ADT 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

its fair value. In performing these assessments, management relies on various factors, including operating results,

business plans, economic projections, anticipated future cash flows and other market data. There are inherent

uncertainties related to these factors which require judgment in applying them to the testing of goodwill for

impairment. The Company performs its annual impairment tests for goodwill as of the first day of the Company’s

fourth fiscal quarter of each year. See Note 4 for further information.

In testing goodwill for impairment, the Company has the option to first assess qualitative factors to

determine whether the existence of events or circumstances leads to a determination that it is more likely than not

that the estimated fair value of the reporting unit is less than its carrying amount. If the Company elects to

perform a qualitative assessment and determines that an impairment is more likely than not, a two-step,

quantitative impairment test is then required, otherwise no further analysis is required. The Company also may

elect not to perform the qualitative assessment and, instead, proceed directly to the quantitative impairment test.

Under the qualitative goodwill assessment, events and circumstances that would affect the estimated fair

value of a reporting unit are identified and evaluated. Factors such as the inputs to and results of the most recent

two-step quantitative impairment test, current and long-term forecasted financial results, changes in strategic

outlook or organizational structure, industry and market changes, and macroeconomic indicators are also

considered in the assessment.

As discussed above, the two-step, quantitative goodwill impairment test is performed either at the

Company’s election or when the results of the qualitative goodwill assessment indicate that it is more likely than

not that the estimated fair value of the reporting unit is less than its carrying amount. Under the two-step,

quantitative goodwill impairment test, the Company first compares the fair value of its reporting unit with its

carrying amount. The estimated fair value of the reporting unit used in the goodwill impairment test is

determined utilizing a discounted cash flow analysis based on the Company’s forecasts discounted using market

participants’ weighted average cost of capital and market indicators of terminal year cash flows. If the carrying

amount of the Company’s reporting unit exceeds its fair value, goodwill is considered potentially impaired and

step two of the goodwill impairment test is performed to measure the amount of impairment loss. In the second

step of the goodwill impairment test, the Company compares the implied fair value of the reporting unit’s

goodwill with the carrying amount of the reporting unit’s goodwill. If the carrying amount of the reporting unit’s

goodwill exceeds the implied fair value of that goodwill, an impairment loss is recognized in an amount equal to

the excess of the carrying amount of goodwill over its implied fair value. The implied fair value of goodwill is

determined in the same manner that the amount of goodwill recognized in a business combination is determined.

The Company allocates the fair value of its reporting unit to all of the assets and liabilities of that unit, including

intangible assets, as if the reporting unit had been acquired in a business combination. Any excess of the fair

value of its reporting unit over the amounts assigned to its assets and liabilities represents the implied fair value

of goodwill.

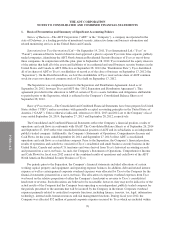

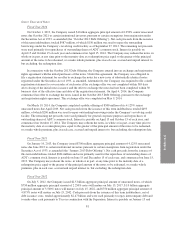

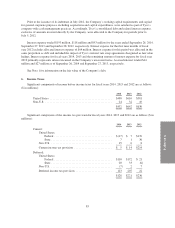

Accrued Expenses and Other Current Liabilities—Included in accrued and other current liabilities in the

Company’s Consolidated Balance Sheets are amounts for payroll-related accruals of $45 million and $48 million

as of September 26, 2014 and September 27, 2013, respectively. Also included in accrued and other current

liabilities are customer advances, which totaled $35 million and $38 million as of September 26, 2014 and

September 27, 2013, respectively.

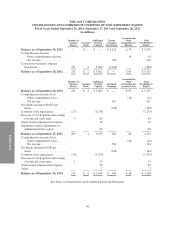

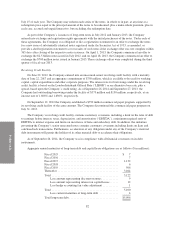

Parent Company Investment—Prior to the Separation, Tyco’s historical investment in the Company, the

Company’s accumulated net earnings after taxes, and the net effect of transactions with and allocations from

Tyco is shown as Parent company investment in the Consolidated and Combined Statements of Stockholders’

Equity. See discussion under “Basis of Presentation” for additional information on the allocation of expenses to

the Company by Tyco for periods prior to the Separation.

Income Taxes—For purposes of the Company’s Consolidated and Combined Financial Statements for

periods prior to the Separation, income tax expense, deferred tax balances and tax carryforwards have been

recorded as if ADT filed tax returns on a standalone basis separate from Tyco (“Separate Return Method”). The

74