ADT 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

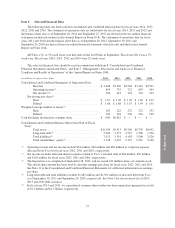

to provide investors with information about operating profits, adjusted for significant non-cash items, generated

from the existing customer base. A reconciliation of EBITDA to net income (the most comparable GAAP

measure) is provided under “Results of Operations—Non-GAAP Measures.”

Free Cash Flow (“FCF”). FCF is a non-GAAP measure that our management employs to measure cash that is

available to repay debt, make other investments and return capital to stockholders through dividends and share

repurchases. The difference between net cash provided by operating activities (the most comparable GAAP

measure) and FCF is the deduction of cash outlays for capital expenditures, subscriber system assets, dealer

generated customer accounts and bulk account purchases. A reconciliation of FCF to net cash provided by

operating activities is provided under “Results of Operations—Non-GAAP Measures.”

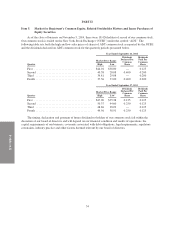

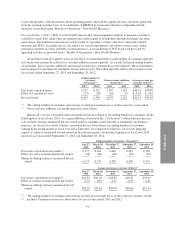

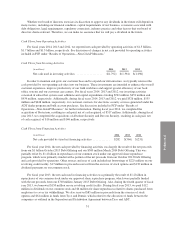

As reported in the first quarter of fiscal year 2014, we determined that a small number of customer upgrades

in Canada were incorrectly reflected as customer additions in prior periods. As a result, historical ending number

of customers, gross customer additions and average revenue per customer have been adjusted. These adjustments

had no impact on our financial statements for any prior periods. The following table reflects the revisions for the

fiscal years ended September 27, 2013 and September 28, 2012:

Ending number of

customers

(thousands)(1)

Gross customer additions

(thousands)(2)

Average revenue per

customer (dollars)(1)

2013 2012 2013 2012 2013 2012

Previously reported metric ................ 6,521 6,422 1,107 1,161 $40.31 $38.87

Effect of Canadian revision ................ (27) (26) (10) (9) $ 0.16 $ 0.16

Revised metric .......................... 6,494 6,396 1,097 1,152 $40.47 $39.03

(1) The ending number of customers and average revenue per customer are as of the respective years ended.

(2) Gross customer additions are for the respective years ended.

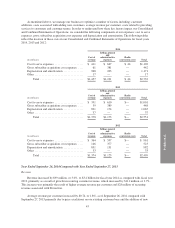

Historically, we have included contracts monitored but not owned in our ending number of customers. In the

fourth quarter of fiscal year 2014, we acquired Reliance Protectron Inc. (“Protectron”), whose business practice

is to exclude contracts monitored but not owned from its customer count. In order to harmonize our business

practices, we elected to exclude contracts monitored but not owned from our ending number of customers

starting in the fourth quarter of fiscal year 2014. Therefore, for comparative purposes, we are providing the

impact of contracts monitored but not owned on the relevant metrics for historical quarters of fiscal year 2014

and for fiscal years ended September 27, 2013 and September 28, 2012:

Ending number of customers (thousands)(1)

June 27,

2014

March 28,

2014

December 27,

2013

September 27,

2013

September 28,

2012

Previously reported/revised metric(2) .......... 6,377 6,416 6,448 6,494 6,396

Effect of contracts monitored but not owned .... (64) (64) (66) (64) (81)

Metric excluding contracts monitored but not

owned ................................ 6,313 6,352 6,382 6,430 6,315

Average revenue per customer (dollars)(1)

June 27,

2014

March 28,

2014

December 27,

2013

September 27,

2013

September 28,

2012

Previously reported/revised metric(2) .......... $41.85 $41.05 $40.63 $40.47 $39.03

Effect of contracts monitored but not owned .... 0.35 0.35 0.35 0.33 0.41

Metric excluding contracts monitored but not

owned ................................ $42.20 $41.40 $40.98 $40.80 $39.44

(1) The ending number of customers and average revenue per customer are as of the respective quarters ended.

(2) Includes Canadian revision described above for fiscal years ended 2013 and 2012.

41