ADT 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

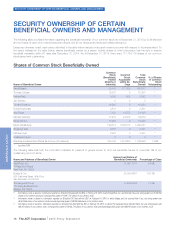

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

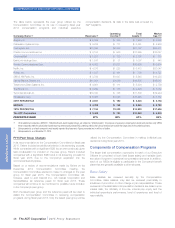

The following table provides information regarding the beneficial ownership of our common stock as of December 31, 2014 by (i) all directors

and nominees, (ii) each of our named executive officers, and (iii) our directors and executive officers as a group.

Except as otherwise noted, each person identified in the table below has sole voting and investment power with respect to the shares listed. To

the extent indicated in the table below, shares beneficially owned by a person include shares of which the person has the right to acquire

beneficial ownership within 60 days after December 31, 2014. As of December 31, 2014, there were 171,754,119 shares of our common

stock issued and outstanding.

Shares of Common Stock Beneficially Owned

Name of Beneficial Owner

Common

Stock

Beneficially

Owned

Directly or

Indirectly

Common

Stock

Acquirable

within 60-

Days

Total

Common

Stock

Beneficially

Owned

% of Shares

of Common

Stock

Outstanding

David Bleisch 33,142 117,835 150,977 *

Thomas Colligan 12,301 0 12,301 *

Richard Daly 3,000 522 3,522 *

Jerri DeVard 00 0*

Timothy Donahue 10,263 0 10,263 *

Robert Dutkowsky 3,801 0 3,801 *

Alan Ferber 7,120 14,725 21,845 *

Michael Geltzeiler 11,970 23,000 34,970 *

Bruce Gordon 17,905 0 17,905 *

Naren Gursahaney 199,414 1,090,873 1,290,287 *

Bridgette Heller 3,801 0 3,801 *

Kathleen Hyle 3,801 0 3,801 *

Christopher Hylen 00 0*

Directors and Executive Officers as a Group (20 persons) 365,189 1,401,660 1,766,849 1.03%

* Less than 1.0%

The following table sets forth the information indicated for persons or groups known to us to be beneficial owners of more than 5% of our

outstanding common stock.

Name and Address of Beneficial Owner Amount and Nature of

Beneficial Ownership Percentage of Class

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022

11,067,707(1) 6.44%

Dodge & Cox

555 California Street, 40th Floor

San Francisco, CA 94104

28,008,568(2) 16.31%

The Vanguard Group

100 Vanguard Boulevard

Malvern, PA 19355

13,444,636(3) 7.83%

1) Information shown is based on information reported on Schedule 13G filed with the SEC on February 10, 2014 in which BlackRock, Inc. reported that it has sole voting power over 9,156,992

shares of our common stock and sole dispositive power of 11,067,707 shares of our common stock.

2) Information shown is based on information reported on Schedule 13G filed with the SEC on February 14, 2014, in which Dodge and Cox reported that it has sole voting power over

26,861,356 shares of our common stock and sole dispositive power of 28,008,568 shares of our common stock.

3) Information shown is based on information reported on Schedule 13G filed with the SEC on February 10, 2014, in which The Vanguard Group reported that it has sole voting power over

326,251 shares of our common stock, sole dispositive power of 13,135,724 shares of our common stock and shared dispositive power over 308,912 shares of our common stock.

18 The ADT Corporation 2015 Proxy Statement

PROXY STATEMENT