ADT 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

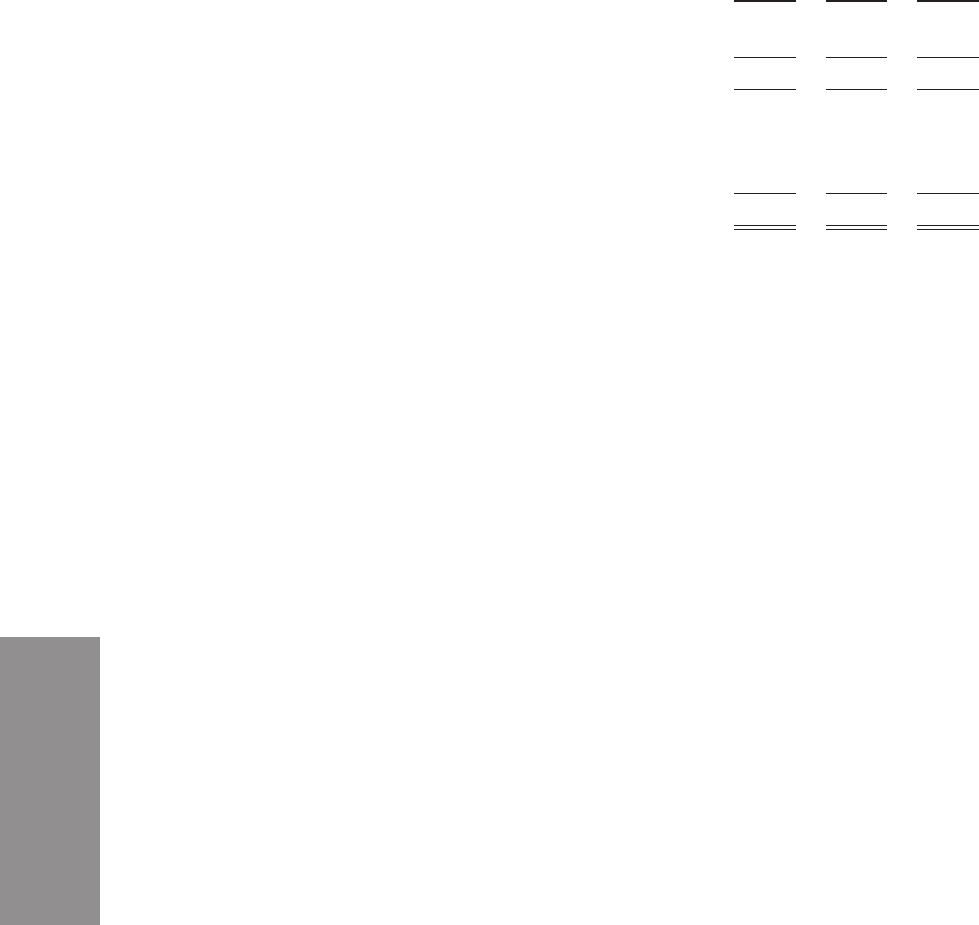

Results of Operations

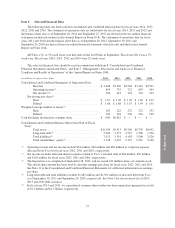

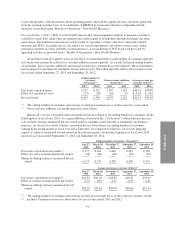

(in millions, except as otherwise indicated) 2014 2013 2012

Recurring customer revenue ........................ $3,152 $ 3,041 $ 2,903

Other revenue .................................... 256 268 325

Total revenue ................................ 3,408 3,309 3,228

Operating income ................................. 659 735 722

Interest expense, net ............................... (192) (117) (92)

Other (expense) income ............................ (35) 24 —

Income tax expense ............................... (128) (221) (236)

Net income .................................. $ 304 $ 421 $ 394

Summary Cash Flow Data:

Net cash provided by operating activities .......... $1,519 $ 1,666 $ 1,493

Net cash used in investing activities .............. (1,792) (1,394) (1,096)

Net cash provided by (used in) financing activities . . . 202 (366) (231)

Key Performance Indicators:

Ending number of customers (thousands)(1)(2) ....... 6,663 6,430 6,315

Gross customer additions (thousands)(1)(2) .......... 995 1,097 1,152

Customer revenue attrition rate (percent) .......... 13.5% 13.9% 13.5%

Customer unit attrition rate (percent) .............. 13.2% 13.3% 12.9%

Average revenue per customer (dollars)(2) .......... $41.54 $ 40.80 $ 39.44

Cost to serve expenses ......................... $1,102 $ 1,001 $ 961

Gross subscriber acquisition cost expenses ......... $ 442 $ 448 $ 523

EBITDA(3) .................................. $1,644 $ 1,689 $ 1,584

FCF(3) ...................................... $ 251 $ 460 $ 406

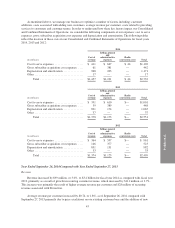

(1) Gross customer additions for fiscal year 2013 exclude approximately 117,000 customer accounts acquired in

connection with the acquisition of Devcon Security Holdings, Inc. in August 2013. These accounts are

included in the 6.4 million ending number of customers as of September 27, 2013. Gross customer additions

for fiscal year 2014 exclude approximately 373,000 customer accounts acquired in connection with the

acquisition of Protectron in July 2014. These accounts are included in the 6.7 million ending number of

customers as of September 26, 2014.

(2) The ending number of customers, gross customer additions and average revenue per customer for fiscal

years 2012 and 2013 have been revised. See discussion under “Key Performance Measures” above for

further information.

(3) EBITDA and FCF are non-GAAP measures. Refer to the “Non-GAAP Measures” section for the definitions

thereof and a reconciliation to the most comparable GAAP measures.

42