ADT 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

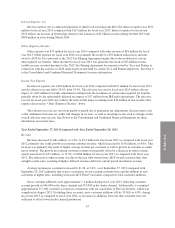

customers at higher rates largely driven by an increase in ADT Pulse®customers compared to total customer

additions, partially offset by lower average revenue per customer associated with customers acquired in the

acquisition of Protectron.

Gross customer additions were approximately 1.0 million during fiscal year 2014, reflecting direct and

dealer channel additions of 612,000 and 383,000, respectively. Additionally, we added approximately 373,000

customer accounts in conjunction with our acquisition of Protectron in July 2014 compared to approximately

117,000 customer accounts added in conjunction with our acquisition of Devcon Security Holdings, Inc.

(“Devcon Security”) in August 2013. Excluding these accounts, gross customer additions fell by 102,000, or

9.3%, during fiscal year 2014 as compared to fiscal year 2013, primarily due to lower dealer channel production,

29,000 fewer bulk account purchases and, to a lesser extent, lower levels of customer accounts generated through

our direct channel. The decline in our dealer channel production was primarily due to a lower number of dealers

for the majority of the year, in addition to dealers facing lead generation challenges as a result of the competitive

environment and tighter enforcement of telemarketing regulations. We continue to add new dealers and to work

closely with our existing dealers to help them strengthen their capabilities and better leverage ADT’s marketing

assets to grow their businesses, as evidenced by a 16% increase in dealer channel production from the quarter

ended June 27, 2014 compared to the quarter ended September 26, 2014, excluding bulk purchases. The decline

in customer accounts generated through our direct channel resulted from lead generation challenges partially due

to the impact of the competitive environment, the implementation of more stringent credit policies for new

subscribers and increased focus on ADT Pulse®upgrades for existing customers.

Our ending number of customers, net of attrition, increased by 233,000, or 3.6%, during fiscal year 2014

primarily due to the acquisition of Protectron during the fiscal fourth quarter. Our annualized customer unit

attrition and annualized customer revenue attrition as of September 26, 2014 were 13.2% and 13.5%,

respectively, compared with 13.3% and 13.9%, respectively, as of September 27, 2013. Attrition was impacted

favorably by several new programs implemented to address voluntary, non-pay and relocation disconnects, offset

by the impact of the competitive environment.

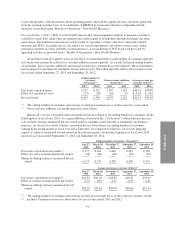

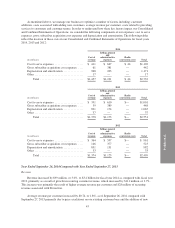

Operating Income

Operating income decreased by $76 million, or 10.3%, to $659 million for fiscal year 2014 as compared

with fiscal year 2013. Operating margin was 19.3% for fiscal year 2014 compared with 22.2% for fiscal year

2013.

Operating expenses for fiscal year 2014 totaled $2.7 billion, up 6.8% or $175 million as compared to fiscal

year 2013. Operating expenses included $17 million and $23 million of costs related to the Separation during

fiscal years 2014 and 2013, respectively. The increase in operating expenses is partially a result of $106 million

higher depreciation and amortization expense primarily related to increased depreciation of our subscriber system

assets, which included higher costs associated with ADT Pulse®additions and upgrades, and greater amortization

of dealer generated accounts and customer relationships. Additionally, there was a $101 million increase in cost

to serve expenses which was largely a result of $44 million of costs associated with our three-year conversion

program to replace 2G radios used in many of our security systems, an $18 million increase in restructuring and

other expenses primarily related to severance and a loss on the sublease portion of our office space, $15 million

of incremental costs associated with the operations of Protectron, and a $5 million increase in acquisition and

integration costs. After considering these items, cost to serve expenses increased by $19 million which was

primarily related to increased customer service and maintenance expenses from programs to improve customer

retention, incremental investments to strengthen our business platforms and capabilities to support our business

simplification, innovation and M&A opportunities and higher costs associated with being a stand-alone public

company.

As discussed above, we implemented a three-year conversion program for the replacement of 2G radios

used in many of our security systems which will continue to drive future incremental costs. We anticipate that we

will incur approximately $60 million to $70 million in fiscal year 2015 in conjunction with this program.

44