ADT 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Prior to the issuance of its indenture in July 2012, the Company’s working capital requirements and capital

for general corporate purposes, including acquisitions and capital expenditures, were satisfied as part of Tyco’s

company-wide cash management practices. Accordingly, Tyco’s consolidated debt and related interest expense,

exclusive of amounts incurred directly by the Company, were allocated to the Company for periods prior to

July 5, 2012.

Interest expense totaled $193 million, $118 million and $93 million for the years ended September 26, 2014,

September 27, 2013 and September 28, 2012, respectively. Interest expense for the first nine months of fiscal

year 2012 includes allocated interest expense of $64 million. Interest expense for this period was allocated in the

same proportion as debt and included the impact of Tyco’s interest rate swap agreements designated as fair value

hedges. Interest expense for fiscal years 2014, 2013 and the remaining amount of interest expense for fiscal year

2012 primarily represents interest incurred on the Company’s unsecured notes. Accrued interest totaled $44

million and $27 million as of September 26, 2014 and September 27, 2013, respectively.

See Note 1 for information on the fair value of the Company’s debt.

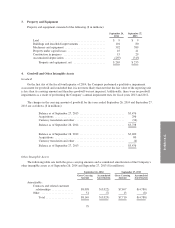

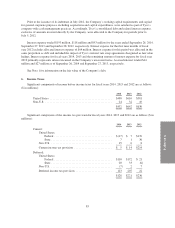

6. Income Taxes

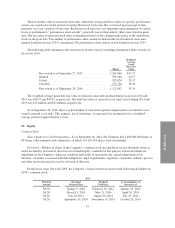

Significant components of income before income taxes for fiscal years 2014, 2013 and 2012 are as follows

($ in millions):

2014 2013 2012

United States ........................................... $408 $610 $581

Non-U.S. .............................................. 24 32 49

$432 $642 $630

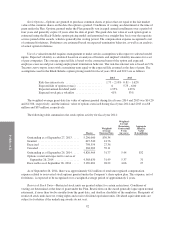

Significant components of the income tax provision for fiscal years 2014, 2013 and 2012 are as follows ($ in

millions):

2014 2013 2012

Current:

United States:

Federal ........................................ $(17) $ 7 $170

State .......................................... 7 1 36

Non-U.S. .......................................... 15 6 8

Current income tax provision .......................... $ 5 $ 14 $214

Deferred:

United States:

Federal ........................................ $110 $172 $ 21

State .......................................... 20 33 (6)

Non-U.S. .......................................... (7) 2 7

Deferred income tax provision ......................... 123 207 22

$128 $221 $236

83