ADT 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

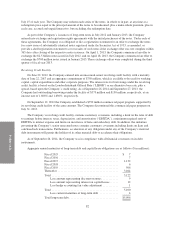

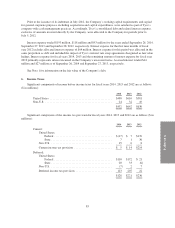

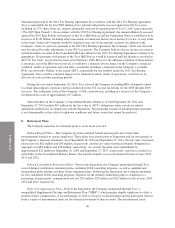

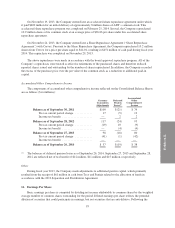

Many of the Company’s uncertain tax positions relate to tax years that remain subject to audit by the taxing

authorities in the U.S. federal, state and local or foreign jurisdictions. Open tax years in significant jurisdictions

are as follows:

Jurisdiction

Years

Open To Audit

Canada ....................................... 2007 – 2013

United States ................................... 1997 – 2013

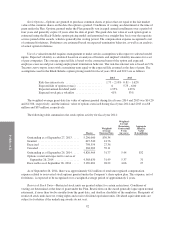

Undistributed Earnings of Subsidiaries

The Company’s primary non-U.S. operations are located in Canada. The Company has not provided U.S.

income taxes and foreign withholding taxes on the undistributed earnings of its Canadian subsidiaries as of

September 26, 2014, as earnings are expected to be permanently reinvested outside the U.S. If these foreign

earnings were to be repatriated in the future, the related U.S. tax liability may be reduced by any foreign income

taxes previously paid on these earnings. As of September 26, 2014, the cumulative amount of earnings upon

which U.S. income taxes have not been provided is approximately $220 million. The determination of the

amount of unrecognized deferred tax liability related to these earnings is not practicable.

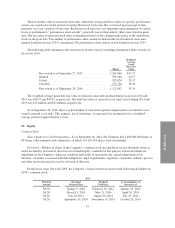

Tax Sharing Agreement and Other Income Tax Matters

In connection with the Separation from Tyco, the Company entered into a tax sharing agreement (the “2012

Tax Sharing Agreement”) with Tyco and Pentair Ltd., formerly Tyco Flow Control International, Ltd. (“Pentair”)

that governs the rights and obligations of ADT, Tyco and Pentair for certain pre-Separation tax liabilities,

including Tyco’s obligations under the tax sharing agreement among Tyco, Covidien Ltd. (“Covidien”), and TE

Connectivity Ltd. (“TE Connectivity”) entered into in 2007 (the “2007 Tax Sharing Agreement”). The 2012 Tax

Sharing Agreement provides that ADT, Tyco and Pentair will share (i) certain pre-Separation income tax

liabilities that arise from adjustments made by tax authorities to ADT’s, Tyco’s, and Pentair’s U.S. and certain

non-U.S. income tax returns, and (ii) payments required to be made by Tyco in respect to the 2007 Tax Sharing

Agreement (collectively, “Shared Tax Liabilities”). Tyco will be responsible for the first $500 million of Shared

Tax Liabilities. ADT and Pentair will share 58% and 42%, respectively, of the next $225 million of Shared Tax

Liabilities. ADT, Tyco and Pentair will share 27.5%, 52.5% and 20.0%, respectively, of Shared Tax Liabilities

above $725 million.

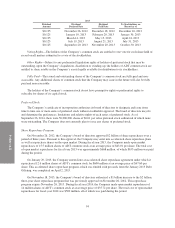

In addition, under the terms of the 2012 Tax Sharing Agreement, in the event the distribution of ADT’s

common shares to the Tyco shareholders (the “Distribution”), the distribution of Pentair common shares to the

Tyco shareholders (the “Pentair Distribution” and, together with the Distribution, the “Distributions”), or certain

internal transactions undertaken in connection therewith were determined to be taxable as a result of actions

taken by ADT, Pentair or Tyco after the Distributions, the party responsible for such failure would be responsible

for all taxes imposed on ADT, Pentair or Tyco as a result thereof. Taxes resulting from the determination that the

Distribution, the Pentair Distribution, or any internal transaction that were intended to be tax-free is taxable are

referred to herein as “Distribution Taxes.” If such failure is not the result of actions taken after the Distributions

by ADT, Pentair or Tyco, then ADT, Pentair and Tyco would be responsible for any Distribution Taxes imposed

on ADT, Pentair or Tyco as a result of such determination in the same manner and in the same proportions as the

Shared Tax Liabilities. ADT has sole responsibility of any income tax liability arising as a result of Tyco’s

acquisition of Broadview Security in May 2010, including any liability of Broadview Security under the tax

sharing agreement between Broadview Security and The Brink’s Company dated October 31, 2008 (collectively,

“Broadview Tax Liabilities”). Costs and expenses associated with the management of Shared Tax Liabilities,

Distribution Taxes, and Broadview Tax Liabilities will generally be shared 20.0% by Pentair, 27.5% by ADT,

and 52.5% by Tyco. ADT is responsible for all of its own taxes that are not shared pursuant to the 2012 Tax

Sharing Agreement’s sharing formulae. In addition, Tyco and Pentair are responsible for their tax liabilities that

are not subject to the 2012 Tax Sharing Agreement’s sharing formulae.

86