FCF under “Results of Operations—Non-GAAP Measures.”

Cash Flows from Investing Activities

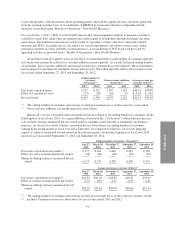

(in millions) 2014 2013 2012

Net cash used in investing activities .................. $(1,792) $(1,394) $(1,096)

In order to maintain and grow our customer base and to expand our infrastructure, we typically reinvest the

cash provided by our operating activities into our business. These investments are intended to enhance the overall

customer experience, improve productivity of our field workforce and support greater efficiency of our back

office systems and our customer care centers. For fiscal years 2014, 2013 and 2012, our investing activities

consisted of subscriber system asset additions and capital expenditures totaling $742 million, $651 million and

$439 million, respectively. Additionally, during fiscal years 2014, 2013 and 2012, we paid $526 million, $555

million and $648 million, respectively, for customer contracts for electronic security services generated under the

ADT dealer program and bulk account purchases. See discussion included in FCF under “Results of

Operations—Non-GAAP Measures” for further information. During fiscal year 2014, we completed the

acquisition of Protectron, resulting in cash paid, net of cash acquired, of $517 million. Additionally, during fiscal

year 2013, we completed the acquisitions of Absolute Security and Devcon Security, resulting in cash paid, net

of cash acquired, of $16 million and $146 million, respectively.

Cash Flows from Financing Activities

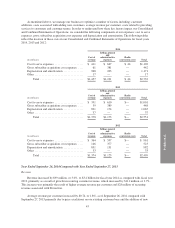

(in millions) 2014 2013 2012

Net cash provided by (used in) financing activities ............ $202 $(366) $(231)

For fiscal year 2014, the net cash provided by financing activities was largely the result of the net proceeds

from our $1 billion October 2013 Debt Offering and our $500 million March 2014 Debt Offering. This was

partially offset by $1.4 billion in repurchases of our common stock under our approved share repurchase

program, which were primarily funded with a portion of the net proceeds from our October 2013 Debt Offering

and cash provided by operations. Other sources and uses of cash included net borrowings of $225 million on our

revolving credit facility, $17 million in proceeds received from the exercise of stock options and $132 million in

dividend payments on our common stock.

For fiscal year 2013, the net cash used in financing activities was primarily the result of $1.2 billion in

repurchases of our common stock under our approved share repurchase program, which were partially funded

with the net proceeds from our $700 million January 2013 Debt Offering. Also, during the fourth quarter of fiscal

year 2013, we borrowed $150 million on our revolving credit facility. During fiscal year 2013, we paid $112

million in dividends on our common stock and $6 million for share repurchases related to shares purchased from

employees to cover tax withholdings. We also received $85 million in proceeds from the exercise of stock

options and $61 million in funds from Tyco and Pentair, which related to the allocation of funds between the

companies as outlined in the Separation and Distribution Agreement between Tyco and ADT.

51