ADT 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

The following discussion should be read in conjunction with our Consolidated and Combined Financial

Statements and the notes thereto. This discussion and analysis contains forward-looking statements that involve

risks, uncertainties and assumptions. Actual results may differ materially from those anticipated in these forward-

looking statements as a result of many factors, including but not limited to those provided in Item 1A. Risk

Factors and under the heading “Cautionary Statement Regarding Forward-Looking Statements” below.

The Consolidated and Combined Financial Statements have been prepared in accordance with generally

accepted accounting principles in the United States of America (“GAAP”). Unless otherwise indicated,

references to 2014, 2013 and 2012 are to our fiscal years ended September 26, 2014, September 27, 2013 and

September 28, 2012, respectively.

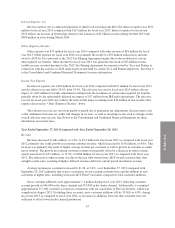

As part of a plan to separate into three independent companies, on or prior to September 28, 2012, Tyco

transferred the equity interests of the entities that held all of the assets and liabilities of its residential and small

business security business in the United States and Canada to ADT. Effective on September 28, 2012 (the

“Distribution Date”), Tyco distributed all of its shares of ADT to Tyco’s stockholders of record as of the close of

business on September 17, 2012 (the “Separation”). On the Distribution Date, each of the stockholders of Tyco

received one share of ADT common stock for every two shares of common stock of Tyco held on September 17,

2012. Our Consolidated Balance Sheets as of September 26, 2014 and September 27, 2013 reflect the

consolidated financial position of ADT and its subsidiaries as an independent publicly-traded company.

Additionally, our Consolidated Statements of Operations, Comprehensive Income and Cash Flows for fiscal

years 2014 and 2013 reflect ADT’s operations and cash flows as a standalone company. Prior to September 28,

2012, our financial position, results of operations and cash flows consisted of Tyco’s residential and small

business security business in the United States, Canada and certain U.S. territories and were derived from Tyco’s

historical accounting records and presented on a carve-out basis. As such, our Statements of Operations,

Comprehensive Income and Cash Flows for fiscal year 2012 consist of the combined results of operations and

cash flows of the ADT North American Residential Security Business of Tyco.

We conduct business through our operating entities and report financial and operating information in one

reportable operating segment. We have a 52- or 53-week fiscal year that ends on the last Friday in September.

Fiscal years 2014, 2013 and 2012 are 52-week years. Our next 53-week year will occur in fiscal year 2016.

Business Overview

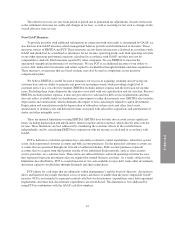

ADT is a leading provider of monitored security, interactive home and business automation and related

monitoring services. We currently serve approximately 6.7 million customers, making us the largest company of

our kind in both the United States and Canada. With a 140-year history, the ADT®brand is one of the most

respected, trusted and well-known brands in the monitored security industry today. Our broad and pioneering set

of products and services, including interactive home and business solutions and our home health services, meet a

range of customer needs for today’s active and increasingly mobile lifestyles. Our partner network is the broadest

in the industry, and includes independent authorized dealers, affinity organizations like USAA and AARP and

third-party referral companies. ADT delivers an integrated customer experience by maintaining the industry’s

largest sales, installation and service field force as well as a robust monitoring network, all backed by the support

of approximately 17,500 employees and about 200 sales and service offices.

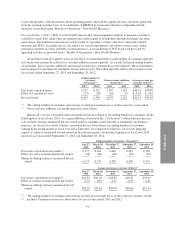

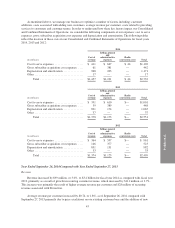

For fiscal year 2014, our revenue was $3.4 billion and our operating income was $659 million. The majority

of the monitoring services and a large portion of the maintenance services we provide to our customers are

governed by multi-year contracts with automatic renewal provisions. This provides us with significant recurring

revenue, which for fiscal year 2014 was approximately 92% of our revenue. We believe that the recurring nature

of the majority of our revenue enables us to continuously invest in growing our business. This includes

38