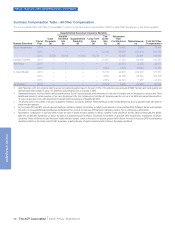

ADT 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

value in the form of PSUs, whose vesting is contingent upon

achieving TSR and SSFCF goals over a three-year performance

period. An additional 25% of long-term incentive value for our CEO

and other Executive Officers was delivered in the form of Stock

Options, which deliver value only when long-term stock price

appreciation is achieved. The remaining 25% of long-term incentive

value delivered to our CEO and other Executive Officers was awarded

in the form of RSUs, which deliver higher value when there is long-

term stock price appreciation.

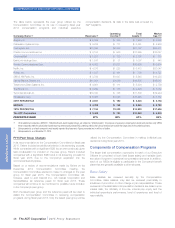

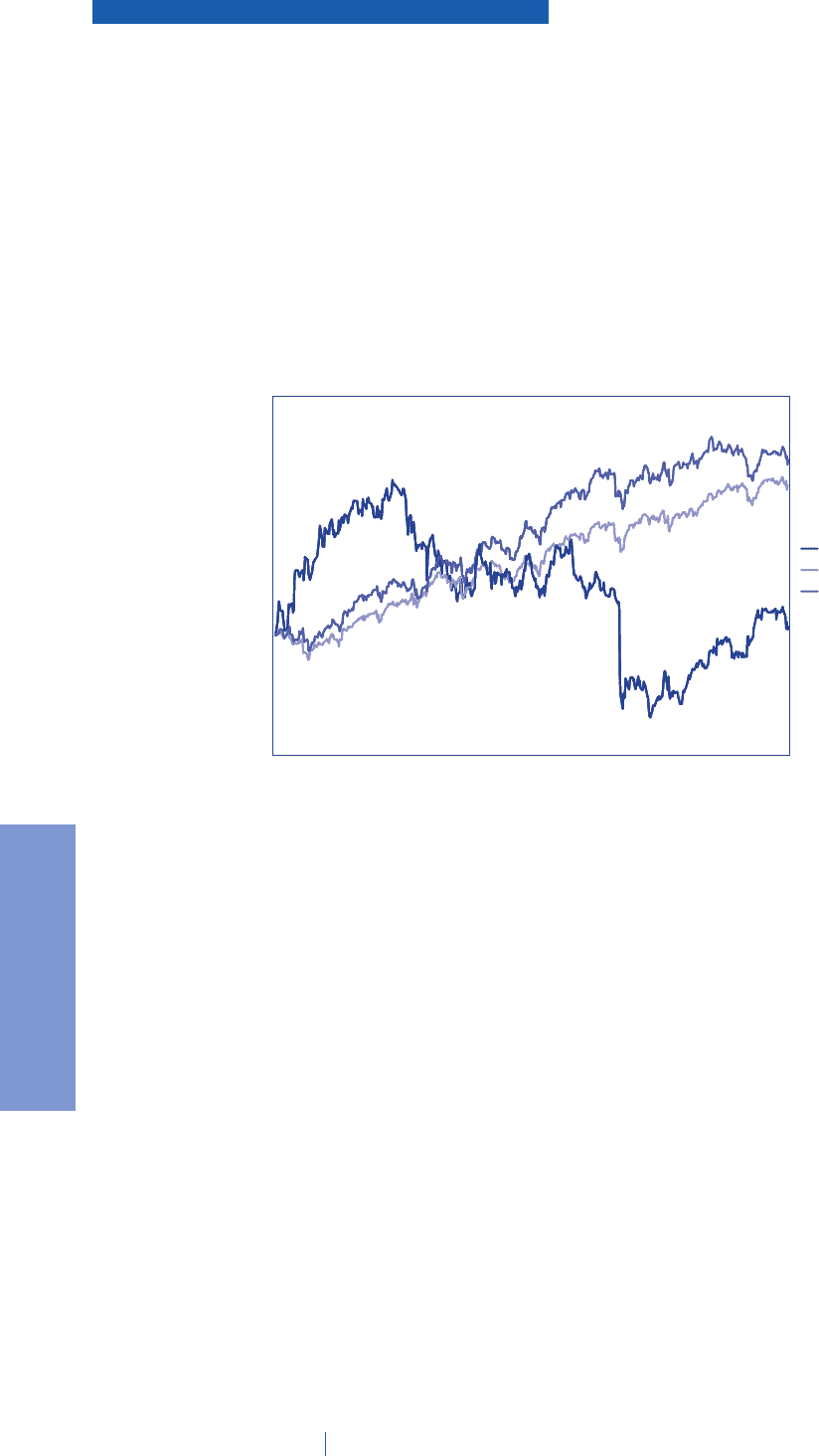

The following graph provides a comparison of the cumulative TSR on

the Company’s common stock to the returns of the S&P 500 Index

and the S&P 500 Industrial Index from October 1, 2012 (the first day

of fiscal year 2013 and the inception of trading of ADT common stock

as an independent, publicly traded company) through September 26,

2014 (the end of fiscal year 2014). From inception through the end of

fiscal year 2014, our TSR is 2.2%. As an indicator of the solid

sequential improvements in our operational performance during the

last three quarters of fiscal year 2014, however, our TSR between

January 30, 2014 (the date of release of the 10-Q for first fiscal

quarter) and September 26, 2014 is approximately 15%. The graph is

not, and is not intended to be, indicative of future performance of our

common stock.

150%

160%

140%

120%

130%

110%

90%

100%

80%

70%

Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14

ADT

S&P500

S&P 500 Industrials (S5INDU)

The above graph assumes the following:

(1) $100 invested at the close of business on October 1, 2012, in

ADT common stock, S&P 500 Index, and the S&P 500 Industrial

Index.

(2) The cumulative total return assumes reinvestment of dividends.

The Compensation Committee believes that the annual incentive

awards earned by the NEOs, in comparison to the performance of

the Company’s stock relative to the S&P 500 Index and the S&P 500

Industrial Index, reflect a proper alignment of pay and performance.

Process for Determining Executive Officer

Compensation (including NEOs)

Role of the Compensation Committee

The Compensation Committee consists exclusively of independent

directors, the requirements of which are set forth in the NYSE listing

rules, who are also considered “outside directors” as defined in

Section 162(m) of the Code. The Compensation Committee is

responsible for, among other things, reviewing the performance of

and approving the compensation awarded to our Executive Officers,

other “senior officers” subject to the filing requirements of Section 16

of the Securities Exchange Act of 1934, as amended, and “senior

executives” (those executives who are not senior officers, but who

have a base salary of $350,000 or greater). The Compensation

Committee also reviews CEO performance and makes

recommendations regarding his compensation to the independent

members of the Board of Directors.

Role of Independent Compensation Consultant

The Compensation Committee regularly works with an independent

compensation consultant in carrying out its duties. The

Compensation Committee has the sole authority to retain,

compensate and terminate the independent compensation consultant

and any other advisors necessary to assist it in its evaluation of non-

management director, CEO or other senior executive compensation.

The Compensation Committee has engaged Farient Advisors LLC

(“Farient”) to provide advice regarding compensation practices for our

executives. In fulfilling its duties to the Compensation Committee,

Farient often works directly with management of the Company to

prepare materials for the Committee’s review. Farient regularly attends

Compensation Committee meetings and in fiscal year 2014 advised

the Committee on matters including, among others:

•an evaluation of our executives’ base salaries and short- and long-

term target incentive compensation relative to the Company’s peer

group and the broader market;

•insight and advice in connection with the design of our incentive

plans, including the measures, goals, and leverage inherent in the

performance plans;

26 The ADT Corporation 2015 Proxy Statement

PROXY STATEMENT