ADT 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

July 15 of each year. The Company may redeem each series of the notes, in whole or in part, at any time at a

redemption price equal to the principal amount of the notes to be redeemed, plus a make-whole premium, plus in

each case, accrued and unpaid interest to, but excluding, the redemption date.

As part of the Company’s issuances of long-term notes in July 2012 and January 2013, the Company

entered into exchange and registration rights agreements with the initial purchasers of the notes. Under each of

these agreements, the Company was obligated to file a registration statement for an offer to exchange the notes

for a new issue of substantially identical notes registered under the Securities Act of 1933, as amended, or

provide a shelf registration statement to cover resales of such notes if the exchange offer was not complete within

365 days after closing of the respective notes issuance. On April 1, 2013, the Company commenced an offer to

exchange the $2.5 billion notes issued in July 2012, and on April 18, 2013, the Company commenced an offer to

exchange the $700 million notes issued in January 2013. These exchange offers were completed during the third

quarter of fiscal year 2013.

Revolving Credit Facility

On June 22, 2012, the Company entered into an unsecured senior revolving credit facility with a maturity

date of June 22, 2017 and an aggregate commitment of $750 million, which is available to be used for working

capital, capital expenditures and other corporate purposes. The interest rate for borrowings under the revolving

credit facility is based on the London Interbank Offered Rate (“LIBOR”) or an alternative base rate, plus a

spread, based upon the Company’s credit rating. As of September 26, 2014 and September 27, 2013, the

Company had outstanding borrowings under the facility of $375 million and $150 million, respectively, at an

interest rate of 1.606% and 1.630%, respectively.

On September 12, 2012 the Company established a $750 million commercial paper program, supported by

its revolving credit facility of the same amount. The Company discontinued this commercial paper program on

July 31, 2013.

The Company’s revolving credit facility contains customary covenants, including a limit on the ratio of debt

to earnings before interest, taxes, depreciation, and amortization (“EBITDA”), a minimum required ratio of

EBITDA to interest expense and limits on incurrence of liens and subsidiary debt. In addition, the indenture

governing the Company’s senior unsecured notes contains customary covenants including limits on liens and

sale/leaseback transactions. Furthermore, acceleration of any obligation under any of the Company’s material

debt instruments will permit the holders of its other material debt to accelerate their obligations.

As of September 26, 2014, the Company was in compliance with all financial covenants on its debt

instruments.

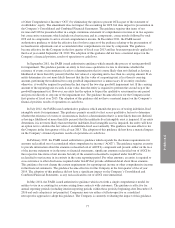

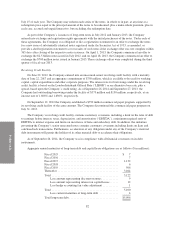

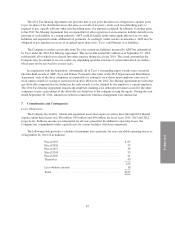

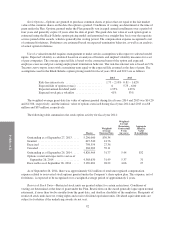

Aggregate annual maturities of long-term debt and capital lease obligations are as follows ($ in millions):

Fiscal 2015 ......................................... $ 7

Fiscal 2016 ......................................... 7

Fiscal 2017 ......................................... 1,132

Fiscal 2018 ......................................... 6

Fiscal 2019 ......................................... 506

Thereafter .......................................... 3,464

Total .............................................. 5,122

Less amount representing discount on notes ........... 9

Less amount representing interest on capital leases ...... 12

Less hedge accounting fair value adjustment ........... 1

Total .............................................. 5,100

Less current maturities of long-term debt ............. 4

Total long-term debt .................................. $5,096

82