ADT 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMPENSATION OF EXECUTIVE OFFICERS—CONTINUED

Description of Performance Measures:“Recurring Revenue

Growth” is defined as the growth in revenue generated by monthly

recurring fees related to electronic security, interactive home and

business automation and related monitoring services. Revenues

associated with the installation of our security and automation

systems, along with other one-time revenues, are excluded from this

calculation. From time to time, discretionary adjustments may be

applied for AIP and Officer Bonus Plan purposes. “Steady State Free

Cash Flow” is defined as a measure of pre-levered cash generated

by the Company after the cost of replacing recurring revenue lost to

attrition, but before the cost of new subscribers that drive recurring

revenue growth. Steady State Free Cash Flow is calculated by

subtracting both the Subscriber Acquisition Cost (“SAC”) required to

maintain recurring revenue and maintenance capex from EBITDA

(pre-SAC). From time to time, discretionary adjustments may be

applied for AIP and Officer Bonus Plan purposes. “Net Attrition” is the

customer revenue attrition rate which is defined as recurring revenue

lost resulting from customer attrition, net of dealer charge-backs and

re-sales. The customer revenue attrition rate is a 52-week trailing

ratio, the numerator of which is the recurring revenue lost during the

period due to attrition, net of dealer charge-backs and re-sales, and

the denominator of which is total annualized recurring revenue based

on an average of recurring revenue under contract at the beginning of

each month during the period.

In approving payouts for each of our NEOs in November 2014, the

Compensation Committee (and, in the case of the CEO, the

independent members of the Board of Directors) first determined the

amount of the maximum bonus award each NEO was eligible to

receive under the Officer Bonus Plan, based upon the Company’s

Operating Income performance. The Compensation Committee then

determined the final awards for each of the NEOs through the

exercise of negative discretion based upon both the achievement of

the quantitative performance measures shown in the Fiscal 2014

Annual Incentive Compensation Design Summary table above and a

Strategic Modifier.

The Strategic Modifier provides the Compensation Committee the

ability to adjust the awards as calculated based upon the quantitative

performance measures plus or minus twenty percent (+/- 20%). The

Compensation Committee evaluated the overall strategic

performance of the Company, which included Small Business

Recurring Revenue Growth and Recurring Revenue Margin as well as

other strategic factors and, based upon that overall assessment,

made the determination that the overall pool of funds available to

allocate for awards for the Executive Officers of the Company,

including the NEOs, would be reduced by five (5) percentage points.

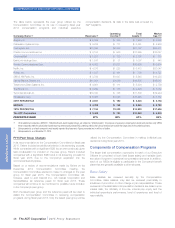

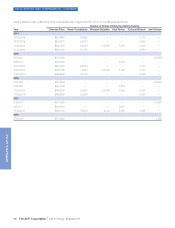

The table below shows the maximum and target annual incentive

compensation opportunities, as well as the actual incentive payouts

earned for fiscal year 2014, for each of our NEOs. These incentive

payments earned are reported in the “Non-Equity Incentive Plan

Compensation” column of the Summary Compensation Table on

page 35 of this Proxy Statement.

Named Executive Officer Maximum Target Actual

Naren Gursahaney $1,800,000 $900,000 $630,000

Michael Geltzeiler $1,500,000 $750,000 $538,125

Alan Ferber $ 700,000 $350,000 $235,200

N. David Bleisch $ 595,000 $297,500 $211,374

Jerri DeVard (1) $ 700,000 $350,000 $126,594

(1) Maximum and target amounts for Ms. DeVard represent annual amounts. Actual amount was pro-rated for the period from Ms. DeVard’s hire date (March 31, 2014) through the end of the

fiscal year.

Long-Term Incentive Program

The Company’s LTIP is designed to provide a significant portion of

executives’ compensation opportunity in equity-based instruments. In

so doing, the LTIP is a key component in aligning the long-term

interests of executives with those of stockholders, thus promoting

value creation for both our executives and stockholders. A majority of

total equity granted under the LTIP is awarded during our annual grant

process. This process occurs in conjunction with our annual

assessment of individual performance and potential, and also takes

into account a review of the competitive compensation landscape.

Awards of equity under the annual LTIP process are delivered to

employees utilizing a mix of Stock Options, RSUs and PSUs. The

weighting of the different components of the awards varies by

employee level. In fiscal year 2014 we increased the weighting of

PSUs while reducing the weighting of Stock Options. The value of

awards granted to our CEO and the other NEOs during the annual

LTIP process are based upon the following mix of equity:

Grant Type Weighting

PSUs 50%

Stock Options 25%

RSUs 25%

30 The ADT Corporation 2015 Proxy Statement

PROXY STATEMENT