ADT 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

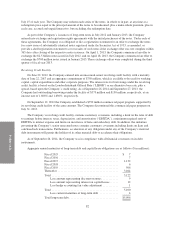

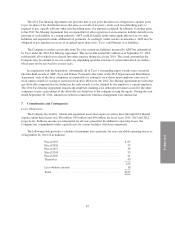

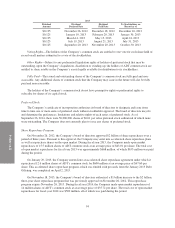

The reconciliation between the actual effective tax rate on continuing operations and the statutory U.S.

federal income tax rate for fiscal years 2014, 2013 and 2012 is as follows:

2014 2013 2012

Federal statutory tax rate .................................. 35.0 % 35.0 % 35.0 %

Increases (reductions) in taxes due to:

U.S. state income tax provision, net ..................... 4.2% 3.5% 3.4%

Non-U.S. net earnings ................................ (0.5)% (0.5)% (0.6)%

Trademark amortization .............................. (5.3)% (3.6)% — %

Nondeductible charges ............................... — % (1.0)% — %

Resolution of unrecognized tax benefits .................. (6.5)% — % — %

2005-2009 IRS adjustments ........................... 3.7% — % — %

Other ............................................. (1.0)% 1.0 % (0.3)%

Provision for income taxes ................................ 29.6 % 34.4 % 37.5 %

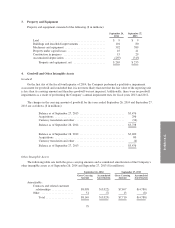

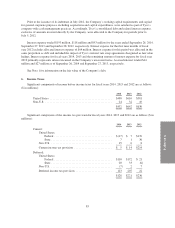

Deferred income taxes result from temporary differences between the amount of assets and liabilities

recognized for financial reporting and tax purposes.

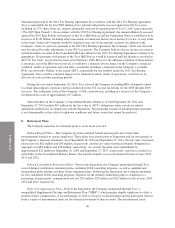

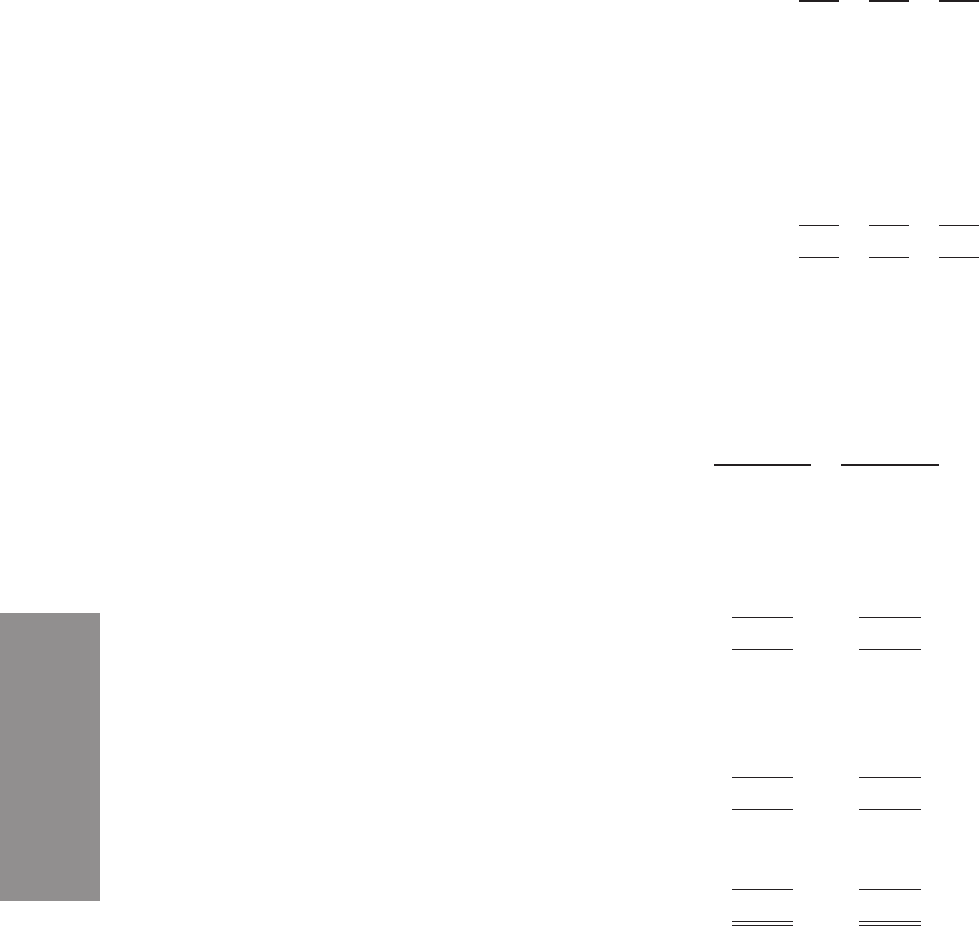

The components of the Company’s net deferred income tax liability as of September 26, 2014 and

September 27, 2013 are as follows ($ in millions):

September 26,

2014

September 27,

2013

Deferred tax assets:

Accrued liabilities and reserves ................ $ 35 $ 37

Tax loss and credit carryforwards .............. 1,023 1,114

Postretirement benefits ....................... 14 15

Deferred revenue ........................... 167 161

Other ..................................... 13 10

$ 1,252 $ 1,337

Deferred tax liabilities:

Property and equipment ...................... (34) (16)

Subscriber system assets ..................... (633) (600)

Intangible assets ............................ (1,111) (1,052)

Other ..................................... (10) (12)

$(1,788) $(1,680)

Net deferred tax liability before valuation

allowance ............................... (536) (343)

Valuation allowance ......................... (2) (2)

Net deferred tax liability ..................... $ (538) $ (345)

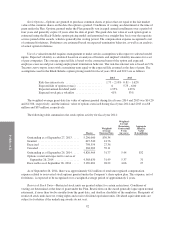

The net deferred tax liability increased primarily due to accelerated depreciation and amortization and

current year net operating loss (“NOL”) utilization.

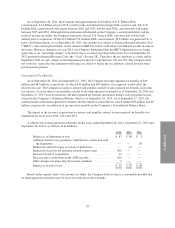

The valuation allowance for deferred tax assets of $2 million as of September 26, 2014 and September 27,

2013, relates to the uncertainty of the utilization of certain state and U.S. deferred tax assets. The Company

believes that it is more likely than not that it will generate sufficient future taxable income to realize the tax

benefits related to its remaining deferred tax assets, including credit and NOL carryforwards, on the Company’s

Consolidated Balance Sheet.

84