ADT 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

Derivative Litigation

In May and June 2014, four derivative actions were filed against a number of past and present officers and

directors of the Company. Like the securities actions described above, the derivative actions focus primarily on

the Company’s stock repurchase program in 2012 and 2013, the buyback of stock from Corvex in November

2013 and the Company’s statements concerning its financial condition and future business prospects for fiscal

2013 and the first quarter of fiscal 2014. Three of the derivative actions were filed in the United States District

Court for the Southern District of Florida. On July 16, 2014, the Court consolidated those three actions under the

caption In re The ADT Corporation Derivative Litigation, Lead Case No. 14-80570-CIV-DIMITROULEAS/

SNOW. The fourth derivative action, entitled Seidl v. Colligan, Case No. 2014CA007529, was filed in the

Circuit Court of the 15th Judicial Circuit, Palm Beach County, Florida. On July 14, 2014, the parties agreed to

stay that action pending resolution of motions to dismiss that are expected to be filed in the securities actions

described above. The Court approved the stay on July 23, 2014. A fifth derivative action asserting similar claims

was filed in the Delaware Court of Chancery on August 1, 2014. Defendants have moved to dismiss that action,

which is entitled Ryan v. Gursahaney, C.A. No. 9992-VCP.

In March 2014, the Company also received a demand from a shareholder to initiate litigation against the

officers and directors of the Company in connection with the Company’s stock repurchase program in 2012 and

2013 and the buyback of stock from Corvex in November 2013. The Company’s Board of Directors investigated

the matters with the assistance of an outside law firm and, on July 18, 2014, decided to reject the demand. In

September 2014, the Company received a demand from another shareholder to initiate litigation with regard to

the same matters raised in the March 2014 demand. On September 19, 2014, the Company’s Board of Directors

decided to reject the demand.

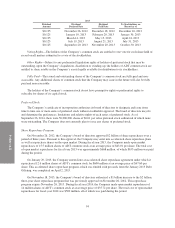

Income Tax Matters

As discussed above in Note 6, in connection with the Separation from Tyco, the Company entered into the

2012 Tax Sharing Agreement with Tyco and Pentair Ltd. that governs the rights and obligations of the Company,

Tyco and Pentair for certain pre-Separation tax liabilities, including Tyco’s obligations under the tax sharing

agreement among Tyco, Covidien, and TE Connectivity entered into the 2007 Tax Sharing Agreement”. The

Company is responsible for all of its own taxes that are not shared pursuant to the 2012 Tax Sharing Agreement’s

sharing formulae. Tyco and Pentair are responsible for their tax liabilities that are not subject to the 2012 Tax

Sharing Agreement’s sharing formulae.

With respect to years prior to and including the 2007 separation of Covidien and TE Connectivity by Tyco,

tax authorities have raised issues and proposed tax adjustments that are generally subject to the sharing

provisions of the 2007 Tax Sharing Agreement and which may require Tyco to make a payment to a taxing

authority, Covidien or TE Connectivity. Although Tyco has advised ADT that it has resolved a substantial

number of these adjustments, a few significant items raised by the IRS remain open with respect to the audits of

the 1997 through 2007 tax years. On July 1, 2013, Tyco announced that the IRS issued Notices of Deficiency to

Tyco primarily related to the treatment of certain intercompany debt transactions (the “Tyco IRS

Notices”). These notices assert that additional taxes of $883 million plus penalties of $154 million are owed

based on audits of the 1997 through 2000 tax years of Tyco and its subsidiaries, as they existed at that time.

Further, Tyco reported receiving Final Partnership Administrative Adjustments (the “Partnership Notices”) for

certain U.S. partnerships owned by its former U.S. subsidiaries, for which Tyco has informed that it estimates an

additional tax deficiency of approximately $30 million will be asserted. The additional tax assessments related to

the Tyco IRS Notices and the Partnership Notices exclude interest and do not reflect the impact on subsequent

periods if the IRS challenge to Tyco’s tax filings is proved correct. Tyco has filed petitions with the U.S. Tax

Court to contest the IRS assessments. Consistent with its petitions filed with the U.S. Tax Court, Tyco has

advised the Company that it strongly disagrees with the IRS position and believes (i) it has meritorious defenses

for the respective tax filings, (ii) the IRS positions with regard to these matters are inconsistent with applicable

tax laws and Treasury regulations, and (iii) the previously reported taxes for the years in question are appropriate.

If the IRS should successfully assert its position, the Company’s share of the collective liability, if any, would be

89